Cushman & Wakefield (NYSE:CWK - Free Report) had its target price cut by The Goldman Sachs Group from $13.00 to $11.50 in a report published on Wednesday,Benzinga reports. They currently have a sell rating on the stock.

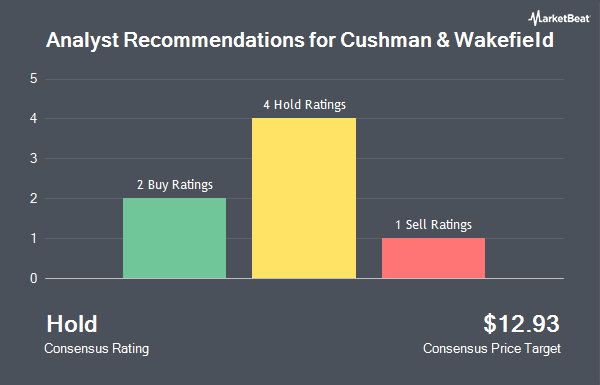

A number of other equities analysts have also weighed in on CWK. Citigroup lowered their price target on shares of Cushman & Wakefield from $16.00 to $12.00 and set a "neutral" rating on the stock in a research report on Monday, March 17th. JPMorgan Chase & Co. lifted their target price on shares of Cushman & Wakefield from $14.00 to $17.00 and gave the stock a "neutral" rating in a research note on Monday, December 16th. Finally, Jefferies Financial Group downgraded shares of Cushman & Wakefield from a "buy" rating to a "hold" rating and reduced their target price for the stock from $18.00 to $14.00 in a research note on Thursday, January 2nd. One research analyst has rated the stock with a sell rating, four have issued a hold rating and one has assigned a buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus price target of $14.10.

Check Out Our Latest Stock Report on Cushman & Wakefield

Cushman & Wakefield Price Performance

CWK traded down $0.16 on Wednesday, reaching $10.42. 3,997,174 shares of the company's stock were exchanged, compared to its average volume of 1,945,801. The stock has a market cap of $2.39 billion, a PE ratio of 18.94 and a beta of 1.40. Cushman & Wakefield has a twelve month low of $9.24 and a twelve month high of $16.11. The stock's fifty day moving average price is $12.37 and its 200-day moving average price is $13.20. The company has a debt-to-equity ratio of 1.67, a current ratio of 1.15 and a quick ratio of 1.18.

Cushman & Wakefield (NYSE:CWK - Get Free Report) last posted its quarterly earnings results on Thursday, February 20th. The company reported $0.48 earnings per share for the quarter, topping analysts' consensus estimates of $0.45 by $0.03. The firm had revenue of $2.63 billion for the quarter, compared to analyst estimates of $2.67 billion. Cushman & Wakefield had a net margin of 1.39% and a return on equity of 12.62%. Sell-side analysts expect that Cushman & Wakefield will post 1.2 EPS for the current year.

Hedge Funds Weigh In On Cushman & Wakefield

A number of institutional investors have recently bought and sold shares of the company. Universal Beteiligungs und Servicegesellschaft mbH purchased a new position in Cushman & Wakefield during the fourth quarter worth about $1,778,000. Jefferies Financial Group Inc. purchased a new stake in shares of Cushman & Wakefield in the 4th quarter valued at approximately $2,498,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in shares of Cushman & Wakefield by 54.7% in the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,067,526 shares of the company's stock valued at $40,123,000 after acquiring an additional 1,084,940 shares during the period. Teza Capital Management LLC raised its stake in shares of Cushman & Wakefield by 124.4% in the 4th quarter. Teza Capital Management LLC now owns 62,797 shares of the company's stock valued at $821,000 after acquiring an additional 34,807 shares during the period. Finally, ProShare Advisors LLC raised its stake in shares of Cushman & Wakefield by 44.5% in the 4th quarter. ProShare Advisors LLC now owns 69,020 shares of the company's stock valued at $903,000 after acquiring an additional 21,242 shares during the period. 95.56% of the stock is owned by hedge funds and other institutional investors.

Cushman & Wakefield Company Profile

(

Get Free Report)

Cushman & Wakefield Plc engages in the provision of commercial real estate services. It operates through the following geographical segments: Americas, Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC). The Americas segment consists of operations located in the United States, Canada and key markets in Latin America.

Recommended Stories

Before you consider Cushman & Wakefield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cushman & Wakefield wasn't on the list.

While Cushman & Wakefield currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.