Crossmark Global Holdings Inc. boosted its stake in Medpace Holdings, Inc. (NASDAQ:MEDP - Free Report) by 29.7% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 7,828 shares of the company's stock after purchasing an additional 1,793 shares during the period. Crossmark Global Holdings Inc.'s holdings in Medpace were worth $2,613,000 at the end of the most recent reporting period.

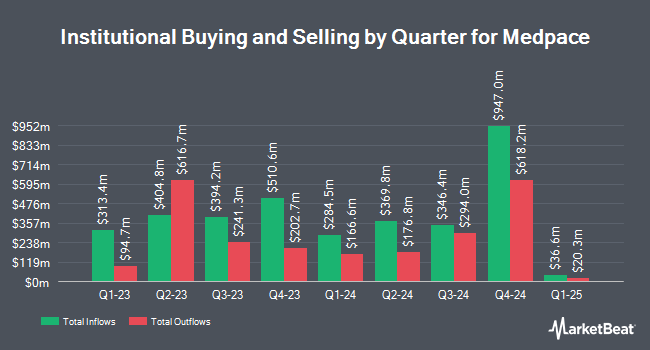

A number of other institutional investors have also added to or reduced their stakes in MEDP. Private Advisor Group LLC raised its stake in shares of Medpace by 10.1% during the first quarter. Private Advisor Group LLC now owns 1,065 shares of the company's stock worth $430,000 after acquiring an additional 98 shares in the last quarter. Swiss National Bank lifted its stake in Medpace by 0.4% in the 1st quarter. Swiss National Bank now owns 48,400 shares of the company's stock worth $19,561,000 after purchasing an additional 200 shares in the last quarter. Meeder Advisory Services Inc. bought a new stake in shares of Medpace in the 1st quarter worth about $230,000. ProShare Advisors LLC raised its stake in shares of Medpace by 3.1% in the first quarter. ProShare Advisors LLC now owns 3,337 shares of the company's stock valued at $1,349,000 after acquiring an additional 101 shares during the period. Finally, Picton Mahoney Asset Management bought a new position in shares of Medpace during the 1st quarter worth $2,926,000. 77.98% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

MEDP has been the topic of several analyst reports. Guggenheim dropped their price target on shares of Medpace from $464.00 to $432.00 and set a "buy" rating on the stock in a research report on Wednesday, July 24th. Jefferies Financial Group cut Medpace from a "buy" rating to a "hold" rating and cut their price objective for the stock from $415.00 to $345.00 in a research report on Wednesday, September 25th. Robert W. Baird lowered Medpace from an "outperform" rating to a "neutral" rating and dropped their target price for the company from $413.00 to $349.00 in a research note on Wednesday, October 23rd. Truist Financial cut their price objective on shares of Medpace from $415.00 to $397.00 and set a "hold" rating on the stock in a report on Monday, October 14th. Finally, Baird R W lowered shares of Medpace from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, October 23rd. Seven research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. According to data from MarketBeat.com, Medpace currently has an average rating of "Hold" and a consensus price target of $380.00.

Get Our Latest Stock Report on MEDP

Medpace Stock Performance

Shares of NASDAQ MEDP traded up $1.13 during trading on Wednesday, hitting $361.94. The company had a trading volume of 332,709 shares, compared to its average volume of 277,581. The stock has a 50 day simple moving average of $341.97 and a 200 day simple moving average of $376.72. Medpace Holdings, Inc. has a 12 month low of $268.80 and a 12 month high of $459.77. The firm has a market capitalization of $11.25 billion, a P/E ratio of 31.79, a price-to-earnings-growth ratio of 2.00 and a beta of 1.37.

Medpace (NASDAQ:MEDP - Get Free Report) last posted its quarterly earnings data on Monday, October 21st. The company reported $3.01 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.77 by $0.24. Medpace had a net margin of 17.66% and a return on equity of 50.87%. The firm had revenue of $533.32 million for the quarter, compared to the consensus estimate of $540.99 million. During the same quarter in the prior year, the company posted $2.22 earnings per share. The company's revenue for the quarter was up 8.3% compared to the same quarter last year. As a group, analysts predict that Medpace Holdings, Inc. will post 11.93 EPS for the current year.

Medpace Company Profile

(

Free Report)

Medpace Holdings, Inc provides clinical research-based drug and medical device development services in North America, Europe, and Asia. The company offers a suite of services supporting the clinical development process from Phase I to Phase IV in various therapeutic areas. It provides clinical development services to the pharmaceutical, biotechnology, and medical device industries; and development plan design, coordinated central laboratory, project management, regulatory affairs, clinical monitoring, data management and analysis, pharmacovigilance new drug application submissions, and post-marketing clinical support services.

Recommended Stories

Before you consider Medpace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medpace wasn't on the list.

While Medpace currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.