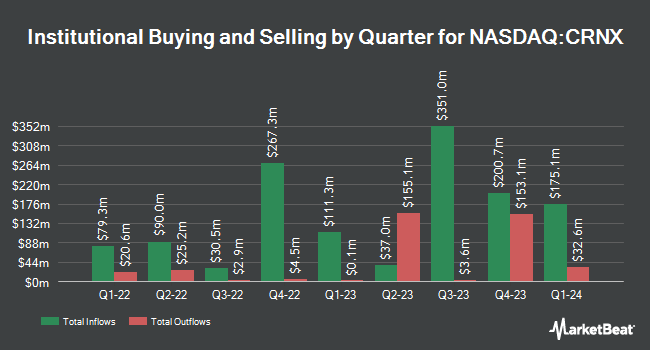

Victory Capital Management Inc. decreased its stake in Crinetics Pharmaceuticals, Inc. (NASDAQ:CRNX - Free Report) by 18.0% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 281,451 shares of the company's stock after selling 61,893 shares during the period. Victory Capital Management Inc. owned 0.30% of Crinetics Pharmaceuticals worth $14,391,000 at the end of the most recent reporting period.

Several other large investors have also modified their holdings of CRNX. Keybank National Association OH boosted its stake in Crinetics Pharmaceuticals by 14.4% during the 4th quarter. Keybank National Association OH now owns 9,352 shares of the company's stock worth $478,000 after purchasing an additional 1,176 shares during the period. Charles Schwab Investment Management Inc. boosted its stake in Crinetics Pharmaceuticals by 15.8% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 759,126 shares of the company's stock worth $38,814,000 after purchasing an additional 103,708 shares during the period. Fisher Asset Management LLC boosted its stake in Crinetics Pharmaceuticals by 16.0% during the 4th quarter. Fisher Asset Management LLC now owns 559,287 shares of the company's stock worth $28,596,000 after purchasing an additional 77,188 shares during the period. Proficio Capital Partners LLC acquired a new stake in shares of Crinetics Pharmaceuticals in the 4th quarter worth $750,000. Finally, Oppenheimer Asset Management Inc. lifted its stake in shares of Crinetics Pharmaceuticals by 19.5% in the 4th quarter. Oppenheimer Asset Management Inc. now owns 5,038 shares of the company's stock worth $258,000 after acquiring an additional 822 shares during the period. Institutional investors and hedge funds own 98.51% of the company's stock.

Crinetics Pharmaceuticals Trading Up 3.3 %

NASDAQ:CRNX opened at $35.40 on Thursday. The firm has a 50-day moving average price of $38.53 and a two-hundred day moving average price of $49.11. Crinetics Pharmaceuticals, Inc. has a twelve month low of $31.84 and a twelve month high of $62.53. The company has a market capitalization of $3.29 billion, a P/E ratio of -9.49 and a beta of 0.58.

Crinetics Pharmaceuticals (NASDAQ:CRNX - Get Free Report) last released its quarterly earnings results on Thursday, February 27th. The company reported ($0.88) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.92) by $0.04. On average, equities research analysts predict that Crinetics Pharmaceuticals, Inc. will post -3.73 earnings per share for the current year.

Insiders Place Their Bets

In related news, insider Dana Pizzuti sold 5,000 shares of the firm's stock in a transaction that occurred on Monday, February 3rd. The shares were sold at an average price of $39.07, for a total value of $195,350.00. Following the sale, the insider now directly owns 31,748 shares of the company's stock, valued at approximately $1,240,394.36. This trade represents a 13.61 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. 6.00% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

CRNX has been the subject of several recent analyst reports. JMP Securities restated a "market outperform" rating and issued a $87.00 target price on shares of Crinetics Pharmaceuticals in a research note on Monday, December 16th. Wolfe Research initiated coverage on shares of Crinetics Pharmaceuticals in a research note on Tuesday, February 4th. They issued a "peer perform" rating for the company. Jefferies Financial Group upgraded shares of Crinetics Pharmaceuticals from a "hold" rating to a "buy" rating and set a $55.00 target price for the company in a research note on Wednesday, January 22nd. TD Cowen assumed coverage on shares of Crinetics Pharmaceuticals in a research note on Tuesday, February 11th. They issued a "buy" rating for the company. Finally, HC Wainwright reiterated a "buy" rating and issued a $81.00 price target on shares of Crinetics Pharmaceuticals in a report on Monday, January 13th. One research analyst has rated the stock with a hold rating and twelve have given a buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $72.64.

Check Out Our Latest Stock Analysis on Crinetics Pharmaceuticals

About Crinetics Pharmaceuticals

(

Free Report)

Crinetics Pharmaceuticals, Inc, a clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors. The company's lead product candidate is paltusotine, an oral selective nonpeptide somatostatin receptor type 2 agonist, which is in Phase 3 trial for the treatment of acromegaly; and Phase 2 trial for treating carcinoid syndrome associated with neuroendocrine tumors.

Read More

Want to see what other hedge funds are holding CRNX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Crinetics Pharmaceuticals, Inc. (NASDAQ:CRNX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Crinetics Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crinetics Pharmaceuticals wasn't on the list.

While Crinetics Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.