CWA Asset Management Group LLC bought a new stake in Gold Fields Limited (NYSE:GFI - Free Report) in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm bought 68,564 shares of the company's stock, valued at approximately $1,052,000.

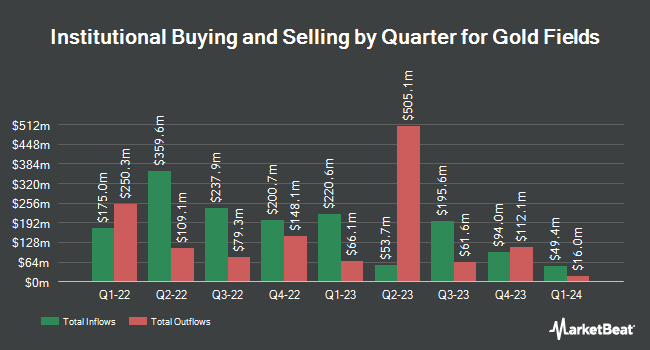

Several other hedge funds have also made changes to their positions in GFI. LGT Fund Management Co Ltd. bought a new stake in shares of Gold Fields in the second quarter valued at about $149,000. Concurrent Investment Advisors LLC acquired a new position in shares of Gold Fields in the 2nd quarter worth approximately $153,000. QRG Capital Management Inc. bought a new position in shares of Gold Fields during the 3rd quarter worth approximately $160,000. Hennion & Walsh Asset Management Inc. raised its stake in Gold Fields by 10.4% during the second quarter. Hennion & Walsh Asset Management Inc. now owns 11,538 shares of the company's stock worth $172,000 after acquiring an additional 1,090 shares in the last quarter. Finally, Candriam S.C.A. bought a new position in shares of Gold Fields during the second quarter valued at $189,000. Institutional investors own 26.02% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts recently issued reports on GFI shares. Scotiabank dropped their target price on shares of Gold Fields from $18.00 to $17.00 and set a "sector perform" rating for the company in a research report on Monday, August 26th. StockNews.com downgraded shares of Gold Fields from a "strong-buy" rating to a "buy" rating in a report on Tuesday, November 5th. Investec raised shares of Gold Fields from a "hold" rating to a "buy" rating in a report on Friday, October 18th. Finally, Bank of America began coverage on shares of Gold Fields in a research report on Monday, September 16th. They issued a "buy" rating and a $16.00 price objective for the company. Four analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat, Gold Fields has an average rating of "Hold" and a consensus price target of $15.93.

View Our Latest Stock Report on GFI

Gold Fields Stock Down 8.5 %

Shares of NYSE:GFI traded down $1.35 during trading on Monday, hitting $14.45. 2,978,229 shares of the company's stock were exchanged, compared to its average volume of 3,652,605. Gold Fields Limited has a 1-year low of $12.19 and a 1-year high of $18.97. The firm has a 50-day moving average price of $15.66 and a two-hundred day moving average price of $15.77.

Gold Fields Cuts Dividend

The company also recently disclosed a semi-annual dividend, which was paid on Thursday, September 26th. Investors of record on Friday, September 13th were paid a dividend of $0.1692 per share. This represents a yield of 2.2%. The ex-dividend date was Friday, September 13th.

Gold Fields Company Profile

(

Free Report)

Gold Fields Limited operates as a gold producer with reserves and resources in Chile, South Africa, Ghana, Canada, Australia, and Peru. It also explores for copper and silver deposits. The company was founded in 1887 and is based in Sandton, South Africa.

Read More

Before you consider Gold Fields, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gold Fields wasn't on the list.

While Gold Fields currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.