Cummins (NYSE:CMI - Get Free Report) was downgraded by equities researchers at StockNews.com from a "strong-buy" rating to a "buy" rating in a research note issued on Tuesday.

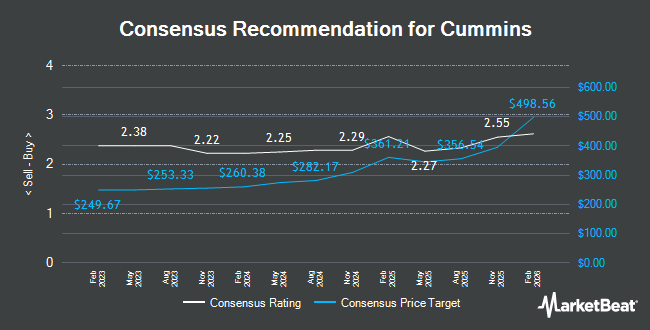

Several other equities analysts have also recently commented on the stock. Vertical Research cut shares of Cummins from a "buy" rating to a "hold" rating and set a $350.00 target price on the stock. in a research note on Wednesday, November 6th. JPMorgan Chase & Co. raised Cummins from an "underweight" rating to a "neutral" rating and lifted their target price for the stock from $355.00 to $420.00 in a report on Monday, December 9th. Robert W. Baird boosted their target price on shares of Cummins from $330.00 to $372.00 and gave the stock a "neutral" rating in a report on Wednesday, November 6th. Evercore ISI upgraded shares of Cummins from an "in-line" rating to an "outperform" rating and raised their target price for the stock from $294.00 to $408.00 in a report on Wednesday, November 13th. Finally, Jefferies Financial Group increased their price objective on Cummins from $410.00 to $435.00 and gave the company a "buy" rating in a research report on Friday, December 6th. Eight equities research analysts have rated the stock with a hold rating and six have given a buy rating to the company. Based on data from MarketBeat, Cummins has a consensus rating of "Hold" and a consensus target price of $374.17.

View Our Latest Stock Analysis on Cummins

Cummins Stock Performance

Shares of CMI traded up $2.99 during midday trading on Tuesday, hitting $364.06. 582,895 shares of the stock traded hands, compared to its average volume of 576,624. The business's 50 day moving average price is $362.81 and its two-hundred day moving average price is $326.21. Cummins has a 1-year low of $226.52 and a 1-year high of $387.90. The firm has a market capitalization of $49.94 billion, a PE ratio of 24.05, a price-to-earnings-growth ratio of 1.78 and a beta of 0.99. The company has a debt-to-equity ratio of 0.43, a quick ratio of 0.79 and a current ratio of 1.32.

Cummins (NYSE:CMI - Get Free Report) last posted its earnings results on Tuesday, November 5th. The company reported $5.86 EPS for the quarter, beating the consensus estimate of $4.89 by $0.97. Cummins had a return on equity of 26.86% and a net margin of 6.13%. The firm had revenue of $8.46 billion for the quarter, compared to analysts' expectations of $8.29 billion. During the same period last year, the firm earned $4.73 EPS. The firm's revenue was up .3% compared to the same quarter last year. Equities research analysts predict that Cummins will post 20.75 EPS for the current fiscal year.

Insider Buying and Selling at Cummins

In other news, VP Sharon R. Barner sold 2,163 shares of the company's stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $369.12, for a total value of $798,406.56. Following the transaction, the vice president now directly owns 20,803 shares of the company's stock, valued at approximately $7,678,803.36. This represents a 9.42 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Insiders have sold a total of 6,489 shares of company stock valued at $2,357,531 in the last 90 days. 0.56% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Several hedge funds have recently bought and sold shares of the company. Pathway Financial Advisers LLC increased its position in Cummins by 31,489.1% during the third quarter. Pathway Financial Advisers LLC now owns 2,531,869 shares of the company's stock worth $819,794,000 after buying an additional 2,523,854 shares during the last quarter. International Assets Investment Management LLC boosted its position in Cummins by 38,765.8% during the third quarter. International Assets Investment Management LLC now owns 974,755 shares of the company's stock worth $315,616,000 after purchasing an additional 972,247 shares during the period. Renaissance Technologies LLC acquired a new position in Cummins during the second quarter valued at approximately $46,607,000. Fisher Asset Management LLC lifted its stake in shares of Cummins by 5.8% in the third quarter. Fisher Asset Management LLC now owns 3,005,570 shares of the company's stock worth $973,174,000 after buying an additional 165,398 shares during the last quarter. Finally, AXA S.A. boosted its holdings in shares of Cummins by 247.5% during the 2nd quarter. AXA S.A. now owns 229,051 shares of the company's stock worth $63,431,000 after buying an additional 163,129 shares during the period. 83.46% of the stock is owned by institutional investors and hedge funds.

About Cummins

(

Get Free Report)

Cummins Inc designs, manufactures, distributes, and services diesel and natural gas engines, electric and hybrid powertrains, and related components worldwide. It operates through five segments: Engine, Distribution, Components, Power Systems, and Accelera. The company offers diesel and natural gas-powered engines under the Cummins and other customer brands for the heavy and medium-duty truck, bus, recreational vehicle, light-duty automotive, construction, mining, marine, rail, oil and gas, defense, and agricultural markets; and offers parts and services, as well as remanufactured parts and engines.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cummins, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cummins wasn't on the list.

While Cummins currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.