Crestwood Capital Management L.P. raised its holdings in shares of Progyny, Inc. (NASDAQ:PGNY - Free Report) by 17.9% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 436,081 shares of the company's stock after purchasing an additional 66,331 shares during the period. Progyny accounts for approximately 5.6% of Crestwood Capital Management L.P.'s holdings, making the stock its 8th biggest holding. Crestwood Capital Management L.P. owned about 0.48% of Progyny worth $7,309,000 at the end of the most recent quarter.

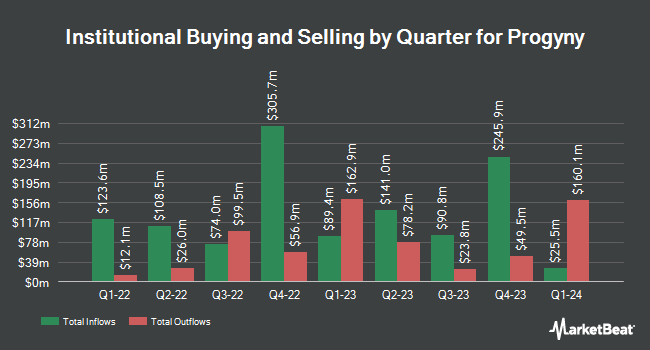

Several other hedge funds also recently modified their holdings of the business. Vanguard Group Inc. boosted its position in shares of Progyny by 0.5% in the 1st quarter. Vanguard Group Inc. now owns 8,311,840 shares of the company's stock worth $317,097,000 after purchasing an additional 41,687 shares during the last quarter. PEAK6 Investments LLC increased its stake in shares of Progyny by 68.1% in the 1st quarter. PEAK6 Investments LLC now owns 10,942 shares of the company's stock valued at $417,000 after acquiring an additional 4,433 shares during the last quarter. Price T Rowe Associates Inc. MD raised its position in shares of Progyny by 5.7% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 54,912 shares of the company's stock valued at $2,095,000 after acquiring an additional 2,947 shares during the period. Janus Henderson Group PLC grew its holdings in Progyny by 2.2% during the first quarter. Janus Henderson Group PLC now owns 307,909 shares of the company's stock valued at $11,745,000 after purchasing an additional 6,549 shares during the period. Finally, Comerica Bank increased its stake in Progyny by 5.3% in the first quarter. Comerica Bank now owns 67,547 shares of the company's stock valued at $2,577,000 after purchasing an additional 3,428 shares in the last quarter. Institutional investors own 94.93% of the company's stock.

Progyny Price Performance

PGNY stock traded down $0.64 during trading on Tuesday, reaching $15.11. The company had a trading volume of 539,618 shares, compared to its average volume of 1,401,770. The business has a 50 day moving average of $16.23 and a 200 day moving average of $22.49. The company has a market cap of $1.29 billion, a P/E ratio of 27.16, a PEG ratio of 1.78 and a beta of 1.44. Progyny, Inc. has a 52 week low of $13.39 and a 52 week high of $42.08.

Progyny (NASDAQ:PGNY - Get Free Report) last released its quarterly earnings results on Tuesday, November 12th. The company reported $0.11 earnings per share for the quarter, missing the consensus estimate of $0.37 by ($0.26). The firm had revenue of $286.63 million for the quarter, compared to the consensus estimate of $296.85 million. Progyny had a net margin of 5.03% and a return on equity of 11.36%. The company's revenue for the quarter was up 2.0% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $0.16 earnings per share. Research analysts expect that Progyny, Inc. will post 0.58 earnings per share for the current year.

Analysts Set New Price Targets

A number of research firms have recently commented on PGNY. BTIG Research lowered Progyny from a "buy" rating to a "neutral" rating in a research report on Wednesday, August 7th. Cantor Fitzgerald reissued an "overweight" rating and set a $25.00 price objective on shares of Progyny in a report on Tuesday, October 1st. Jefferies Financial Group decreased their price target on shares of Progyny from $31.00 to $24.00 and set a "buy" rating for the company in a research report on Thursday, September 19th. JPMorgan Chase & Co. cut their price objective on Progyny from $31.00 to $22.00 and set an "overweight" rating on the stock in a research note on Thursday, September 19th. Finally, Bank of America cut their price objective on shares of Progyny from $22.00 to $21.00 and set a "buy" rating on the stock in a research report on Wednesday, November 13th. Eight analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and an average price target of $25.42.

Check Out Our Latest Stock Report on Progyny

Progyny Company Profile

(

Free Report)

Progyny, Inc, a benefits management company, specializes in fertility and family building benefits solutions in the United States. Its fertility benefits solution includes differentiated benefits plan design, personalized concierge-style member support services, and selective network of fertility specialists.

Featured Articles

Before you consider Progyny, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progyny wasn't on the list.

While Progyny currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.