Crossmark Global Holdings Inc. reduced its stake in shares of Franco-Nevada Co. (NYSE:FNV - Free Report) TSE: FNV by 39.3% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 9,061 shares of the basic materials company's stock after selling 5,866 shares during the quarter. Crossmark Global Holdings Inc.'s holdings in Franco-Nevada were worth $1,126,000 as of its most recent SEC filing.

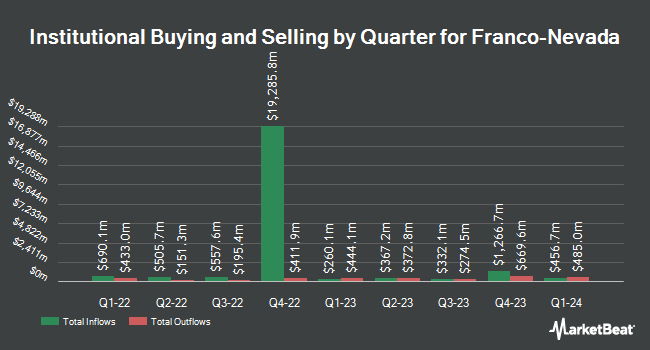

A number of other institutional investors also recently added to or reduced their stakes in FNV. Massachusetts Financial Services Co. MA boosted its position in shares of Franco-Nevada by 0.5% in the 2nd quarter. Massachusetts Financial Services Co. MA now owns 12,286,603 shares of the basic materials company's stock valued at $1,456,208,000 after purchasing an additional 64,429 shares during the period. Van ECK Associates Corp boosted its stake in shares of Franco-Nevada by 1.8% during the second quarter. Van ECK Associates Corp now owns 8,626,736 shares of the basic materials company's stock valued at $1,022,452,000 after acquiring an additional 151,566 shares during the last quarter. Vanguard Group Inc. grew its holdings in shares of Franco-Nevada by 1.8% during the first quarter. Vanguard Group Inc. now owns 7,374,086 shares of the basic materials company's stock worth $878,696,000 after buying an additional 129,876 shares in the last quarter. Capital World Investors grew its stake in Franco-Nevada by 2.7% in the 1st quarter. Capital World Investors now owns 4,597,472 shares of the basic materials company's stock worth $547,807,000 after acquiring an additional 120,367 shares during the period. Finally, First Eagle Investment Management LLC increased its stake in Franco-Nevada by 1.5% in the second quarter. First Eagle Investment Management LLC now owns 3,260,300 shares of the basic materials company's stock valued at $386,597,000 after purchasing an additional 47,311 shares during the last quarter. Institutional investors own 77.06% of the company's stock.

Franco-Nevada Stock Down 1.0 %

NYSE FNV traded down $1.19 during trading on Friday, reaching $114.03. 220,582 shares of the stock traded hands, compared to its average volume of 660,088. Franco-Nevada Co. has a fifty-two week low of $102.29 and a fifty-two week high of $137.60. The stock's 50-day moving average price is $126.29 and its 200 day moving average price is $123.98.

Franco-Nevada (NYSE:FNV - Get Free Report) TSE: FNV last announced its earnings results on Wednesday, November 6th. The basic materials company reported $0.80 EPS for the quarter, missing the consensus estimate of $0.83 by ($0.03). The business had revenue of $275.70 million for the quarter, compared to analyst estimates of $279.11 million. Franco-Nevada had a positive return on equity of 10.55% and a negative net margin of 55.28%. The business's revenue for the quarter was down 10.9% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.91 EPS. Analysts expect that Franco-Nevada Co. will post 3.22 EPS for the current year.

Franco-Nevada Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Thursday, December 19th. Stockholders of record on Thursday, December 5th will be issued a dividend of $0.36 per share. This represents a $1.44 dividend on an annualized basis and a dividend yield of 1.26%. The ex-dividend date is Thursday, December 5th. Franco-Nevada's dividend payout ratio is currently -45.57%.

Analyst Upgrades and Downgrades

Several equities research analysts have issued reports on FNV shares. StockNews.com upgraded shares of Franco-Nevada from a "sell" rating to a "hold" rating in a research note on Thursday, August 22nd. Bank of America downgraded shares of Franco-Nevada from a "buy" rating to a "neutral" rating and lowered their price objective for the company from $142.00 to $139.00 in a research report on Tuesday, October 1st. TD Cowen upgraded Franco-Nevada from a "hold" rating to a "buy" rating in a research note on Thursday, August 15th. HC Wainwright increased their price objective on Franco-Nevada from $185.00 to $200.00 and gave the stock a "buy" rating in a report on Friday, November 8th. Finally, TD Securities upgraded shares of Franco-Nevada from a "hold" rating to a "buy" rating in a research note on Thursday, August 15th. Four investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. According to data from MarketBeat, Franco-Nevada currently has an average rating of "Moderate Buy" and an average target price of $156.57.

Get Our Latest Stock Report on Franco-Nevada

About Franco-Nevada

(

Free Report)

Franco-Nevada Corporation operates as a gold-focused royalty and streaming company in South America, Central America, Mexico, the United States, Canada, and internationally. It operates through Mining and Energy segments. The company manages its portfolio with a focus on precious metals, such as gold, silver, and platinum group metals; and engages in the sale of crude oil, natural gas, and natural gas liquids through a third-party marketing agent.

Featured Stories

Before you consider Franco-Nevada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Franco-Nevada wasn't on the list.

While Franco-Nevada currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.