HC Wainwright reiterated their buy rating on shares of Cytokinetics (NASDAQ:CYTK - Free Report) in a research note published on Monday,Benzinga reports. HC Wainwright currently has a $120.00 price objective on the biopharmaceutical company's stock.

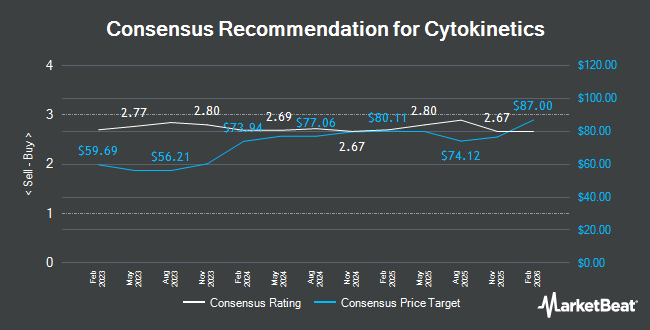

Other equities analysts have also recently issued reports about the stock. Royal Bank of Canada initiated coverage on shares of Cytokinetics in a research report on Friday, November 8th. They issued an "outperform" rating and a $80.00 price target for the company. JPMorgan Chase & Co. upped their price target on Cytokinetics from $65.00 to $71.00 and gave the company an "overweight" rating in a research report on Thursday, September 5th. The Goldman Sachs Group lowered shares of Cytokinetics from a "buy" rating to a "neutral" rating and dropped their target price for the company from $85.00 to $60.00 in a report on Tuesday, August 13th. JMP Securities reaffirmed a "market outperform" rating and set a $78.00 target price on shares of Cytokinetics in a research report on Wednesday, September 4th. Finally, Needham & Company LLC reaffirmed a "buy" rating and issued a $72.00 price target on shares of Cytokinetics in a research report on Thursday, October 17th. One investment analyst has rated the stock with a sell rating, four have given a hold rating and twelve have issued a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $83.67.

Get Our Latest Report on CYTK

Cytokinetics Price Performance

Shares of CYTK stock traded up $1.72 during trading hours on Monday, reaching $51.94. The company's stock had a trading volume of 1,268,816 shares, compared to its average volume of 2,059,786. The company has a quick ratio of 9.28, a current ratio of 9.28 and a debt-to-equity ratio of 5.93. Cytokinetics has a fifty-two week low of $30.68 and a fifty-two week high of $110.25. The company has a market capitalization of $6.13 billion, a price-to-earnings ratio of -9.33 and a beta of 0.78. The firm's 50 day simple moving average is $54.08 and its 200-day simple moving average is $55.20.

Cytokinetics (NASDAQ:CYTK - Get Free Report) last released its earnings results on Wednesday, November 6th. The biopharmaceutical company reported ($1.36) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($1.27) by ($0.09). The business had revenue of $0.46 million during the quarter, compared to analysts' expectations of $1.21 million. The firm's revenue was up 22.5% on a year-over-year basis. During the same quarter in the previous year, the company posted ($1.35) EPS. Sell-side analysts forecast that Cytokinetics will post -4.32 earnings per share for the current year.

Insider Transactions at Cytokinetics

In other news, Director Wendall Wierenga sold 4,452 shares of Cytokinetics stock in a transaction on Monday, October 28th. The shares were sold at an average price of $52.25, for a total transaction of $232,617.00. Following the completion of the sale, the director now directly owns 24,559 shares of the company's stock, valued at approximately $1,283,207.75. The trade was a 15.35 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, EVP Fady Ibraham Malik sold 6,342 shares of the company's stock in a transaction dated Tuesday, November 12th. The stock was sold at an average price of $58.48, for a total value of $370,880.16. Following the completion of the transaction, the executive vice president now owns 113,878 shares of the company's stock, valued at $6,659,585.44. The trade was a 5.28 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 60,078 shares of company stock worth $3,261,369 over the last quarter. Corporate insiders own 3.40% of the company's stock.

Institutional Trading of Cytokinetics

Several hedge funds have recently added to or reduced their stakes in the business. J.Safra Asset Management Corp boosted its position in Cytokinetics by 642.3% during the 2nd quarter. J.Safra Asset Management Corp now owns 527 shares of the biopharmaceutical company's stock valued at $29,000 after buying an additional 456 shares during the period. UMB Bank n.a. raised its position in Cytokinetics by 65.6% during the 3rd quarter. UMB Bank n.a. now owns 601 shares of the biopharmaceutical company's stock valued at $32,000 after purchasing an additional 238 shares during the last quarter. Blue Trust Inc. grew its position in shares of Cytokinetics by 225.9% in the 3rd quarter. Blue Trust Inc. now owns 981 shares of the biopharmaceutical company's stock worth $53,000 after buying an additional 680 shares during the last quarter. Values First Advisors Inc. purchased a new position in shares of Cytokinetics during the third quarter valued at approximately $54,000. Finally, EntryPoint Capital LLC purchased a new stake in Cytokinetics in the first quarter worth $74,000.

About Cytokinetics

(

Get Free Report)

Cytokinetics, Incorporated, a late-stage biopharmaceutical company, focuses on discovering, developing, and commercializing muscle activators and inhibitors as potential treatments for debilitating diseases. The company develops small molecule drug candidates primarily engineered to impact muscle function and contractility.

Featured Stories

Before you consider Cytokinetics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cytokinetics wasn't on the list.

While Cytokinetics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.