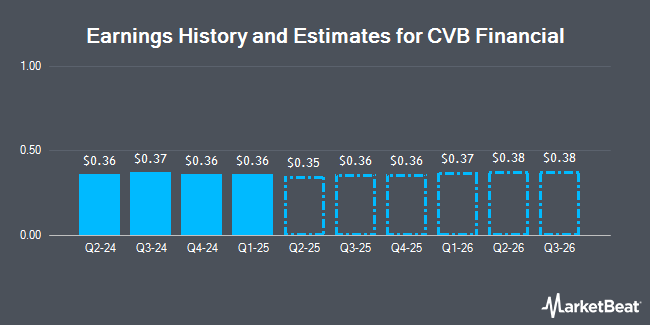

CVB Financial Corp. (NASDAQ:CVBF - Free Report) - Analysts at DA Davidson raised their FY2025 earnings estimates for CVB Financial in a note issued to investors on Thursday, December 19th. DA Davidson analyst G. Tenner now forecasts that the financial services provider will earn $1.41 per share for the year, up from their prior forecast of $1.40. The consensus estimate for CVB Financial's current full-year earnings is $1.43 per share.

CVBF has been the topic of a number of other research reports. Keefe, Bruyette & Woods lifted their price objective on shares of CVB Financial from $23.00 to $27.00 and gave the stock an "outperform" rating in a research report on Wednesday, December 4th. Wedbush reissued a "neutral" rating and issued a $20.00 price objective on shares of CVB Financial in a research report on Thursday, October 24th. Finally, Piper Sandler reduced their target price on CVB Financial from $25.00 to $23.00 and set an "overweight" rating on the stock in a research report on Friday, November 1st. One equities research analyst has rated the stock with a sell rating, four have given a hold rating and two have given a buy rating to the company's stock. According to data from MarketBeat, CVB Financial has an average rating of "Hold" and an average target price of $21.80.

Check Out Our Latest Stock Analysis on CVBF

CVB Financial Price Performance

NASDAQ CVBF traded up $0.71 during midday trading on Friday, hitting $22.00. 2,691,899 shares of the company traded hands, compared to its average volume of 836,837. The company has a market cap of $3.07 billion, a PE ratio of 15.38 and a beta of 0.49. CVB Financial has a 52 week low of $15.71 and a 52 week high of $24.58. The company's 50-day simple moving average is $21.62 and its 200-day simple moving average is $18.96.

CVB Financial (NASDAQ:CVBF - Get Free Report) last announced its quarterly earnings results on Wednesday, October 23rd. The financial services provider reported $0.37 earnings per share for the quarter, topping the consensus estimate of $0.35 by $0.02. The firm had revenue of $126.45 million during the quarter, compared to analysts' expectations of $126.75 million. CVB Financial had a net margin of 28.29% and a return on equity of 9.80%. The company's revenue was down 8.2% compared to the same quarter last year. During the same quarter in the prior year, the company earned $0.42 EPS.

Institutional Trading of CVB Financial

Several large investors have recently added to or reduced their stakes in the company. Wellington Management Group LLP purchased a new position in shares of CVB Financial in the third quarter worth about $8,653,000. American Century Companies Inc. increased its holdings in CVB Financial by 1.0% in the 2nd quarter. American Century Companies Inc. now owns 5,813,290 shares of the financial services provider's stock worth $100,221,000 after buying an additional 58,774 shares during the period. Citigroup Inc. raised its position in CVB Financial by 9.8% during the 3rd quarter. Citigroup Inc. now owns 264,663 shares of the financial services provider's stock worth $4,716,000 after buying an additional 23,682 shares during the last quarter. Seaside Wealth Management Inc. acquired a new stake in CVB Financial during the 2nd quarter valued at approximately $1,395,000. Finally, Charles Schwab Investment Management Inc. boosted its holdings in shares of CVB Financial by 3.8% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 4,952,354 shares of the financial services provider's stock valued at $88,251,000 after acquiring an additional 181,769 shares during the last quarter. Hedge funds and other institutional investors own 74.18% of the company's stock.

CVB Financial Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be paid a $0.20 dividend. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $0.80 dividend on an annualized basis and a yield of 3.64%. CVB Financial's dividend payout ratio (DPR) is 55.94%.

About CVB Financial

(

Get Free Report)

CVB Financial Corp. operates as a bank holding company for Citizens Business Bank, a state-chartered bank that provides banking and financial services to small to mid-sized businesses and individuals. It offers checking, savings, money market, and time certificates of deposit products for business and personal accounts; and serves as a federal tax depository for business customers.

Featured Articles

Before you consider CVB Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CVB Financial wasn't on the list.

While CVB Financial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.