Cumberland Partners Ltd boosted its position in shares of McKesson Co. (NYSE:MCK - Free Report) by 12.3% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 11,830 shares of the company's stock after acquiring an additional 1,295 shares during the quarter. Cumberland Partners Ltd's holdings in McKesson were worth $5,849,000 at the end of the most recent quarter.

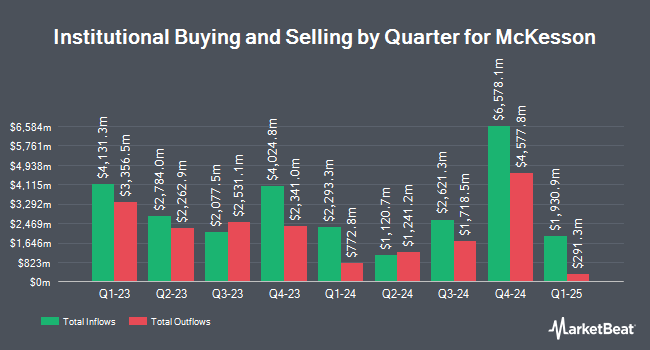

A number of other hedge funds also recently bought and sold shares of MCK. Aigen Investment Management LP purchased a new stake in McKesson during the third quarter valued at about $1,750,000. Savvy Advisors Inc. bought a new position in McKesson in the 3rd quarter worth about $321,000. Ashton Thomas Private Wealth LLC raised its position in shares of McKesson by 2.3% during the 3rd quarter. Ashton Thomas Private Wealth LLC now owns 3,935 shares of the company's stock worth $1,946,000 after buying an additional 90 shares in the last quarter. Sumitomo Mitsui Trust Group Inc. boosted its position in shares of McKesson by 0.5% during the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 320,207 shares of the company's stock valued at $158,317,000 after purchasing an additional 1,725 shares in the last quarter. Finally, WealthPLAN Partners LLC increased its stake in McKesson by 4.3% in the 3rd quarter. WealthPLAN Partners LLC now owns 1,421 shares of the company's stock worth $702,000 after purchasing an additional 58 shares in the last quarter. Institutional investors and hedge funds own 85.07% of the company's stock.

Wall Street Analysts Forecast Growth

MCK has been the topic of several recent analyst reports. Baird R W raised McKesson from a "hold" rating to a "strong-buy" rating in a report on Thursday, November 7th. StockNews.com upgraded shares of McKesson from a "hold" rating to a "buy" rating in a report on Wednesday, November 6th. Robert W. Baird upgraded McKesson from a "neutral" rating to an "outperform" rating and lifted their price target for the stock from $531.00 to $688.00 in a report on Thursday, November 7th. Evercore ISI increased their price objective on McKesson from $560.00 to $680.00 and gave the stock an "outperform" rating in a research report on Thursday, November 7th. Finally, JPMorgan Chase & Co. upped their price target on shares of McKesson from $656.00 to $661.00 and gave the company an "overweight" rating in a research note on Wednesday, August 21st. Two analysts have rated the stock with a hold rating, fourteen have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $625.64.

View Our Latest Research Report on McKesson

Insider Transactions at McKesson

In related news, CEO Brian S. Tyler sold 3,753 shares of the business's stock in a transaction that occurred on Thursday, September 5th. The shares were sold at an average price of $561.10, for a total value of $2,105,808.30. Following the completion of the transaction, the chief executive officer now owns 78,586 shares of the company's stock, valued at $44,094,604.60. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Corporate insiders own 0.11% of the company's stock.

McKesson Stock Performance

MCK traded up $2.09 during midday trading on Tuesday, hitting $617.68. The company had a trading volume of 1,012,803 shares, compared to its average volume of 825,146. McKesson Co. has a twelve month low of $431.35 and a twelve month high of $637.51. The company has a market capitalization of $80.10 billion, a PE ratio of 31.88, a P/E/G ratio of 1.39 and a beta of 0.44. The firm's 50-day simple moving average is $514.12 and its 200-day simple moving average is $552.38.

McKesson (NYSE:MCK - Get Free Report) last posted its quarterly earnings data on Wednesday, November 6th. The company reported $7.07 earnings per share for the quarter, topping the consensus estimate of $6.88 by $0.19. McKesson had a negative return on equity of 207.50% and a net margin of 0.77%. The firm had revenue of $93.65 billion for the quarter, compared to analysts' expectations of $89.33 billion. During the same quarter last year, the business earned $6.23 EPS. The company's quarterly revenue was up 21.3% compared to the same quarter last year. As a group, sell-side analysts anticipate that McKesson Co. will post 32.81 EPS for the current fiscal year.

McKesson Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Monday, December 2nd will be paid a $0.71 dividend. This represents a $2.84 annualized dividend and a yield of 0.46%. The ex-dividend date of this dividend is Monday, December 2nd. McKesson's dividend payout ratio is currently 14.71%.

McKesson Profile

(

Free Report)

McKesson Corporation provides healthcare services in the United States and internationally. It operates through four segments: U.S. Pharmaceutical, Prescription Technology Solutions (RxTS), Medical-Surgical Solutions, and International. The U.S. Pharmaceutical segment distributes branded, generic, specialty, biosimilar and over-the-counter pharmaceutical drugs, and other healthcare-related products.

Featured Articles

Before you consider McKesson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and McKesson wasn't on the list.

While McKesson currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.