Sachem Head Capital Management LP lifted its position in CVS Health Co. (NYSE:CVS - Free Report) by 43.7% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 3,520,000 shares of the pharmacy operator's stock after acquiring an additional 1,070,000 shares during the period. CVS Health makes up approximately 11.6% of Sachem Head Capital Management LP's holdings, making the stock its 2nd biggest holding. Sachem Head Capital Management LP owned 0.28% of CVS Health worth $221,338,000 at the end of the most recent reporting period.

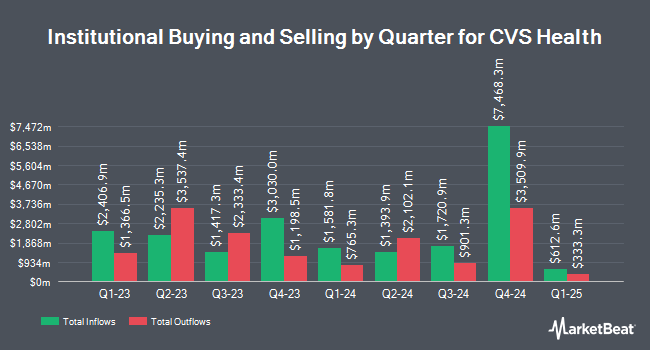

A number of other institutional investors have also recently bought and sold shares of the company. Pzena Investment Management LLC increased its stake in CVS Health by 132.9% during the 2nd quarter. Pzena Investment Management LLC now owns 12,936,388 shares of the pharmacy operator's stock worth $764,023,000 after purchasing an additional 7,382,931 shares in the last quarter. Hotchkis & Wiley Capital Management LLC increased its position in shares of CVS Health by 34.8% during the third quarter. Hotchkis & Wiley Capital Management LLC now owns 11,897,034 shares of the pharmacy operator's stock worth $748,085,000 after acquiring an additional 3,071,613 shares in the last quarter. TOMS Capital Investment Management LP acquired a new stake in shares of CVS Health during the third quarter worth $121,987,000. Pathway Financial Advisers LLC boosted its stake in CVS Health by 5,864.2% in the 3rd quarter. Pathway Financial Advisers LLC now owns 1,730,343 shares of the pharmacy operator's stock worth $108,804,000 after purchasing an additional 1,701,331 shares during the period. Finally, State of Michigan Retirement System increased its holdings in CVS Health by 402.5% during the 2nd quarter. State of Michigan Retirement System now owns 2,005,677 shares of the pharmacy operator's stock worth $118,455,000 after purchasing an additional 1,606,500 shares in the last quarter. Institutional investors and hedge funds own 80.66% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts recently issued reports on CVS shares. Wells Fargo & Company upgraded CVS Health from an "equal weight" rating to an "overweight" rating and increased their price objective for the stock from $60.00 to $66.00 in a report on Monday, November 18th. Piper Sandler lowered their price objective on shares of CVS Health from $72.00 to $64.00 and set an "overweight" rating on the stock in a report on Monday, November 25th. Truist Financial restated a "buy" rating and set a $67.00 target price (down previously from $76.00) on shares of CVS Health in a report on Wednesday, November 20th. Cantor Fitzgerald reissued a "neutral" rating and set a $62.00 price target on shares of CVS Health in a research report on Tuesday, October 1st. Finally, Deutsche Bank Aktiengesellschaft raised CVS Health from a "hold" rating to a "buy" rating and set a $66.00 target price on the stock in a research report on Tuesday. One research analyst has rated the stock with a sell rating, six have issued a hold rating and fourteen have given a buy rating to the company's stock. According to MarketBeat.com, CVS Health has a consensus rating of "Moderate Buy" and an average target price of $70.50.

Get Our Latest Analysis on CVS Health

CVS Health Stock Performance

CVS Health stock traded down $1.19 during trading hours on Thursday, hitting $56.86. The company had a trading volume of 6,989,336 shares, compared to its average volume of 11,268,724. CVS Health Co. has a one year low of $52.71 and a one year high of $83.25. The firm has a market cap of $71.55 billion, a PE ratio of 14.73, a PEG ratio of 1.01 and a beta of 0.54. The firm has a 50-day moving average of $59.43 and a 200 day moving average of $58.81. The company has a debt-to-equity ratio of 0.80, a current ratio of 0.80 and a quick ratio of 0.59.

CVS Health (NYSE:CVS - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The pharmacy operator reported $1.09 earnings per share for the quarter, topping the consensus estimate of $1.08 by $0.01. The business had revenue of $95.43 billion during the quarter, compared to analysts' expectations of $92.72 billion. CVS Health had a return on equity of 10.72% and a net margin of 1.36%. The firm's revenue for the quarter was up 6.3% compared to the same quarter last year. During the same period last year, the firm posted $2.21 EPS. On average, sell-side analysts expect that CVS Health Co. will post 5.37 earnings per share for the current year.

CVS Health Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, November 1st. Shareholders of record on Monday, October 21st were paid a $0.665 dividend. This represents a $2.66 annualized dividend and a yield of 4.68%. The ex-dividend date of this dividend was Monday, October 21st. CVS Health's dividend payout ratio (DPR) is 67.51%.

CVS Health Company Profile

(

Free Report)

CVS Health Corporation provides health solutions in the United States. It operates through Health Care Benefits, Health Services, and Pharmacy & Consumer Wellness segments. The Health Care Benefits segment offers traditional, voluntary, and consumer-directed health insurance products and related services.

Recommended Stories

Before you consider CVS Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CVS Health wasn't on the list.

While CVS Health currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.