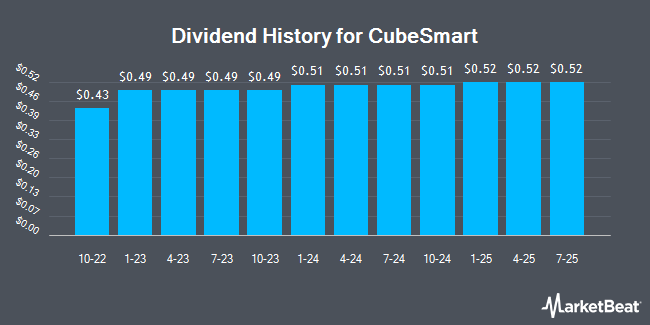

CubeSmart (NYSE:CUBE - Get Free Report) declared a quarterly dividend on Tuesday, December 17th,Wall Street Journal reports. Investors of record on Thursday, January 2nd will be given a dividend of 0.52 per share by the real estate investment trust on Thursday, January 16th. This represents a $2.08 annualized dividend and a dividend yield of 4.57%. The ex-dividend date is Thursday, January 2nd. This is a boost from CubeSmart's previous quarterly dividend of $0.51.

CubeSmart has increased its dividend by an average of 14.2% annually over the last three years and has raised its dividend annually for the last 14 consecutive years. CubeSmart has a payout ratio of 115.9% indicating that the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Equities analysts expect CubeSmart to earn $2.70 per share next year, which means the company should continue to be able to cover its $2.04 annual dividend with an expected future payout ratio of 75.6%.

CubeSmart Stock Performance

CUBE traded down $0.35 on Tuesday, reaching $45.54. The stock had a trading volume of 1,092,061 shares, compared to its average volume of 1,346,907. The business's 50-day moving average price is $48.47 and its two-hundred day moving average price is $48.51. The company has a market cap of $10.30 billion, a P/E ratio of 25.73, a price-to-earnings-growth ratio of 13.00 and a beta of 0.84. CubeSmart has a 12-month low of $39.80 and a 12-month high of $55.14. The company has a current ratio of 0.20, a quick ratio of 0.20 and a debt-to-equity ratio of 1.02.

CubeSmart (NYSE:CUBE - Get Free Report) last announced its earnings results on Thursday, October 31st. The real estate investment trust reported $0.44 earnings per share for the quarter, missing the consensus estimate of $0.68 by ($0.24). CubeSmart had a return on equity of 14.33% and a net margin of 37.79%. The business had revenue of $270.90 million for the quarter, compared to analyst estimates of $267.49 million. During the same period in the previous year, the company earned $0.68 earnings per share. The company's quarterly revenue was up 1.1% compared to the same quarter last year. Sell-side analysts forecast that CubeSmart will post 2.63 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of brokerages have commented on CUBE. Scotiabank reduced their target price on CubeSmart from $53.00 to $52.00 and set a "sector outperform" rating for the company in a report on Monday, November 25th. Evercore ISI increased their price objective on CubeSmart from $52.00 to $53.00 and gave the company an "in-line" rating in a research note on Monday, September 16th. Barclays lowered their target price on shares of CubeSmart from $55.00 to $54.00 and set an "equal weight" rating on the stock in a research note on Monday, October 28th. UBS Group lowered shares of CubeSmart from a "buy" rating to a "neutral" rating and upped their target price for the stock from $53.00 to $54.00 in a report on Friday, September 13th. Finally, Royal Bank of Canada decreased their price target on shares of CubeSmart from $56.00 to $53.00 and set an "outperform" rating on the stock in a research note on Monday, November 4th. One research analyst has rated the stock with a sell rating, six have assigned a hold rating and four have issued a buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $51.36.

Check Out Our Latest Stock Report on CubeSmart

CubeSmart Company Profile

(

Get Free Report)

CubeSmart is a self-administered and self-managed real estate investment trust. The Company's self-storage properties are designed to offer affordable, easily accessible and, in most locations, climate-controlled storage space for residential and commercial customers. According to the 2023 Self-Storage Almanac, CubeSmart is one of the top three owners and operators of self-storage properties in the United States.

Featured Articles

Before you consider CubeSmart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CubeSmart wasn't on the list.

While CubeSmart currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.