Crossmark Global Holdings Inc. lifted its stake in shares of Smith & Nephew plc (NYSE:SNN - Free Report) by 63.7% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 112,859 shares of the medical equipment provider's stock after purchasing an additional 43,924 shares during the period. Crossmark Global Holdings Inc.'s holdings in Smith & Nephew were worth $3,515,000 at the end of the most recent quarter.

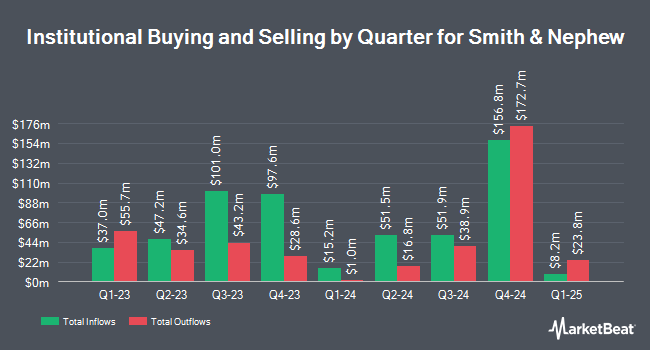

Several other large investors also recently modified their holdings of SNN. Argonautica Private Wealth Management Inc. boosted its holdings in Smith & Nephew by 6.3% in the 2nd quarter. Argonautica Private Wealth Management Inc. now owns 10,244 shares of the medical equipment provider's stock worth $254,000 after buying an additional 605 shares during the period. First Trust Direct Indexing L.P. boosted its holdings in Smith & Nephew by 6.9% in the 3rd quarter. First Trust Direct Indexing L.P. now owns 9,659 shares of the medical equipment provider's stock valued at $301,000 after purchasing an additional 626 shares during the period. Inspire Advisors LLC boosted its holdings in Smith & Nephew by 3.0% in the 2nd quarter. Inspire Advisors LLC now owns 22,286 shares of the medical equipment provider's stock valued at $552,000 after purchasing an additional 639 shares during the period. Rhumbline Advisers boosted its holdings in Smith & Nephew by 8.6% in the 2nd quarter. Rhumbline Advisers now owns 10,365 shares of the medical equipment provider's stock valued at $257,000 after purchasing an additional 819 shares during the period. Finally, Janney Montgomery Scott LLC boosted its holdings in Smith & Nephew by 13.8% in the 1st quarter. Janney Montgomery Scott LLC now owns 9,611 shares of the medical equipment provider's stock valued at $244,000 after purchasing an additional 1,165 shares during the period. Hedge funds and other institutional investors own 25.64% of the company's stock.

Smith & Nephew Price Performance

Shares of NYSE:SNN traded down $0.07 during midday trading on Tuesday, reaching $24.67. 769,649 shares of the company were exchanged, compared to its average volume of 864,909. The company has a debt-to-equity ratio of 0.63, a current ratio of 2.51 and a quick ratio of 1.11. The business's fifty day moving average is $29.24 and its two-hundred day moving average is $27.87. Smith & Nephew plc has a one year low of $23.65 and a one year high of $31.72.

Analyst Upgrades and Downgrades

A number of research firms have recently issued reports on SNN. Deutsche Bank Aktiengesellschaft downgraded shares of Smith & Nephew from a "buy" rating to a "hold" rating in a report on Friday, November 1st. Berenberg Bank lowered shares of Smith & Nephew from a "buy" rating to a "hold" rating in a research note on Wednesday, November 6th. Finally, StockNews.com upgraded shares of Smith & Nephew from a "buy" rating to a "strong-buy" rating in a research note on Monday, August 5th. Three investment analysts have rated the stock with a hold rating, one has assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy".

Check Out Our Latest Research Report on SNN

Smith & Nephew Company Profile

(

Free Report)

Smith & Nephew plc, together with its subsidiaries, develops, manufactures, markets, and sells medical devices and services in the United Kingdom and internationally. It operates through three segments: Orthopaedics, Sports Medicine & ENT, and Advanced Wound Management. The company offers knee implant products for knee replacement procedures; hip implants for revision procedures; trauma and extremities products that include internal and external devices used in the stabilization of severe fractures and deformity correction procedures; and other reconstruction products.

Featured Stories

Before you consider Smith & Nephew, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Smith & Nephew wasn't on the list.

While Smith & Nephew currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.