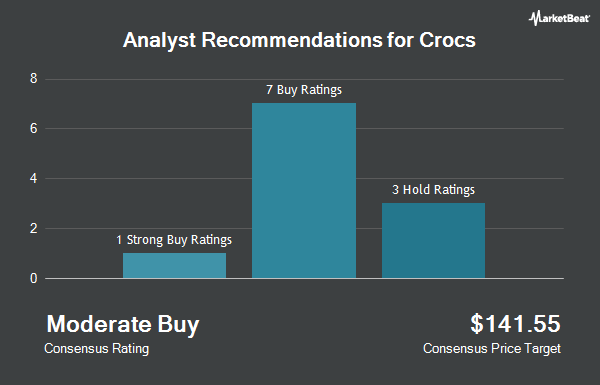

Shares of Crocs, Inc. (NASDAQ:CROX - Get Free Report) have been given an average rating of "Moderate Buy" by the fifteen ratings firms that are covering the stock, Marketbeat.com reports. Four research analysts have rated the stock with a hold rating and eleven have given a buy rating to the company. The average 1-year target price among brokers that have updated their coverage on the stock in the last year is $151.14.

A number of research analysts have recently weighed in on the company. Barclays dropped their price target on Crocs from $164.00 to $125.00 and set an "overweight" rating for the company in a research report on Tuesday, October 29th. UBS Group reduced their target price on Crocs from $146.00 to $122.00 and set a "neutral" rating on the stock in a report on Wednesday, October 30th. Guggenheim cut their target price on shares of Crocs from $182.00 to $155.00 and set a "buy" rating on the stock in a research note on Wednesday, October 30th. Raymond James cut Crocs from an "outperform" rating to a "market perform" rating in a report on Wednesday, October 30th. Finally, Robert W. Baird reduced their price target on Crocs from $190.00 to $180.00 and set an "outperform" rating for the company in a report on Wednesday, October 30th.

Check Out Our Latest Report on Crocs

Insiders Place Their Bets

In other news, CFO Susan L. Healy acquired 1,000 shares of the business's stock in a transaction dated Wednesday, November 13th. The stock was acquired at an average price of $99.70 per share, for a total transaction of $99,700.00. Following the completion of the acquisition, the chief financial officer now directly owns 22,652 shares in the company, valued at $2,258,404.40. This represents a 4.62 % increase in their position. The acquisition was disclosed in a filing with the SEC, which is available through this link. Also, Director John B. Replogle purchased 2,240 shares of the company's stock in a transaction on Wednesday, October 30th. The stock was acquired at an average price of $112.60 per share, for a total transaction of $252,224.00. Following the completion of the transaction, the director now owns 9,304 shares of the company's stock, valued at $1,047,630.40. This represents a 31.71 % increase in their position. The disclosure for this purchase can be found here. 2.72% of the stock is owned by insiders.

Institutional Trading of Crocs

Hedge funds and other institutional investors have recently modified their holdings of the business. Davis Investment Partners LLC grew its holdings in Crocs by 0.8% during the third quarter. Davis Investment Partners LLC now owns 9,673 shares of the textile maker's stock valued at $1,362,000 after purchasing an additional 77 shares during the last quarter. Nisa Investment Advisors LLC raised its stake in shares of Crocs by 8.9% in the second quarter. Nisa Investment Advisors LLC now owns 1,041 shares of the textile maker's stock valued at $152,000 after acquiring an additional 85 shares during the last quarter. Central Pacific Bank Trust Division increased its position in Crocs by 8.0% in the 3rd quarter. Central Pacific Bank Trust Division now owns 1,350 shares of the textile maker's stock valued at $195,000 after acquiring an additional 100 shares in the last quarter. 180 Wealth Advisors LLC lifted its stake in shares of Crocs by 1.6% during the second quarter. 180 Wealth Advisors LLC now owns 7,248 shares of the textile maker's stock valued at $1,036,000 after acquiring an additional 111 shares during the period. Finally, Covestor Ltd boosted its stake in shares of Crocs by 10.3% in the 3rd quarter. Covestor Ltd now owns 1,225 shares of the textile maker's stock valued at $178,000 after purchasing an additional 114 shares during the last quarter. Institutional investors and hedge funds own 93.44% of the company's stock.

Crocs Stock Down 2.1 %

Crocs stock traded down $2.08 during mid-day trading on Friday, hitting $97.78. The company had a trading volume of 1,373,750 shares, compared to its average volume of 1,347,755. The company has a quick ratio of 0.90, a current ratio of 1.43 and a debt-to-equity ratio of 0.82. Crocs has a 1 year low of $85.71 and a 1 year high of $165.32. The stock has a market cap of $5.70 billion, a price-to-earnings ratio of 7.09, a PEG ratio of 1.00 and a beta of 2.01. The business has a fifty day moving average of $127.81 and a 200 day moving average of $136.61.

Crocs (NASDAQ:CROX - Get Free Report) last released its quarterly earnings data on Tuesday, October 29th. The textile maker reported $3.60 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.10 by $0.50. Crocs had a return on equity of 49.70% and a net margin of 20.50%. The firm had revenue of $1.06 billion during the quarter, compared to analysts' expectations of $1.05 billion. During the same quarter in the prior year, the business posted $3.25 earnings per share. Crocs's revenue was up 1.6% compared to the same quarter last year. On average, sell-side analysts expect that Crocs will post 12.93 earnings per share for the current fiscal year.

About Crocs

(

Get Free ReportCrocs, Inc, together with its subsidiaries, designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under Crocs and HEYDUDE Brand in the United States and internationally. The company offers various footwear products, including clogs, sandals, slides, flips, wedges, platforms, socks, boots, charms, flip flops, sneakers, and slippers.

See Also

Before you consider Crocs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crocs wasn't on the list.

While Crocs currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.