Benchmark reaffirmed their buy rating on shares of Criteo (NASDAQ:CRTO - Free Report) in a research note issued to investors on Tuesday,Benzinga reports. The firm currently has a $51.00 target price on the information services provider's stock.

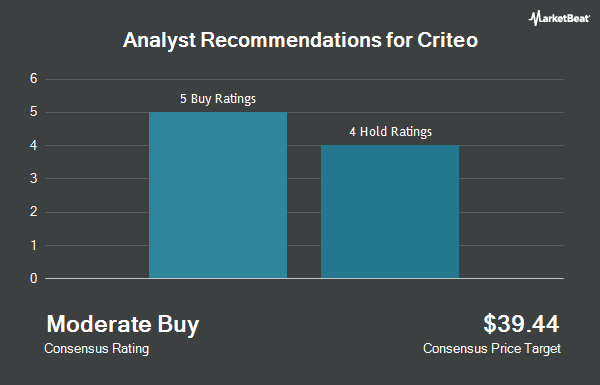

Several other brokerages also recently issued reports on CRTO. Wells Fargo & Company initiated coverage on Criteo in a report on Monday, October 28th. They issued an "overweight" rating and a $70.00 price target on the stock. BMO Capital Markets raised their target price on Criteo from $45.00 to $55.00 and gave the stock an "outperform" rating in a research report on Friday, August 2nd. Susquehanna dropped their price objective on Criteo from $50.00 to $36.00 and set a "neutral" rating on the stock in a research note on Thursday, October 31st. Morgan Stanley boosted their price target on Criteo from $35.00 to $39.00 and gave the company an "equal weight" rating in a research note on Tuesday, July 23rd. Finally, KeyCorp lowered Criteo from an "overweight" rating to a "sector weight" rating in a research note on Tuesday, July 30th. Four research analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $50.67.

Check Out Our Latest Analysis on CRTO

Criteo Trading Up 4.7 %

NASDAQ:CRTO traded up $1.71 on Tuesday, hitting $38.25. 604,851 shares of the stock were exchanged, compared to its average volume of 372,649. Criteo has a fifty-two week low of $23.80 and a fifty-two week high of $49.93. The stock has a market cap of $2.11 billion, a PE ratio of 24.86 and a beta of 1.02. The stock has a fifty day moving average of $39.79 and a 200-day moving average of $40.77.

Insider Activity at Criteo

In other Criteo news, CFO Sarah Js Glickman sold 5,442 shares of the stock in a transaction dated Wednesday, October 23rd. The shares were sold at an average price of $40.60, for a total value of $220,945.20. Following the transaction, the chief financial officer now directly owns 313,398 shares of the company's stock, valued at $12,723,958.80. This represents a 1.71 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, insider Brian Gleason sold 2,841 shares of the stock in a transaction dated Tuesday, October 29th. The shares were sold at an average price of $41.10, for a total transaction of $116,765.10. Following the completion of the transaction, the insider now directly owns 146,470 shares in the company, valued at approximately $6,019,917. This represents a 1.90 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.71% of the stock is currently owned by company insiders.

Institutional Trading of Criteo

A number of hedge funds have recently added to or reduced their stakes in the stock. Alpha DNA Investment Management LLC bought a new stake in Criteo in the second quarter valued at $473,000. Seizert Capital Partners LLC bought a new stake in Criteo in the third quarter valued at $1,405,000. Inspire Investing LLC bought a new stake in Criteo in the second quarter valued at $819,000. SG Americas Securities LLC bought a new stake in Criteo in the second quarter valued at $248,000. Finally, Congress Asset Management Co. bought a new stake in Criteo in the third quarter valued at $48,653,000. Institutional investors and hedge funds own 94.27% of the company's stock.

About Criteo

(

Get Free Report)

Criteo SA, a technology company, provides marketing and monetization services on the open Internet in North and South America, Europe, the Middle East, Africa, and the Asia-Pacific. The company's Criteo Shopper Graph, which derives clients' proprietary commerce data, such as transaction activity on their digital properties.

Recommended Stories

Before you consider Criteo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Criteo wasn't on the list.

While Criteo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.