Crossmark Global Holdings Inc. decreased its holdings in shares of Barrick Gold Corp (NYSE:GOLD - Free Report) TSE: ABX by 72.6% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 17,882 shares of the gold and copper producer's stock after selling 47,414 shares during the quarter. Crossmark Global Holdings Inc.'s holdings in Barrick Gold were worth $355,000 as of its most recent filing with the Securities and Exchange Commission.

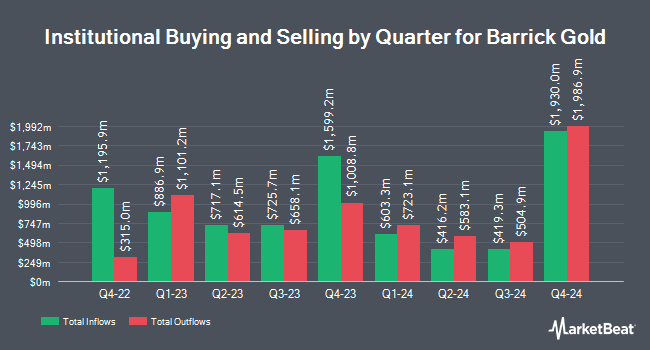

Other large investors have also recently bought and sold shares of the company. Vanguard Group Inc. grew its holdings in shares of Barrick Gold by 1.7% during the 1st quarter. Vanguard Group Inc. now owns 64,761,067 shares of the gold and copper producer's stock valued at $1,077,624,000 after acquiring an additional 1,089,572 shares in the last quarter. EdgePoint Investment Group Inc. grew its stake in Barrick Gold by 3.7% in the second quarter. EdgePoint Investment Group Inc. now owns 18,837,028 shares of the gold and copper producer's stock valued at $314,254,000 after purchasing an additional 666,214 shares in the last quarter. National Bank of Canada FI increased its position in Barrick Gold by 9.0% in the 1st quarter. National Bank of Canada FI now owns 14,887,656 shares of the gold and copper producer's stock worth $251,929,000 after purchasing an additional 1,231,184 shares during the last quarter. CIBC Asset Management Inc raised its stake in shares of Barrick Gold by 3.3% during the 2nd quarter. CIBC Asset Management Inc now owns 14,546,530 shares of the gold and copper producer's stock worth $242,491,000 after purchasing an additional 461,406 shares in the last quarter. Finally, Dimensional Fund Advisors LP raised its stake in shares of Barrick Gold by 16.5% during the 2nd quarter. Dimensional Fund Advisors LP now owns 7,471,407 shares of the gold and copper producer's stock worth $124,635,000 after purchasing an additional 1,057,886 shares in the last quarter. 62.85% of the stock is owned by institutional investors and hedge funds.

Barrick Gold Stock Performance

Shares of Barrick Gold stock traded up $0.56 during midday trading on Monday, hitting $17.21. The company had a trading volume of 31,097,264 shares, compared to its average volume of 21,467,057. The stock has a market cap of $30.08 billion, a PE ratio of 18.38, a P/E/G ratio of 0.39 and a beta of 0.56. Barrick Gold Corp has a 1-year low of $13.76 and a 1-year high of $21.35. The business's 50 day simple moving average is $19.69 and its two-hundred day simple moving average is $18.49. The company has a debt-to-equity ratio of 0.14, a current ratio of 2.65 and a quick ratio of 2.06.

Barrick Gold Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Friday, November 29th will be given a dividend of $0.10 per share. This represents a $0.40 dividend on an annualized basis and a dividend yield of 2.32%. The ex-dividend date is Friday, November 29th. Barrick Gold's dividend payout ratio is currently 43.01%.

Analyst Upgrades and Downgrades

A number of equities analysts recently commented on the company. Royal Bank of Canada increased their price objective on Barrick Gold from $21.00 to $22.00 and gave the stock an "outperform" rating in a report on Tuesday, September 10th. Argus upgraded shares of Barrick Gold from a "hold" rating to a "buy" rating and set a $24.00 price target on the stock in a research note on Thursday, August 29th. TD Securities reduced their price objective on shares of Barrick Gold from $27.00 to $26.00 and set a "buy" rating for the company in a research note on Friday, November 8th. Scotiabank decreased their price objective on shares of Barrick Gold from $25.00 to $24.00 and set a "sector outperform" rating for the company in a report on Friday, November 8th. Finally, Jefferies Financial Group raised their target price on Barrick Gold from $23.00 to $24.00 and gave the company a "buy" rating in a report on Friday, September 13th. Three investment analysts have rated the stock with a hold rating and eight have issued a buy rating to the company. According to data from MarketBeat.com, Barrick Gold currently has an average rating of "Moderate Buy" and an average price target of $23.90.

View Our Latest Research Report on GOLD

Barrick Gold Company Profile

(

Free Report)

Barrick Gold Corporation is a sector-leading gold and copper producer. Its shares trade on the New York Stock Exchange under the symbol GOLD and on the Toronto Stock Exchange under the symbol ABX.

In January 2019 Barrick merged with Randgold Resources and in July that year it combined its gold mines in Nevada, USA, with those of Newmont Corporation in a joint venture, Nevada Gold Mines, which is majority-owned and operated by Barrick.

See Also

Before you consider Barrick Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barrick Gold wasn't on the list.

While Barrick Gold currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.