Crossmark Global Holdings Inc. cut its stake in shares of National Storage Affiliates Trust (NYSE:NSA - Free Report) by 71.6% in the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 5,290 shares of the real estate investment trust's stock after selling 13,354 shares during the quarter. Crossmark Global Holdings Inc.'s holdings in National Storage Affiliates Trust were worth $255,000 at the end of the most recent reporting period.

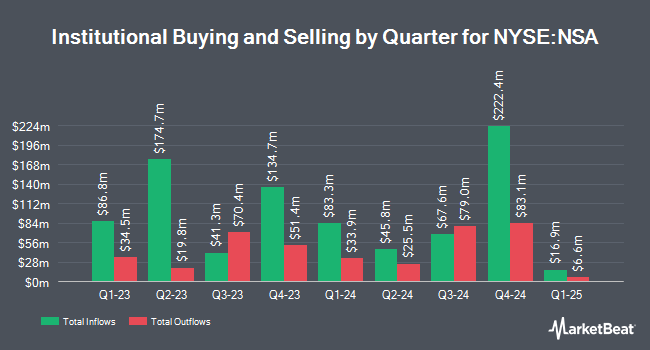

A number of other large investors have also recently made changes to their positions in the company. Northwestern Mutual Wealth Management Co. acquired a new position in National Storage Affiliates Trust during the 2nd quarter worth approximately $33,000. Ashton Thomas Private Wealth LLC acquired a new position in shares of National Storage Affiliates Trust during the second quarter worth $39,000. Bellevue Asset Management LLC purchased a new position in National Storage Affiliates Trust in the third quarter valued at $39,000. Rothschild Investment LLC acquired a new position in shares of National Storage Affiliates Trust during the 2nd quarter worth about $59,000. Finally, GAMMA Investing LLC increased its holdings in shares of National Storage Affiliates Trust by 174.9% in the 3rd quarter. GAMMA Investing LLC now owns 1,457 shares of the real estate investment trust's stock valued at $70,000 after acquiring an additional 927 shares during the last quarter. 99.97% of the stock is currently owned by hedge funds and other institutional investors.

National Storage Affiliates Trust Stock Performance

NSA traded up $0.64 on Tuesday, hitting $44.00. 154,393 shares of the company traded hands, compared to its average volume of 712,279. The company has a 50 day moving average of $45.08 and a 200-day moving average of $42.56. National Storage Affiliates Trust has a 12-month low of $32.42 and a 12-month high of $49.44. The stock has a market capitalization of $3.35 billion, a PE ratio of 25.35 and a beta of 0.99. The company has a quick ratio of 0.72, a current ratio of 0.72 and a debt-to-equity ratio of 2.35.

National Storage Affiliates Trust (NYSE:NSA - Get Free Report) last issued its quarterly earnings results on Wednesday, October 30th. The real estate investment trust reported $0.18 earnings per share for the quarter, missing the consensus estimate of $0.60 by ($0.42). The company had revenue of $174.80 million for the quarter, compared to analyst estimates of $185.45 million. National Storage Affiliates Trust had a return on equity of 10.35% and a net margin of 20.59%. National Storage Affiliates Trust's revenue for the quarter was down 20.2% compared to the same quarter last year. During the same period in the prior year, the business earned $0.67 earnings per share. Sell-side analysts anticipate that National Storage Affiliates Trust will post 2.4 earnings per share for the current year.

National Storage Affiliates Trust Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Friday, December 13th will be given a $0.57 dividend. The ex-dividend date is Friday, December 13th. This represents a $2.28 dividend on an annualized basis and a yield of 5.18%. This is an increase from National Storage Affiliates Trust's previous quarterly dividend of $0.56. National Storage Affiliates Trust's dividend payout ratio (DPR) is presently 130.99%.

Analyst Upgrades and Downgrades

A number of equities analysts recently issued reports on the company. Robert W. Baird upped their price target on National Storage Affiliates Trust from $39.00 to $42.00 and gave the company a "neutral" rating in a report on Wednesday, November 6th. Barclays lifted their price target on shares of National Storage Affiliates Trust from $45.00 to $46.00 and gave the stock an "equal weight" rating in a research note on Monday, October 28th. Wells Fargo & Company upped their price objective on shares of National Storage Affiliates Trust from $40.00 to $42.00 and gave the company an "underweight" rating in a research note on Monday, October 21st. Citigroup lifted their target price on National Storage Affiliates Trust from $36.00 to $44.50 and gave the stock a "neutral" rating in a research report on Friday, August 30th. Finally, Truist Financial upped their target price on National Storage Affiliates Trust from $38.00 to $41.00 and gave the company a "hold" rating in a research report on Friday, August 16th. Three investment analysts have rated the stock with a sell rating, six have issued a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average price target of $43.17.

Read Our Latest Report on National Storage Affiliates Trust

About National Storage Affiliates Trust

(

Free Report)

National Storage Affiliates Trust is a real estate investment trust headquartered in Greenwood Village, Colorado, focused on the ownership, operation and acquisition of self storage properties predominantly located within the top 100 metropolitan statistical areas throughout the United States. As of December 31, 2023, the Company held ownership interests in and operated 1,050 self storage properties, located in 42 states and Puerto Rico with approximately 68.6 million rentable square feet, which excludes 39 self storage properties classified as held for sale to be sold to a third party.

See Also

Before you consider National Storage Affiliates Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Storage Affiliates Trust wasn't on the list.

While National Storage Affiliates Trust currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.