Crossmark Global Holdings Inc. grew its holdings in Crocs, Inc. (NASDAQ:CROX - Free Report) by 55.8% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 40,192 shares of the textile maker's stock after acquiring an additional 14,387 shares during the period. Crossmark Global Holdings Inc. owned 0.07% of Crocs worth $5,820,000 as of its most recent SEC filing.

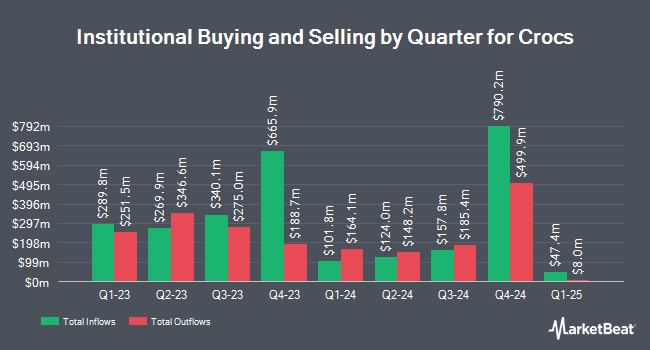

Other large investors also recently added to or reduced their stakes in the company. Catalyst Capital Advisors LLC raised its stake in Crocs by 2,775.6% during the 3rd quarter. Catalyst Capital Advisors LLC now owns 7,908 shares of the textile maker's stock valued at $1,145,000 after purchasing an additional 7,633 shares during the last quarter. International Assets Investment Management LLC acquired a new position in Crocs during the 3rd quarter valued at $2,076,000. Boston Partners acquired a new position in Crocs during the 1st quarter valued at $10,771,000. Pinnacle Associates Ltd. raised its stake in Crocs by 1,166.3% during the 3rd quarter. Pinnacle Associates Ltd. now owns 36,407 shares of the textile maker's stock valued at $5,272,000 after purchasing an additional 33,532 shares during the last quarter. Finally, Russell Investments Group Ltd. raised its stake in Crocs by 78.2% during the 1st quarter. Russell Investments Group Ltd. now owns 35,142 shares of the textile maker's stock valued at $5,053,000 after purchasing an additional 15,418 shares during the last quarter. 93.44% of the stock is owned by institutional investors.

Crocs Stock Up 1.5 %

Shares of CROX traded up $1.55 during mid-day trading on Monday, hitting $102.85. 1,451,992 shares of the company's stock were exchanged, compared to its average volume of 1,344,456. The company has a market cap of $5.99 billion, a PE ratio of 7.46, a P/E/G ratio of 1.02 and a beta of 2.01. Crocs, Inc. has a 52 week low of $77.16 and a 52 week high of $165.32. The company has a 50-day simple moving average of $130.72 and a 200 day simple moving average of $137.51. The company has a debt-to-equity ratio of 0.82, a current ratio of 1.43 and a quick ratio of 0.90.

Crocs (NASDAQ:CROX - Get Free Report) last issued its quarterly earnings results on Tuesday, October 29th. The textile maker reported $3.60 earnings per share for the quarter, topping the consensus estimate of $3.10 by $0.50. Crocs had a net margin of 20.50% and a return on equity of 49.70%. The company had revenue of $1.06 billion during the quarter, compared to analysts' expectations of $1.05 billion. During the same period last year, the business earned $3.25 EPS. The business's quarterly revenue was up 1.6% on a year-over-year basis. On average, research analysts forecast that Crocs, Inc. will post 12.93 earnings per share for the current fiscal year.

Insider Activity at Crocs

In related news, Director John B. Replogle acquired 2,240 shares of Crocs stock in a transaction on Wednesday, October 30th. The stock was purchased at an average cost of $112.60 per share, with a total value of $252,224.00. Following the completion of the transaction, the director now directly owns 9,304 shares in the company, valued at $1,047,630.40. This trade represents a 0.00 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. 2.72% of the stock is owned by company insiders.

Analyst Ratings Changes

A number of equities analysts have recently issued reports on the stock. KeyCorp dropped their price objective on shares of Crocs from $155.00 to $150.00 and set an "overweight" rating for the company in a research note on Wednesday, October 30th. Barclays lowered their target price on shares of Crocs from $164.00 to $125.00 and set an "overweight" rating on the stock in a report on Tuesday, October 29th. Piper Sandler reaffirmed an "overweight" rating and issued a $170.00 target price on shares of Crocs in a report on Friday, August 23rd. Loop Capital lowered shares of Crocs from a "buy" rating to a "hold" rating and lowered their target price for the stock from $150.00 to $110.00 in a report on Thursday. Finally, Guggenheim lowered their target price on shares of Crocs from $182.00 to $155.00 and set a "buy" rating on the stock in a report on Wednesday, October 30th. Five analysts have rated the stock with a hold rating and eleven have issued a buy rating to the company. According to MarketBeat.com, Crocs presently has a consensus rating of "Moderate Buy" and a consensus price target of $151.14.

Check Out Our Latest Stock Analysis on CROX

Crocs Company Profile

(

Free Report)

Crocs, Inc, together with its subsidiaries, designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under Crocs and HEYDUDE Brand in the United States and internationally. The company offers various footwear products, including clogs, sandals, slides, flips, wedges, platforms, socks, boots, charms, flip flops, sneakers, and slippers.

Recommended Stories

Before you consider Crocs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crocs wasn't on the list.

While Crocs currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.