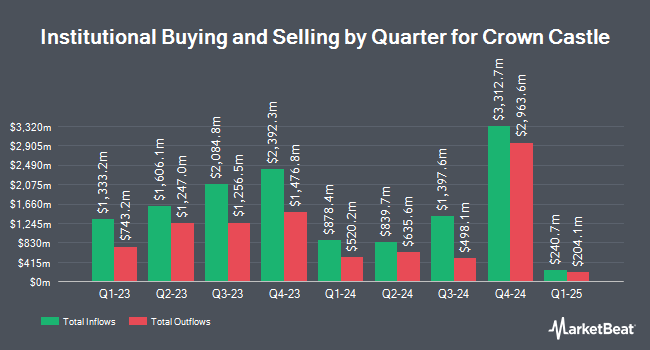

Crossmark Global Holdings Inc. reduced its stake in Crown Castle Inc. (NYSE:CCI - Free Report) by 7.8% in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 74,678 shares of the real estate investment trust's stock after selling 6,347 shares during the quarter. Crossmark Global Holdings Inc.'s holdings in Crown Castle were worth $8,859,000 as of its most recent SEC filing.

Other institutional investors and hedge funds have also bought and sold shares of the company. Van ECK Associates Corp grew its stake in Crown Castle by 24.7% in the 3rd quarter. Van ECK Associates Corp now owns 157,895 shares of the real estate investment trust's stock valued at $17,476,000 after purchasing an additional 31,319 shares during the period. BOKF NA grew its stake in Crown Castle by 25.6% in the 1st quarter. BOKF NA now owns 4,004 shares of the real estate investment trust's stock valued at $417,000 after purchasing an additional 815 shares during the period. O Shaughnessy Asset Management LLC grew its stake in Crown Castle by 30.4% in the 1st quarter. O Shaughnessy Asset Management LLC now owns 35,805 shares of the real estate investment trust's stock valued at $3,789,000 after purchasing an additional 8,346 shares during the period. Mitsubishi UFJ Asset Management Co. Ltd. grew its stake in shares of Crown Castle by 21.4% during the 1st quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 517,964 shares of the real estate investment trust's stock worth $54,816,000 after acquiring an additional 91,404 shares during the period. Finally, Russell Investments Group Ltd. grew its stake in shares of Crown Castle by 64.5% during the 1st quarter. Russell Investments Group Ltd. now owns 627,544 shares of the real estate investment trust's stock worth $66,402,000 after acquiring an additional 246,043 shares during the period. 90.77% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several brokerages have commented on CCI. TD Cowen cut their target price on Crown Castle from $127.00 to $123.00 and set a "buy" rating for the company in a research note on Thursday, October 17th. Wells Fargo & Company raised their target price on Crown Castle from $100.00 to $105.00 and gave the stock an "equal weight" rating in a research note on Friday, October 18th. Jefferies Financial Group raised their price target on Crown Castle from $123.00 to $127.00 and gave the company a "buy" rating in a report on Thursday, October 17th. The Goldman Sachs Group raised their price target on Crown Castle from $105.00 to $120.00 and gave the company a "neutral" rating in a report on Thursday, September 26th. Finally, Deutsche Bank Aktiengesellschaft raised their price objective on Crown Castle from $103.00 to $105.00 and gave the company a "hold" rating in a report on Tuesday, July 23rd. Twelve analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $116.87.

Get Our Latest Analysis on Crown Castle

Crown Castle Stock Down 1.7 %

NYSE:CCI traded down $1.75 during trading hours on Monday, reaching $104.10. 1,576,300 shares of the company traded hands, compared to its average volume of 2,610,631. Crown Castle Inc. has a 1 year low of $92.48 and a 1 year high of $120.92. The business's 50-day moving average price is $113.12 and its two-hundred day moving average price is $106.30. The company has a current ratio of 0.54, a quick ratio of 0.54 and a debt-to-equity ratio of 4.43. The stock has a market capitalization of $45.24 billion, a P/E ratio of 37.54 and a beta of 0.86.

Crown Castle (NYSE:CCI - Get Free Report) last posted its quarterly earnings results on Wednesday, October 16th. The real estate investment trust reported $0.70 earnings per share for the quarter, missing the consensus estimate of $1.73 by ($1.03). Crown Castle had a return on equity of 20.98% and a net margin of 18.59%. The business had revenue of $1.65 billion during the quarter, compared to analysts' expectations of $1.64 billion. During the same quarter in the prior year, the firm earned $1.77 EPS. The firm's revenue for the quarter was down .9% compared to the same quarter last year. Analysts predict that Crown Castle Inc. will post 6.65 earnings per share for the current year.

Crown Castle Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Friday, December 13th will be given a dividend of $1.565 per share. This represents a $6.26 dividend on an annualized basis and a yield of 6.01%. The ex-dividend date of this dividend is Friday, December 13th. Crown Castle's dividend payout ratio (DPR) is presently 221.99%.

About Crown Castle

(

Free Report)

Crown Castle owns, operates and leases more than 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S. market. This nationwide portfolio of communications infrastructure connects cities and communities to essential data, technology and wireless service - bringing information, ideas and innovations to the people and businesses that need them.

Featured Stories

Before you consider Crown Castle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crown Castle wasn't on the list.

While Crown Castle currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.