CWA Asset Management Group LLC bought a new stake in Jabil Inc. (NYSE:JBL - Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm bought 64,428 shares of the technology company's stock, valued at approximately $7,720,000. CWA Asset Management Group LLC owned 0.06% of Jabil at the end of the most recent quarter.

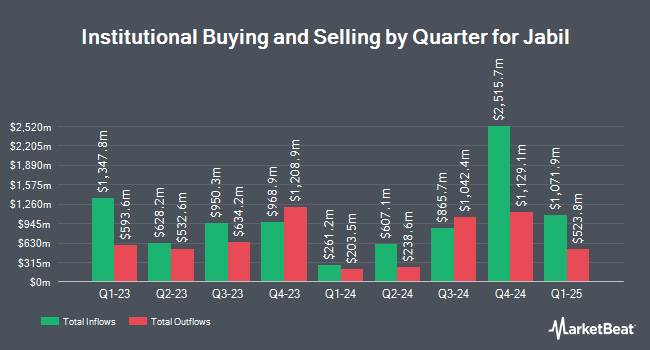

Other hedge funds and other institutional investors have also made changes to their positions in the company. Primecap Management Co. CA raised its position in Jabil by 3.0% in the second quarter. Primecap Management Co. CA now owns 3,682,875 shares of the technology company's stock valued at $400,660,000 after purchasing an additional 107,800 shares during the period. Dimensional Fund Advisors LP boosted its holdings in Jabil by 7.0% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,636,737 shares of the technology company's stock worth $178,058,000 after acquiring an additional 106,808 shares during the period. Bank of New York Mellon Corp grew its position in Jabil by 29.0% in the second quarter. Bank of New York Mellon Corp now owns 1,383,062 shares of the technology company's stock valued at $150,463,000 after acquiring an additional 310,590 shares in the last quarter. AQR Capital Management LLC raised its stake in shares of Jabil by 195.8% during the second quarter. AQR Capital Management LLC now owns 1,060,799 shares of the technology company's stock valued at $115,404,000 after purchasing an additional 702,199 shares during the period. Finally, Point72 Asset Management L.P. acquired a new position in shares of Jabil during the second quarter worth $78,660,000. Institutional investors and hedge funds own 93.39% of the company's stock.

Insider Buying and Selling at Jabil

In related news, EVP Frederic E. Mccoy sold 4,000 shares of the firm's stock in a transaction that occurred on Tuesday, October 1st. The stock was sold at an average price of $118.70, for a total value of $474,800.00. Following the sale, the executive vice president now owns 108,753 shares of the company's stock, valued at approximately $12,908,981.10. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In other Jabil news, EVP Frederic E. Mccoy sold 4,000 shares of the stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $118.70, for a total value of $474,800.00. Following the sale, the executive vice president now directly owns 108,753 shares of the company's stock, valued at $12,908,981.10. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, EVP Matthew Crowley sold 1,380 shares of the business's stock in a transaction on Friday, October 18th. The shares were sold at an average price of $125.83, for a total transaction of $173,645.40. Following the transaction, the executive vice president now directly owns 18,568 shares of the company's stock, valued at approximately $2,336,411.44. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 43,689 shares of company stock worth $5,377,431 over the last ninety days. Company insiders own 2.62% of the company's stock.

Wall Street Analysts Forecast Growth

JBL has been the topic of several analyst reports. Stifel Nicolaus lifted their price target on shares of Jabil from $130.00 to $140.00 and gave the stock a "buy" rating in a research note on Friday, September 27th. Barclays boosted their price target on Jabil from $135.00 to $157.00 and gave the stock an "overweight" rating in a research note on Friday, September 27th. Bank of America raised their price objective on Jabil from $135.00 to $150.00 and gave the company a "buy" rating in a research note on Friday, September 27th. Finally, JPMorgan Chase & Co. reduced their target price on Jabil from $137.00 to $133.00 and set an "overweight" rating for the company in a research note on Tuesday, September 3rd. Two analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. Based on data from MarketBeat, Jabil currently has an average rating of "Moderate Buy" and an average price target of $143.50.

Get Our Latest Analysis on Jabil

Jabil Stock Performance

NYSE:JBL traded down $1.55 during trading hours on Friday, reaching $135.75. 936,572 shares of the stock were exchanged, compared to its average volume of 1,180,335. The stock has a market capitalization of $15.32 billion, a P/E ratio of 12.32, a P/E/G ratio of 1.62 and a beta of 1.24. The firm has a 50 day simple moving average of $118.51 and a 200-day simple moving average of $114.94. The company has a quick ratio of 0.72, a current ratio of 1.09 and a debt-to-equity ratio of 1.66. Jabil Inc. has a 52 week low of $95.85 and a 52 week high of $156.94.

Jabil (NYSE:JBL - Get Free Report) last released its quarterly earnings data on Thursday, September 26th. The technology company reported $2.30 EPS for the quarter, topping analysts' consensus estimates of $2.22 by $0.08. The firm had revenue of $6.96 billion during the quarter, compared to the consensus estimate of $6.59 billion. Jabil had a net margin of 4.81% and a return on equity of 42.64%. The firm's revenue was down 17.7% on a year-over-year basis. During the same quarter in the previous year, the company posted $2.34 earnings per share. As a group, sell-side analysts forecast that Jabil Inc. will post 7.84 earnings per share for the current fiscal year.

Jabil Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, December 3rd. Shareholders of record on Friday, November 15th will be issued a $0.08 dividend. The ex-dividend date is Friday, November 15th. This represents a $0.32 dividend on an annualized basis and a yield of 0.24%. Jabil's dividend payout ratio is currently 2.90%.

Jabil Profile

(

Free Report)

Jabil Inc provides manufacturing services and solutions worldwide. It operates in two segments, Electronics Manufacturing Services and Diversified Manufacturing Services. The company offers electronics design, production, and product management services; electronic circuit design services, such as application-specific integrated circuit design, firmware development, and rapid prototyping services; and designs plastic and metal enclosures that include the electro-mechanics, such as the printed circuit board assemblies (PCBA).

Featured Articles

Before you consider Jabil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jabil wasn't on the list.

While Jabil currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report