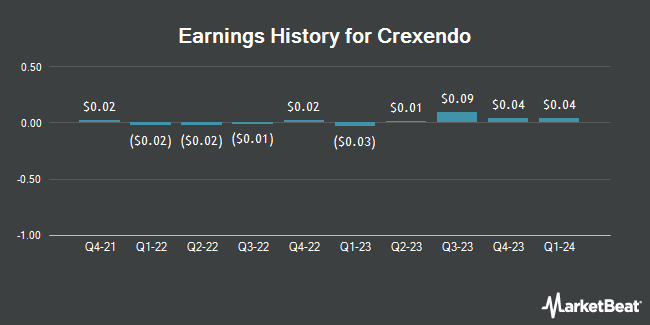

Crexendo (NASDAQ:CXDO - Get Free Report) posted its quarterly earnings data on Tuesday. The company reported $0.04 EPS for the quarter, missing analysts' consensus estimates of $0.05 by ($0.01), Zacks reports. The company had revenue of $16.20 million during the quarter, compared to analyst estimates of $15.64 million. Crexendo had a return on equity of 9.09% and a net margin of 2.09%.

Crexendo Trading Down 4.1 %

CXDO stock traded down $0.28 during mid-day trading on Friday, reaching $6.47. The company's stock had a trading volume of 457,018 shares, compared to its average volume of 150,576. The company has a market cap of $172.85 million, a price-to-earnings ratio of 215.74 and a beta of 1.15. The business's 50 day moving average price is $5.85 and its 200 day moving average price is $5.37. Crexendo has a 12 month low of $2.92 and a 12 month high of $7.34.

Analysts Set New Price Targets

CXDO has been the topic of a number of recent analyst reports. D. Boral Capital lifted their price objective on Crexendo from $7.00 to $10.00 and gave the stock a "buy" rating in a research note on Thursday. B. Riley reaffirmed a "buy" rating and issued a $7.50 price objective (up from $6.75) on shares of Crexendo in a research note on Wednesday.

View Our Latest Stock Analysis on Crexendo

Insiders Place Their Bets

In other news, CTO David Tzat-Kin Wang sold 106,667 shares of the business's stock in a transaction that occurred on Monday, December 16th. The stock was sold at an average price of $4.90, for a total transaction of $522,668.30. Following the completion of the sale, the chief technology officer now owns 443,079 shares in the company, valued at $2,171,087.10. The trade was a 19.40 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CEO Jeffrey G. Korn sold 7,000 shares of the business's stock in a transaction that occurred on Monday, December 9th. The shares were sold at an average price of $5.25, for a total value of $36,750.00. Following the sale, the chief executive officer now owns 249,730 shares of the company's stock, valued at approximately $1,311,082.50. This represents a 2.73 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 131,960 shares of company stock worth $653,627. 56.20% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On Crexendo

A hedge fund recently raised its stake in Crexendo stock. Bank of America Corp DE increased its stake in shares of Crexendo, Inc. (NASDAQ:CXDO - Free Report) by 71.7% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 6,174 shares of the company's stock after buying an additional 2,578 shares during the quarter. Bank of America Corp DE's holdings in Crexendo were worth $32,000 at the end of the most recent quarter. Institutional investors and hedge funds own 9.53% of the company's stock.

About Crexendo

(

Get Free Report)

Crexendo, Inc provides cloud communication platform and services, video collaboration, and managed IT services for businesses in the United States and internationally. It operates through two segments, Cloud Telecommunications Services and Software Solutions. The Cloud Telecommunications segment provides telecommunications services that transmit calls using Internet protocol (IP) or cloud technology, which converts voice signals into digital data packets for transmission over the Internet or cloud; and broadband Internet services, as well as develops end user portals for account and license management, and billing and customer support.

Featured Articles

Before you consider Crexendo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crexendo wasn't on the list.

While Crexendo currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.