Cumberland Partners Ltd lessened its position in shares of Kinsale Capital Group, Inc. (NYSE:KNSL - Free Report) by 50.0% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 2,500 shares of the financial services provider's stock after selling 2,500 shares during the period. Cumberland Partners Ltd's holdings in Kinsale Capital Group were worth $1,164,000 at the end of the most recent reporting period.

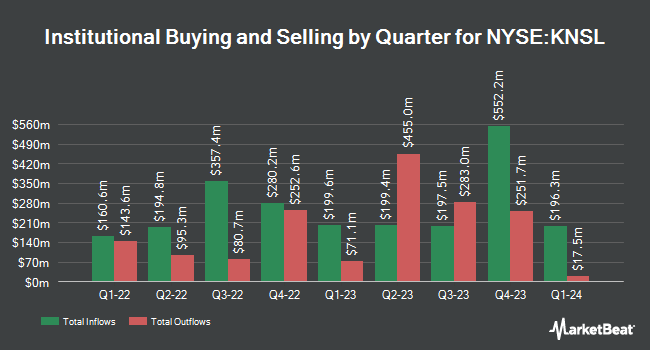

A number of other institutional investors have also recently added to or reduced their stakes in KNSL. Harbor Capital Advisors Inc. boosted its position in shares of Kinsale Capital Group by 249.2% in the second quarter. Harbor Capital Advisors Inc. now owns 5,350 shares of the financial services provider's stock worth $2,061,000 after buying an additional 3,818 shares during the period. Russell Investments Group Ltd. lifted its stake in shares of Kinsale Capital Group by 44.3% in the first quarter. Russell Investments Group Ltd. now owns 37,328 shares of the financial services provider's stock worth $19,588,000 after acquiring an additional 11,451 shares in the last quarter. Swedbank AB acquired a new position in shares of Kinsale Capital Group in the second quarter worth about $15,430,000. QRG Capital Management Inc. acquired a new position in shares of Kinsale Capital Group in the second quarter worth about $503,000. Finally, Bridges Investment Management Inc. acquired a new position in shares of Kinsale Capital Group in the second quarter worth about $642,000. Hedge funds and other institutional investors own 85.36% of the company's stock.

Wall Street Analyst Weigh In

Several research analysts recently commented on the company. Royal Bank of Canada cut their price target on Kinsale Capital Group from $480.00 to $475.00 and set a "sector perform" rating on the stock in a research note on Monday, October 28th. Jefferies Financial Group upped their price objective on Kinsale Capital Group from $444.00 to $471.00 and gave the company a "hold" rating in a research note on Wednesday, October 9th. JPMorgan Chase & Co. cut their price objective on Kinsale Capital Group from $426.00 to $420.00 and set a "neutral" rating on the stock in a research note on Thursday, October 10th. Truist Financial cut their price objective on Kinsale Capital Group from $530.00 to $500.00 and set a "buy" rating on the stock in a research note on Monday, October 28th. Finally, Wolfe Research upgraded Kinsale Capital Group from a "peer perform" rating to an "outperform" rating and set a $535.00 price objective on the stock in a research note on Monday, October 28th. Seven equities research analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average price target of $455.88.

Read Our Latest Stock Analysis on KNSL

Kinsale Capital Group Stock Performance

Shares of NYSE KNSL traded up $4.96 during mid-day trading on Wednesday, hitting $476.92. The company had a trading volume of 103,082 shares, compared to its average volume of 174,714. The stock has a market cap of $11.11 billion, a price-to-earnings ratio of 27.15, a PEG ratio of 2.03 and a beta of 1.09. Kinsale Capital Group, Inc. has a 12 month low of $325.01 and a 12 month high of $548.47. The company has a debt-to-equity ratio of 0.13, a current ratio of 0.09 and a quick ratio of 0.09. The firm's 50 day simple moving average is $458.07 and its two-hundred day simple moving average is $427.22.

Kinsale Capital Group (NYSE:KNSL - Get Free Report) last announced its quarterly earnings results on Thursday, October 24th. The financial services provider reported $4.20 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.60 by $0.60. The business had revenue of $418.06 million for the quarter, compared to the consensus estimate of $359.43 million. Kinsale Capital Group had a return on equity of 28.87% and a net margin of 26.80%. The business's revenue was up 33.0% on a year-over-year basis. During the same quarter last year, the business posted $3.31 EPS. As a group, equities research analysts forecast that Kinsale Capital Group, Inc. will post 15.52 earnings per share for the current year.

Kinsale Capital Group Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, September 12th. Stockholders of record on Thursday, August 29th were given a dividend of $0.15 per share. This represents a $0.60 annualized dividend and a dividend yield of 0.13%. The ex-dividend date of this dividend was Thursday, August 29th. Kinsale Capital Group's dividend payout ratio (DPR) is presently 3.42%.

Kinsale Capital Group Company Profile

(

Free Report)

Kinsale Capital Group, Inc, a specialty insurance company, engages in the provision of property and casualty insurance products in the United States. The company's commercial lines offerings include commercial property, small business casualty and property, excess and general casualty, construction, allied health, life sciences, entertainment, energy, environmental, excess professional, health care, public entity, commercial auto, inland marine, aviation, ocean marine, product recall, and railroad, as well as product, professional, and management liability insurance.

Featured Stories

Before you consider Kinsale Capital Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kinsale Capital Group wasn't on the list.

While Kinsale Capital Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.