Natixis Advisors LLC grew its position in shares of Crinetics Pharmaceuticals, Inc. (NASDAQ:CRNX - Free Report) by 36.6% during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 44,346 shares of the company's stock after buying an additional 11,870 shares during the quarter. Natixis Advisors LLC owned 0.06% of Crinetics Pharmaceuticals worth $2,266,000 as of its most recent filing with the Securities & Exchange Commission.

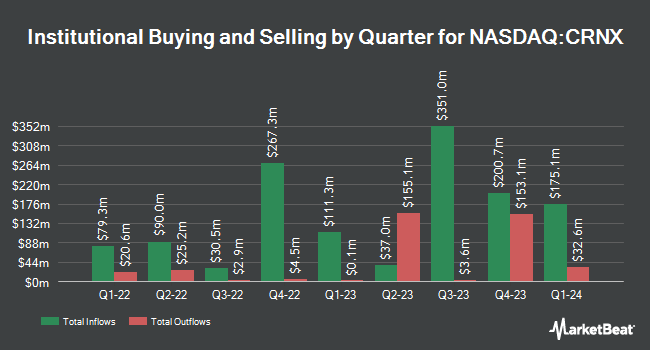

Other hedge funds and other institutional investors have also recently modified their holdings of the company. AQR Capital Management LLC increased its holdings in Crinetics Pharmaceuticals by 3.3% during the second quarter. AQR Capital Management LLC now owns 7,126 shares of the company's stock worth $319,000 after buying an additional 227 shares during the last quarter. US Bancorp DE increased its stake in shares of Crinetics Pharmaceuticals by 3.4% during the 3rd quarter. US Bancorp DE now owns 11,488 shares of the company's stock worth $587,000 after purchasing an additional 373 shares during the last quarter. KBC Group NV increased its stake in shares of Crinetics Pharmaceuticals by 22.8% during the 3rd quarter. KBC Group NV now owns 2,193 shares of the company's stock worth $112,000 after purchasing an additional 407 shares during the last quarter. Amalgamated Bank raised its holdings in shares of Crinetics Pharmaceuticals by 20.8% in the 2nd quarter. Amalgamated Bank now owns 2,692 shares of the company's stock worth $121,000 after purchasing an additional 464 shares during the period. Finally, Mirae Asset Global Investments Co. Ltd. lifted its stake in Crinetics Pharmaceuticals by 23.0% in the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,895 shares of the company's stock valued at $147,000 after purchasing an additional 541 shares during the last quarter. Hedge funds and other institutional investors own 98.51% of the company's stock.

Analyst Ratings Changes

CRNX has been the subject of a number of recent research reports. HC Wainwright raised their target price on Crinetics Pharmaceuticals from $69.00 to $81.00 and gave the stock a "buy" rating in a research report on Wednesday, November 13th. Citigroup lifted their price objective on Crinetics Pharmaceuticals from $70.00 to $74.00 and gave the stock a "buy" rating in a report on Thursday, November 14th. Cantor Fitzgerald reaffirmed an "overweight" rating and set a $90.00 price objective on shares of Crinetics Pharmaceuticals in a report on Monday, September 16th. JMP Securities reiterated a "market outperform" rating and issued a $80.00 target price on shares of Crinetics Pharmaceuticals in a research note on Friday, September 27th. Finally, Oppenheimer restated an "outperform" rating and set a $73.00 price target (down from $74.00) on shares of Crinetics Pharmaceuticals in a research note on Friday, August 9th. One research analyst has rated the stock with a hold rating and ten have issued a buy rating to the stock. According to MarketBeat.com, Crinetics Pharmaceuticals has an average rating of "Moderate Buy" and a consensus price target of $70.18.

Get Our Latest Stock Report on CRNX

Insiders Place Their Bets

In related news, insider Dana Pizzuti sold 14,375 shares of the stock in a transaction on Thursday, October 3rd. The shares were sold at an average price of $54.63, for a total transaction of $785,306.25. Following the transaction, the insider now owns 28,507 shares of the company's stock, valued at approximately $1,557,337.41. This trade represents a 33.52 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, insider Stephen F. Betz sold 1,035 shares of the company's stock in a transaction dated Tuesday, September 10th. The shares were sold at an average price of $51.50, for a total transaction of $53,302.50. Following the sale, the insider now owns 68,576 shares of the company's stock, valued at approximately $3,531,664. The trade was a 1.49 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 40,410 shares of company stock valued at $2,116,359 over the last 90 days. Insiders own 6.00% of the company's stock.

Crinetics Pharmaceuticals Trading Up 0.1 %

Shares of Crinetics Pharmaceuticals stock traded up $0.03 during trading on Monday, hitting $56.09. The stock had a trading volume of 580,897 shares, compared to its average volume of 782,989. The firm has a market cap of $5.20 billion, a price-to-earnings ratio of -15.04 and a beta of 0.62. Crinetics Pharmaceuticals, Inc. has a 12 month low of $30.87 and a 12 month high of $62.53. The business's 50-day moving average is $55.36 and its 200 day moving average is $51.60.

Crinetics Pharmaceuticals (NASDAQ:CRNX - Get Free Report) last posted its quarterly earnings data on Tuesday, November 12th. The company reported ($0.96) earnings per share for the quarter, missing the consensus estimate of ($0.91) by ($0.05). During the same quarter in the previous year, the firm posted ($1.01) EPS. As a group, equities analysts expect that Crinetics Pharmaceuticals, Inc. will post -3.75 EPS for the current year.

Crinetics Pharmaceuticals Company Profile

(

Free Report)

Crinetics Pharmaceuticals, Inc, a clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors. The company's lead product candidate is paltusotine, an oral selective nonpeptide somatostatin receptor type 2 agonist, which is in Phase 3 trial for the treatment of acromegaly; and Phase 2 trial for treating carcinoid syndrome associated with neuroendocrine tumors.

See Also

Before you consider Crinetics Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crinetics Pharmaceuticals wasn't on the list.

While Crinetics Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.