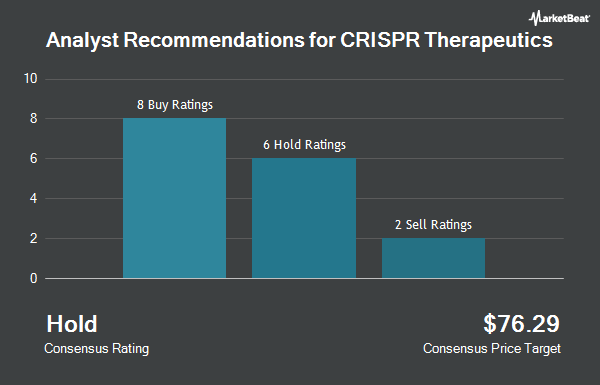

CRISPR Therapeutics AG (NASDAQ:CRSP - Get Free Report) has earned a consensus recommendation of "Hold" from the twenty-one analysts that are currently covering the firm, MarketBeat reports. One investment analyst has rated the stock with a sell recommendation, nine have assigned a hold recommendation and eleven have issued a buy recommendation on the company. The average 12 month price target among brokerages that have updated their coverage on the stock in the last year is $73.11.

A number of brokerages have recently commented on CRSP. The Goldman Sachs Group lowered their price objective on CRISPR Therapeutics from $66.00 to $57.00 and set a "neutral" rating on the stock in a report on Thursday, February 13th. TD Cowen raised shares of CRISPR Therapeutics from a "sell" rating to a "hold" rating and set a $35.00 price target on the stock in a research report on Wednesday, February 12th. JMP Securities reaffirmed a "market outperform" rating and set a $86.00 price objective on shares of CRISPR Therapeutics in a report on Thursday, February 13th. Truist Financial lifted their target price on shares of CRISPR Therapeutics from $100.00 to $120.00 and gave the stock a "buy" rating in a report on Wednesday, February 12th. Finally, HC Wainwright restated a "buy" rating and set a $65.00 price target on shares of CRISPR Therapeutics in a report on Thursday, February 13th.

Read Our Latest Stock Report on CRISPR Therapeutics

CRISPR Therapeutics Price Performance

CRSP traded up $0.41 during midday trading on Monday, hitting $39.22. 277,549 shares of the company's stock traded hands, compared to its average volume of 1,623,981. The company has a market cap of $3.36 billion, a PE ratio of -8.95 and a beta of 1.85. CRISPR Therapeutics has a one year low of $30.04 and a one year high of $67.88. The stock's fifty day simple moving average is $41.07 and its 200-day simple moving average is $43.95.

CRISPR Therapeutics (NASDAQ:CRSP - Get Free Report) last released its quarterly earnings data on Tuesday, February 11th. The company reported ($0.44) earnings per share (EPS) for the quarter, beating the consensus estimate of ($1.15) by $0.71. CRISPR Therapeutics had a negative net margin of 981.54% and a negative return on equity of 18.46%. On average, research analysts expect that CRISPR Therapeutics will post -5.16 EPS for the current year.

Insider Buying and Selling at CRISPR Therapeutics

In related news, Director John Greene bought 7,000 shares of the business's stock in a transaction on Wednesday, February 26th. The shares were purchased at an average price of $44.85 per share, with a total value of $313,950.00. Following the completion of the purchase, the director now owns 7,000 shares of the company's stock, valued at $313,950. This represents a ∞ increase in their position. The acquisition was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, General Counsel James R. Kasinger sold 2,850 shares of the stock in a transaction that occurred on Tuesday, March 11th. The shares were sold at an average price of $42.42, for a total transaction of $120,897.00. Following the completion of the sale, the general counsel now owns 77,530 shares in the company, valued at $3,288,822.60. This represents a 3.55 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 32,381 shares of company stock worth $1,608,243 over the last three months. Company insiders own 4.10% of the company's stock.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. The Manufacturers Life Insurance Company raised its holdings in CRISPR Therapeutics by 1.9% during the 3rd quarter. The Manufacturers Life Insurance Company now owns 12,477 shares of the company's stock worth $586,000 after buying an additional 231 shares during the period. Captrust Financial Advisors increased its holdings in CRISPR Therapeutics by 32.0% during the 3rd quarter. Captrust Financial Advisors now owns 31,712 shares of the company's stock worth $1,490,000 after purchasing an additional 7,688 shares in the last quarter. State Street Corp lifted its holdings in shares of CRISPR Therapeutics by 25.0% in the third quarter. State Street Corp now owns 2,992,988 shares of the company's stock valued at $140,611,000 after purchasing an additional 599,304 shares in the last quarter. XTX Topco Ltd raised its position in CRISPR Therapeutics by 294.0% in the 3rd quarter. XTX Topco Ltd now owns 30,022 shares of the company's stock valued at $1,410,000 after buying an additional 22,402 shares during the last quarter. Finally, Main Management ETF Advisors LLC bought a new stake in CRISPR Therapeutics in the 3rd quarter valued at approximately $693,000. 69.20% of the stock is owned by institutional investors and hedge funds.

CRISPR Therapeutics Company Profile

(

Get Free ReportCRISPR Therapeutics is a gene-editing company focused on developing transformative gene-based medicines for serious diseases using its proprietary CRISPR/Cas9 platform. CRISPR/Cas9 is a revolutionary gene-editing technology that allows for precise, directed changes to genomic DNA. CRISPR Therapeutics has established a portfolio of therapeutic programs across a broad range of disease areas including hemoglobinopathies, oncology, regenerative medicine and rare diseases.

Further Reading

Before you consider CRISPR Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CRISPR Therapeutics wasn't on the list.

While CRISPR Therapeutics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.