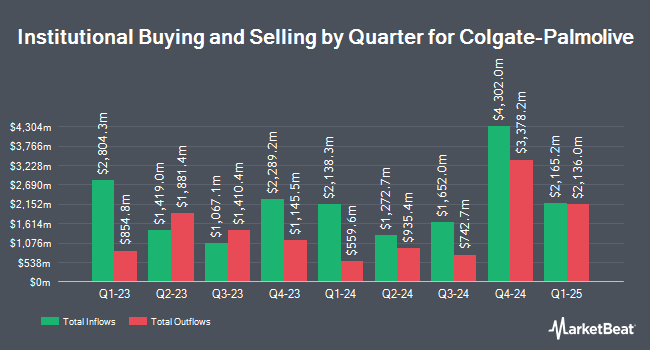

Crossmark Global Holdings Inc. boosted its stake in shares of Colgate-Palmolive (NYSE:CL - Free Report) by 138.0% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 166,726 shares of the company's stock after buying an additional 96,680 shares during the quarter. Crossmark Global Holdings Inc.'s holdings in Colgate-Palmolive were worth $17,308,000 as of its most recent SEC filing.

Other institutional investors have also recently made changes to their positions in the company. Price T Rowe Associates Inc. MD raised its stake in Colgate-Palmolive by 27.8% during the first quarter. Price T Rowe Associates Inc. MD now owns 41,067,130 shares of the company's stock worth $3,698,096,000 after buying an additional 8,933,912 shares during the last quarter. Swedbank AB bought a new position in shares of Colgate-Palmolive in the 1st quarter worth about $286,370,000. Acadian Asset Management LLC lifted its stake in shares of Colgate-Palmolive by 108.4% in the 2nd quarter. Acadian Asset Management LLC now owns 5,682,280 shares of the company's stock valued at $551,367,000 after purchasing an additional 2,955,442 shares during the period. Massachusetts Financial Services Co. MA boosted its position in shares of Colgate-Palmolive by 40.7% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 8,969,498 shares of the company's stock valued at $870,400,000 after purchasing an additional 2,593,313 shares in the last quarter. Finally, Ossiam grew its stake in Colgate-Palmolive by 368.4% during the first quarter. Ossiam now owns 1,563,768 shares of the company's stock worth $140,817,000 after purchasing an additional 1,229,891 shares during the period. Institutional investors own 80.41% of the company's stock.

Wall Street Analyst Weigh In

CL has been the topic of a number of research analyst reports. Deutsche Bank Aktiengesellschaft cut Colgate-Palmolive from a "buy" rating to a "hold" rating and increased their price target for the stock from $107.00 to $109.00 in a report on Monday, September 9th. Stifel Nicolaus lowered shares of Colgate-Palmolive from a "buy" rating to a "hold" rating and cut their target price for the stock from $105.00 to $101.00 in a research note on Monday, October 28th. UBS Group lifted their price target on shares of Colgate-Palmolive from $119.00 to $122.00 and gave the company a "buy" rating in a research note on Wednesday, September 4th. TD Cowen cut their price objective on shares of Colgate-Palmolive from $115.00 to $110.00 and set a "buy" rating on the stock in a research report on Monday, October 28th. Finally, Sanford C. Bernstein boosted their target price on Colgate-Palmolive from $100.00 to $103.00 and gave the company a "market perform" rating in a research report on Tuesday, July 30th. One analyst has rated the stock with a sell rating, nine have issued a hold rating and thirteen have given a buy rating to the stock. Based on data from MarketBeat, Colgate-Palmolive currently has an average rating of "Moderate Buy" and a consensus target price of $105.11.

Get Our Latest Stock Report on Colgate-Palmolive

Colgate-Palmolive Price Performance

CL traded up $1.80 during trading on Friday, reaching $92.57. The stock had a trading volume of 4,568,042 shares, compared to its average volume of 4,630,135. The company has a debt-to-equity ratio of 9.46, a quick ratio of 0.68 and a current ratio of 1.04. The business has a 50-day moving average of $100.91 and a 200-day moving average of $98.44. Colgate-Palmolive has a one year low of $74.67 and a one year high of $109.30. The stock has a market cap of $75.63 billion, a PE ratio of 26.52, a PEG ratio of 3.22 and a beta of 0.42.

Colgate-Palmolive Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, November 15th. Shareholders of record on Friday, October 18th will be paid a $0.50 dividend. This represents a $2.00 annualized dividend and a yield of 2.16%. The ex-dividend date is Friday, October 18th. Colgate-Palmolive's dividend payout ratio is currently 57.31%.

Insider Buying and Selling at Colgate-Palmolive

In other news, Director Martina Hundmejean sold 2,313 shares of the firm's stock in a transaction dated Friday, August 23rd. The stock was sold at an average price of $103.86, for a total transaction of $240,228.18. Following the transaction, the director now directly owns 11,755 shares of the company's stock, valued at approximately $1,220,874.30. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In related news, CFO Stanley J. Sutula III sold 45,410 shares of Colgate-Palmolive stock in a transaction on Tuesday, November 5th. The shares were sold at an average price of $94.11, for a total value of $4,273,535.10. Following the transaction, the chief financial officer now directly owns 36,726 shares of the company's stock, valued at $3,456,283.86. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, Director Martina Hundmejean sold 2,313 shares of the stock in a transaction on Friday, August 23rd. The shares were sold at an average price of $103.86, for a total transaction of $240,228.18. Following the sale, the director now directly owns 11,755 shares of the company's stock, valued at $1,220,874.30. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 0.34% of the company's stock.

Colgate-Palmolive Profile

(

Free Report)

Colgate-Palmolive Company, together with its subsidiaries, manufactures and sells consumer products in the United States and internationally. It operates through two segments: Oral, Personal and Home Care; and Pet Nutrition. The Oral, Personal and Home Care segment offers toothpaste, toothbrushes, mouthwash, bar and liquid hand soaps, shower gels, shampoos, conditioners, deodorants and antiperspirants, skin health products, dishwashing detergents, fabric conditioners, household cleaners, and other related items.

Read More

Before you consider Colgate-Palmolive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Colgate-Palmolive wasn't on the list.

While Colgate-Palmolive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report