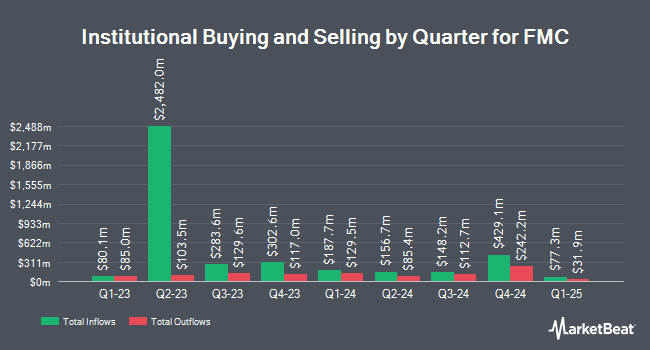

CWA Asset Management Group LLC bought a new position in shares of FMC Co. (NYSE:FMC - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund bought 13,952 shares of the basic materials company's stock, valued at approximately $920,000.

Several other hedge funds and other institutional investors have also bought and sold shares of the business. Texas Permanent School Fund Corp increased its position in FMC by 4.6% during the 1st quarter. Texas Permanent School Fund Corp now owns 25,789 shares of the basic materials company's stock worth $1,643,000 after purchasing an additional 1,128 shares in the last quarter. Empowered Funds LLC boosted its stake in FMC by 26.7% during the first quarter. Empowered Funds LLC now owns 30,495 shares of the basic materials company's stock worth $1,943,000 after acquiring an additional 6,430 shares in the last quarter. SG Americas Securities LLC boosted its stake in FMC by 396.9% during the first quarter. SG Americas Securities LLC now owns 70,268 shares of the basic materials company's stock worth $4,476,000 after acquiring an additional 56,128 shares in the last quarter. Forsta AP Fonden acquired a new position in FMC during the first quarter worth $5,567,000. Finally, Meeder Asset Management Inc. acquired a new position in FMC during the first quarter worth $71,000. Institutional investors and hedge funds own 91.86% of the company's stock.

Analysts Set New Price Targets

FMC has been the subject of several recent analyst reports. JPMorgan Chase & Co. upped their target price on FMC from $50.00 to $59.00 and gave the company a "neutral" rating in a report on Monday, August 12th. Redburn Atlantic raised FMC from a "hold" rating to a "strong-buy" rating in a research note on Friday, July 19th. Mizuho raised their price objective on FMC from $64.00 to $70.00 and gave the company a "neutral" rating in a research note on Friday, November 1st. Barclays raised their target price on FMC from $62.00 to $65.00 and gave the stock an "equal weight" rating in a research note on Monday, August 5th. Finally, Wells Fargo & Company cut their target price on FMC from $68.00 to $62.00 and set an "equal weight" rating on the stock in a research note on Tuesday, July 16th. One research analyst has rated the stock with a sell rating, ten have given a hold rating, four have given a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $68.00.

Check Out Our Latest Stock Analysis on FMC

FMC Trading Down 1.4 %

NYSE:FMC traded down $0.82 during mid-day trading on Monday, hitting $58.88. 455,089 shares of the stock traded hands, compared to its average volume of 1,681,812. The company has a quick ratio of 1.09, a current ratio of 1.48 and a debt-to-equity ratio of 0.65. The stock has a market capitalization of $7.35 billion, a price-to-earnings ratio of 5.14, a PEG ratio of 1.57 and a beta of 0.85. The firm's 50 day moving average is $62.87 and its two-hundred day moving average is $61.09. FMC Co. has a 52 week low of $50.03 and a 52 week high of $68.72.

FMC (NYSE:FMC - Get Free Report) last released its earnings results on Tuesday, October 29th. The basic materials company reported $0.69 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.49 by $0.20. FMC had a return on equity of 7.68% and a net margin of 34.93%. The firm had revenue of $1.07 billion for the quarter, compared to the consensus estimate of $1.04 billion. During the same period in the prior year, the firm earned $0.44 EPS. The firm's revenue was up 8.5% on a year-over-year basis. On average, equities research analysts predict that FMC Co. will post 3.35 earnings per share for the current year.

About FMC

(

Free Report)

FMC Corporation, an agricultural sciences company, provides crop protection, plant health, and professional pest and turf management products. It develops, markets, and sells crop protection chemicals that includes insecticides, herbicides, and fungicides; and biologicals, crop nutrition, and seed treatment products, which are used in agriculture to enhance crop yield and quality by controlling a range of insects, weeds, and diseases, as well as in non-agricultural markets for pest control.

See Also

Before you consider FMC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FMC wasn't on the list.

While FMC currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.