Crossmark Global Holdings Inc. lessened its position in shares of TELUS Co. (NYSE:TU - Free Report) TSE: T by 42.1% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 84,579 shares of the Wireless communications provider's stock after selling 61,522 shares during the period. Crossmark Global Holdings Inc.'s holdings in TELUS were worth $1,419,000 at the end of the most recent reporting period.

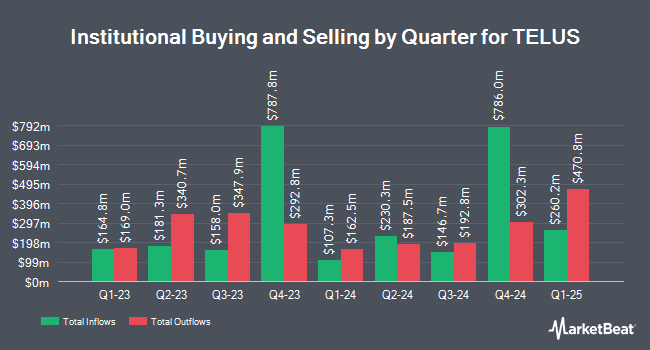

A number of other institutional investors also recently modified their holdings of the company. 1832 Asset Management L.P. increased its position in shares of TELUS by 6.6% during the 2nd quarter. 1832 Asset Management L.P. now owns 38,193,733 shares of the Wireless communications provider's stock worth $578,253,000 after purchasing an additional 2,365,753 shares during the last quarter. Fiera Capital Corp raised its position in shares of TELUS by 9.9% in the second quarter. Fiera Capital Corp now owns 16,670,713 shares of the Wireless communications provider's stock valued at $252,468,000 after buying an additional 1,501,742 shares in the last quarter. National Bank of Canada FI lifted its position in TELUS by 7.2% during the first quarter. National Bank of Canada FI now owns 21,461,769 shares of the Wireless communications provider's stock worth $345,330,000 after purchasing an additional 1,438,904 shares during the period. TD Asset Management Inc raised its position in shares of TELUS by 3.0% in the 2nd quarter. TD Asset Management Inc now owns 41,711,861 shares of the Wireless communications provider's stock valued at $631,310,000 after buying an additional 1,208,720 shares in the last quarter. Finally, Guardian Capital LP lifted its stake in TELUS by 27.8% during the first quarter. Guardian Capital LP now owns 5,486,529 shares of the Wireless communications provider's stock worth $87,857,000 after purchasing an additional 1,195,035 shares during the last quarter. 49.40% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

A number of brokerages recently weighed in on TU. StockNews.com upgraded TELUS from a "sell" rating to a "hold" rating in a research report on Friday, September 6th. Scotiabank raised shares of TELUS from a "sector perform" rating to a "sector outperform" rating in a research note on Monday, October 28th. Finally, Canaccord Genuity Group lowered TELUS from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, August 6th. Three research analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus price target of $26.00.

Get Our Latest Research Report on TU

TELUS Trading Down 2.6 %

Shares of NYSE TU traded down $0.40 during midday trading on Thursday, reaching $15.18. The stock had a trading volume of 4,006,972 shares, compared to its average volume of 2,297,761. The company's 50 day moving average price is $16.29 and its 200 day moving average price is $16.11. The company has a debt-to-equity ratio of 1.50, a quick ratio of 0.61 and a current ratio of 0.69. TELUS Co. has a twelve month low of $14.63 and a twelve month high of $19.14. The firm has a market cap of $22.64 billion, a price-to-earnings ratio of 33.14, a price-to-earnings-growth ratio of 2.12 and a beta of 0.75.

TELUS (NYSE:TU - Get Free Report) TSE: T last released its earnings results on Friday, November 8th. The Wireless communications provider reported $0.28 EPS for the quarter, topping the consensus estimate of $0.17 by $0.11. TELUS had a return on equity of 8.80% and a net margin of 4.56%. The business had revenue of $5.10 billion during the quarter, compared to analysts' expectations of $3.69 billion. During the same quarter last year, the firm posted $0.19 earnings per share. The firm's revenue was up 1.8% on a year-over-year basis. As a group, sell-side analysts expect that TELUS Co. will post 0.78 EPS for the current year.

TELUS Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, January 2nd. Investors of record on Wednesday, December 11th will be paid a dividend of $0.297 per share. This is an increase from TELUS's previous quarterly dividend of $0.28. This represents a $1.19 dividend on an annualized basis and a yield of 7.83%. The ex-dividend date is Wednesday, December 11th. TELUS's dividend payout ratio is 244.69%.

TELUS Company Profile

(

Free Report)

TELUS Corporation, together with its subsidiaries, provides a range of telecommunications and information technology products and services in Canada. It operates through Technology Solutions and Digitally-Led Customer Experiences segments. The Technology Solutions segment offers a range of telecommunications products and services; network services; healthcare services; mobile technologies equipment; data services, such as internet protocol; television; hosting, managed information technology, and cloud-based services; software, data management, and data analytics-driven smart food-chain and consumer goods technologies; home and business security; healthcare software and technology solutions; and voice and other telecommunications services, as well as mobile and fixed voice and data telecommunications services and products.

Further Reading

Before you consider TELUS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TELUS wasn't on the list.

While TELUS currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.