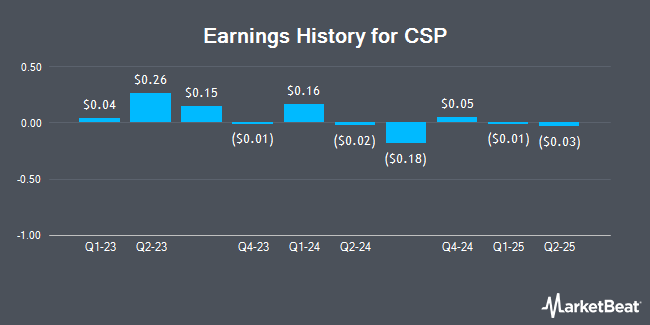

CSP (NASDAQ:CSPI - Get Free Report) announced its quarterly earnings results on Friday. The information technology services provider reported ($0.18) earnings per share (EPS) for the quarter, Zacks reports. CSP had a net margin of 4.42% and a return on equity of 5.38%.

CSP Price Performance

CSP stock traded down $1.58 during midday trading on Friday, hitting $14.92. 106,223 shares of the company were exchanged, compared to its average volume of 79,432. The company has a market cap of $145.68 million, a PE ratio of 53.29 and a beta of 1.44. CSP has a fifty-two week low of $9.07 and a fifty-two week high of $29.92. The company's fifty day moving average price is $14.57 and its 200-day moving average price is $14.18.

About CSP

(

Get Free Report)

CSP Inc develops and markets IT integration solutions, security products, managed IT services, cloud services, purpose-built network adapters, and cluster computer systems for commercial and defense customers worldwide. It operates in two segments, Technology Solutions and High Performance Products. The Technology Solutions segment provides third-party computer hardware and software as a value-added reseller to various customers in web and infrastructure hosting, education, telecommunications, healthcare services, distribution, financial and professional services, and manufacturing industries.

Further Reading

Before you consider CSP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CSP wasn't on the list.

While CSP currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.