HighTower Advisors LLC increased its stake in shares of CyberArk Software Ltd. (NASDAQ:CYBR - Free Report) by 16.6% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 14,478 shares of the technology company's stock after purchasing an additional 2,062 shares during the period. HighTower Advisors LLC's holdings in CyberArk Software were worth $4,212,000 as of its most recent filing with the Securities & Exchange Commission.

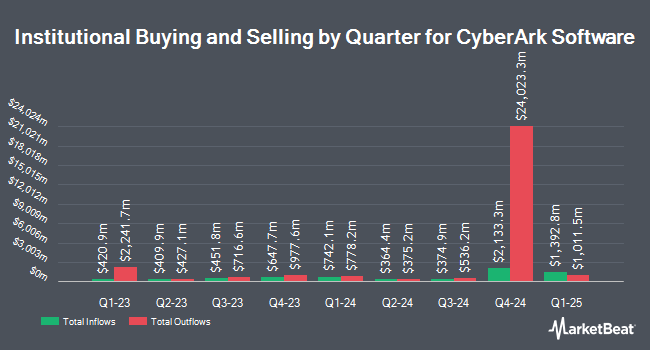

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Greenleaf Trust boosted its stake in CyberArk Software by 2.5% during the 3rd quarter. Greenleaf Trust now owns 1,829 shares of the technology company's stock worth $533,000 after purchasing an additional 45 shares during the last quarter. Signaturefd LLC boosted its position in CyberArk Software by 4.2% during the third quarter. Signaturefd LLC now owns 1,206 shares of the technology company's stock worth $352,000 after acquiring an additional 49 shares during the last quarter. Austin Private Wealth LLC grew its stake in CyberArk Software by 6.8% during the 3rd quarter. Austin Private Wealth LLC now owns 815 shares of the technology company's stock valued at $238,000 after acquiring an additional 52 shares in the last quarter. Arcadia Investment Management Corp MI raised its holdings in CyberArk Software by 42.2% in the 2nd quarter. Arcadia Investment Management Corp MI now owns 182 shares of the technology company's stock valued at $50,000 after acquiring an additional 54 shares during the last quarter. Finally, Juncture Wealth Strategies LLC lifted its stake in CyberArk Software by 2.1% in the 3rd quarter. Juncture Wealth Strategies LLC now owns 2,830 shares of the technology company's stock worth $825,000 after purchasing an additional 57 shares in the last quarter. 91.84% of the stock is owned by hedge funds and other institutional investors.

CyberArk Software Stock Performance

Shares of NASDAQ:CYBR traded down $2.46 during trading on Thursday, hitting $321.54. The company's stock had a trading volume of 297,996 shares, compared to its average volume of 518,273. CyberArk Software Ltd. has a fifty-two week low of $198.01 and a fifty-two week high of $333.32. The business has a 50 day moving average price of $302.18 and a two-hundred day moving average price of $277.92. The company has a market capitalization of $14.01 billion, a PE ratio of 1,190.89 and a beta of 1.13.

CyberArk Software (NASDAQ:CYBR - Get Free Report) last issued its quarterly earnings results on Wednesday, November 13th. The technology company reported $0.94 earnings per share for the quarter, topping the consensus estimate of $0.46 by $0.48. The company had revenue of $240.10 million for the quarter, compared to the consensus estimate of $234.10 million. CyberArk Software had a return on equity of 2.29% and a net margin of 1.38%. CyberArk Software's revenue was up 25.6% on a year-over-year basis. During the same quarter in the prior year, the business earned ($0.31) EPS. As a group, equities analysts expect that CyberArk Software Ltd. will post -0.58 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of equities research analysts have recently issued reports on CYBR shares. BTIG Research upped their price target on CyberArk Software from $310.00 to $325.00 and gave the company a "buy" rating in a research report on Wednesday, October 9th. Piper Sandler upped their target price on CyberArk Software from $300.00 to $345.00 and gave the company an "overweight" rating in a report on Thursday, November 14th. Robert W. Baird lifted their price target on CyberArk Software from $315.00 to $355.00 and gave the stock an "outperform" rating in a report on Thursday, October 24th. Royal Bank of Canada boosted their price target on shares of CyberArk Software from $328.00 to $358.00 and gave the company an "outperform" rating in a research report on Thursday, November 14th. Finally, Scotiabank assumed coverage on shares of CyberArk Software in a research report on Monday, October 21st. They set a "sector outperform" rating and a $340.00 price objective for the company. One equities research analyst has rated the stock with a hold rating and twenty-six have assigned a buy rating to the company. According to data from MarketBeat.com, CyberArk Software currently has a consensus rating of "Moderate Buy" and an average price target of $331.46.

Check Out Our Latest Stock Report on CYBR

About CyberArk Software

(

Free Report)

CyberArk Software Ltd., together with its subsidiaries, develops, markets, and sells software-based identity security solutions and services in the United States, Europe, the Middle East, Africa, and internationally. Its solutions include Privileged Access Manager, which offers risk-based credential security and session; Vendor Privileged Access Manager combines Privileged Access Manager and Remote Access to provide secure access to third-party vendors; Dynamic Privileged Access, a SaaS solution that provides just-in-time access to Linux Virtual Machines; Endpoint Privilege Manager, a SaaS solution that secures privileges on the endpoint; and Secure Desktop, a solution that protects access to endpoints.

Further Reading

Before you consider CyberArk Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CyberArk Software wasn't on the list.

While CyberArk Software currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.