Pathstone Holdings LLC reduced its position in CrowdStrike Holdings, Inc. (NASDAQ:CRWD - Free Report) by 55.8% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 268,522 shares of the company's stock after selling 338,644 shares during the quarter. Pathstone Holdings LLC owned about 0.11% of CrowdStrike worth $75,312,000 at the end of the most recent reporting period.

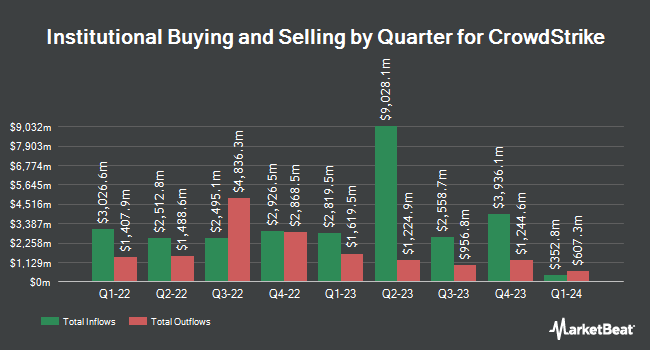

Other hedge funds have also modified their holdings of the company. Quent Capital LLC increased its position in CrowdStrike by 59.9% in the 1st quarter. Quent Capital LLC now owns 235 shares of the company's stock valued at $75,000 after acquiring an additional 88 shares during the period. Ontario Teachers Pension Plan Board purchased a new stake in shares of CrowdStrike during the first quarter worth approximately $273,000. Edgestream Partners L.P. acquired a new stake in shares of CrowdStrike during the first quarter worth $839,000. O Shaughnessy Asset Management LLC grew its position in CrowdStrike by 46.1% in the 1st quarter. O Shaughnessy Asset Management LLC now owns 13,022 shares of the company's stock valued at $4,175,000 after buying an additional 4,110 shares during the last quarter. Finally, UniSuper Management Pty Ltd grew its position in CrowdStrike by 88.2% in the 1st quarter. UniSuper Management Pty Ltd now owns 3,200 shares of the company's stock valued at $1,026,000 after buying an additional 1,500 shares during the last quarter. 71.16% of the stock is currently owned by hedge funds and other institutional investors.

CrowdStrike Stock Up 3.0 %

Shares of CrowdStrike stock traded up $10.32 during trading on Tuesday, reaching $353.29. The company had a trading volume of 2,848,037 shares, compared to its average volume of 5,002,610. The company has a market cap of $86.60 billion, a price-to-earnings ratio of 512.01, a price-to-earnings-growth ratio of 22.77 and a beta of 1.10. CrowdStrike Holdings, Inc. has a fifty-two week low of $200.81 and a fifty-two week high of $398.33. The firm's fifty day moving average is $301.83 and its 200-day moving average is $310.94. The company has a debt-to-equity ratio of 0.26, a quick ratio of 1.90 and a current ratio of 1.90.

CrowdStrike (NASDAQ:CRWD - Get Free Report) last released its earnings results on Wednesday, August 28th. The company reported $1.04 EPS for the quarter, topping analysts' consensus estimates of $0.97 by $0.07. The company had revenue of $963.87 million for the quarter, compared to the consensus estimate of $958.27 million. CrowdStrike had a return on equity of 8.44% and a net margin of 4.84%. CrowdStrike's quarterly revenue was up 31.7% compared to the same quarter last year. During the same quarter last year, the business posted $0.06 EPS. On average, analysts anticipate that CrowdStrike Holdings, Inc. will post 0.52 EPS for the current year.

Wall Street Analysts Forecast Growth

CRWD has been the subject of several recent analyst reports. Morgan Stanley raised their target price on shares of CrowdStrike from $325.00 to $355.00 and gave the stock an "overweight" rating in a research note on Monday. Sanford C. Bernstein reduced their price objective on shares of CrowdStrike from $334.00 to $327.00 and set an "outperform" rating for the company in a research report on Thursday, September 5th. BNP Paribas initiated coverage on CrowdStrike in a research report on Tuesday, October 8th. They set a "neutral" rating and a $285.00 target price on the stock. JMP Securities reissued a "market outperform" rating and issued a $400.00 price target on shares of CrowdStrike in a report on Monday, November 4th. Finally, Barclays lifted their price target on CrowdStrike from $295.00 to $372.00 and gave the company an "overweight" rating in a research note on Monday. One equities research analyst has rated the stock with a sell rating, seven have assigned a hold rating, thirty-one have given a buy rating and three have given a strong buy rating to the stock. According to MarketBeat, CrowdStrike has an average rating of "Moderate Buy" and an average target price of $331.90.

View Our Latest Stock Report on CRWD

Insiders Place Their Bets

In related news, insider Shawn Henry sold 4,500 shares of the firm's stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $260.73, for a total value of $1,173,285.00. Following the sale, the insider now owns 174,591 shares of the company's stock, valued at approximately $45,521,111.43. This trade represents a 2.51 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CEO George Kurtz sold 55,325 shares of the company's stock in a transaction on Monday, September 23rd. The stock was sold at an average price of $296.62, for a total value of $16,410,501.50. Following the transaction, the chief executive officer now owns 1,109,746 shares of the company's stock, valued at approximately $329,172,858.52. The trade was a 4.75 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 108,248 shares of company stock valued at $32,465,110. Company insiders own 4.34% of the company's stock.

About CrowdStrike

(

Free Report)

CrowdStrike Holdings, Inc provides cybersecurity solutions in the United States and internationally. Its unified platform offers cloud-delivered protection of endpoints, cloud workloads, identity, and data. The company offers corporate endpoint and cloud workload security, managed security, security and vulnerability management, IT operations management, identity protection, SIEM and log management, threat intelligence, data protection, security orchestration, automation and response and AI powered workflow automation, and securing generative AI workload services.

Featured Articles

Before you consider CrowdStrike, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CrowdStrike wasn't on the list.

While CrowdStrike currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.