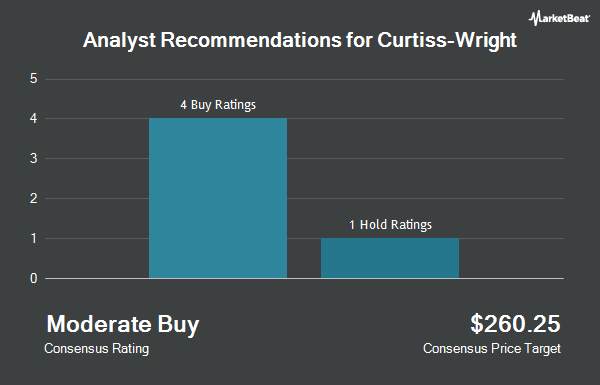

Shares of Curtiss-Wright Co. (NYSE:CW - Get Free Report) have received an average recommendation of "Moderate Buy" from the six research firms that are currently covering the company, Marketbeat Ratings reports. Two equities research analysts have rated the stock with a hold recommendation and four have assigned a buy recommendation to the company. The average twelve-month price target among brokers that have issued a report on the stock in the last year is $379.00.

A number of equities research analysts have weighed in on CW shares. Alembic Global Advisors started coverage on shares of Curtiss-Wright in a research note on Tuesday, October 29th. They set an "overweight" rating and a $412.00 price target on the stock. Deutsche Bank Aktiengesellschaft started coverage on shares of Curtiss-Wright in a research note on Thursday, December 5th. They issued a "buy" rating and a $452.00 target price on the stock. Morgan Stanley raised their price target on shares of Curtiss-Wright from $334.00 to $395.00 and gave the stock an "overweight" rating in a research note on Tuesday, November 5th. StockNews.com lowered Curtiss-Wright from a "strong-buy" rating to a "buy" rating in a research note on Monday, September 23rd. Finally, Truist Financial raised their target price on Curtiss-Wright from $304.00 to $333.00 and gave the stock a "hold" rating in a research report on Friday, November 1st.

Check Out Our Latest Stock Report on CW

Curtiss-Wright Stock Performance

NYSE:CW traded down $19.64 during mid-day trading on Wednesday, hitting $344.85. 490,477 shares of the company's stock traded hands, compared to its average volume of 228,847. The company has a current ratio of 1.98, a quick ratio of 1.39 and a debt-to-equity ratio of 0.39. The firm has a 50 day moving average of $363.86 and a two-hundred day moving average of $318.63. The firm has a market capitalization of $13.09 billion, a price-to-earnings ratio of 32.63, a price-to-earnings-growth ratio of 2.96 and a beta of 1.18. Curtiss-Wright has a 12 month low of $212.05 and a 12 month high of $393.40.

Curtiss-Wright Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Tuesday, December 3rd. Stockholders of record on Friday, November 22nd were given a dividend of $0.21 per share. The ex-dividend date of this dividend was Friday, November 22nd. This represents a $0.84 dividend on an annualized basis and a dividend yield of 0.24%. Curtiss-Wright's dividend payout ratio is 7.95%.

Insider Buying and Selling

In related news, VP John C. Watts sold 412 shares of the firm's stock in a transaction on Tuesday, November 5th. The shares were sold at an average price of $359.55, for a total transaction of $148,134.60. Following the sale, the vice president now directly owns 4,183 shares in the company, valued at $1,503,997.65. This trade represents a 8.97 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, CEO Lynn M. Bamford sold 7,129 shares of the stock in a transaction dated Wednesday, December 11th. The stock was sold at an average price of $368.80, for a total value of $2,629,175.20. Following the transaction, the chief executive officer now owns 28,688 shares of the company's stock, valued at approximately $10,580,134.40. This trade represents a 19.90 % decrease in their position. The disclosure for this sale can be found here. 0.67% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Curtiss-Wright

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Tsfg LLC raised its stake in shares of Curtiss-Wright by 191.4% during the 3rd quarter. Tsfg LLC now owns 102 shares of the aerospace company's stock worth $34,000 after purchasing an additional 67 shares in the last quarter. UMB Bank n.a. lifted its stake in Curtiss-Wright by 303.8% in the 3rd quarter. UMB Bank n.a. now owns 105 shares of the aerospace company's stock valued at $35,000 after purchasing an additional 79 shares during the last quarter. Wilmington Savings Fund Society FSB bought a new position in Curtiss-Wright during the third quarter worth about $53,000. Brooklyn Investment Group bought a new stake in Curtiss-Wright in the 3rd quarter valued at $59,000. Finally, Morse Asset Management Inc acquired a new stake in shares of Curtiss-Wright during the 3rd quarter worth about $69,000. 82.71% of the stock is currently owned by institutional investors and hedge funds.

Curtiss-Wright Company Profile

(

Get Free ReportCurtiss-Wright Corporation, together with its subsidiaries, provides engineered products, solutions, and services mainly to aerospace and defense, commercial power, process, and industrial markets worldwide. It operates through three segments: Aerospace & Industrial, Defense Electronics, and Naval & Power.

See Also

Before you consider Curtiss-Wright, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Curtiss-Wright wasn't on the list.

While Curtiss-Wright currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.