Cytokinetics (NASDAQ:CYTK - Free Report) had its target price lifted by Royal Bank of Canada from $80.00 to $82.00 in a research note issued to investors on Wednesday morning,Benzinga reports. The firm currently has an outperform rating on the biopharmaceutical company's stock.

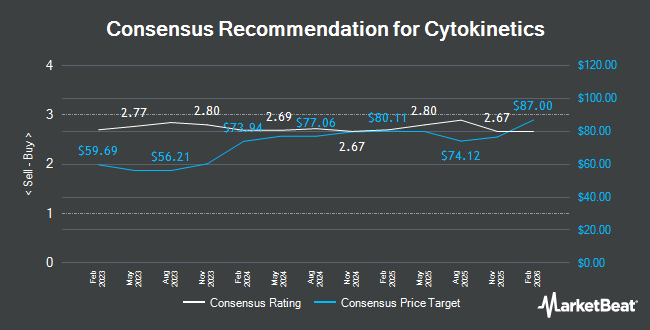

A number of other equities research analysts also recently weighed in on CYTK. JPMorgan Chase & Co. raised their price target on shares of Cytokinetics from $65.00 to $71.00 and gave the company an "overweight" rating in a research note on Thursday, September 5th. JMP Securities reiterated a "market outperform" rating and set a $78.00 price target on shares of Cytokinetics in a report on Wednesday, September 4th. Cantor Fitzgerald reissued an "overweight" rating on shares of Cytokinetics in a report on Friday, October 18th. HC Wainwright restated a "buy" rating and issued a $120.00 price objective on shares of Cytokinetics in a report on Monday, December 2nd. Finally, Needham & Company LLC reaffirmed a "buy" rating and issued a $72.00 price objective on shares of Cytokinetics in a research note on Monday, December 2nd. One equities research analyst has rated the stock with a sell rating, four have given a hold rating and twelve have issued a buy rating to the company. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $84.07.

Read Our Latest Report on CYTK

Cytokinetics Price Performance

Shares of CYTK stock traded down $1.42 during trading on Wednesday, hitting $46.36. The company had a trading volume of 1,587,098 shares, compared to its average volume of 1,984,019. The firm has a market capitalization of $5.47 billion, a P/E ratio of -8.62 and a beta of 0.80. The company has a debt-to-equity ratio of 5.93, a quick ratio of 9.28 and a current ratio of 9.28. The stock's 50-day moving average price is $52.22 and its 200 day moving average price is $54.03. Cytokinetics has a one year low of $32.70 and a one year high of $110.25.

Cytokinetics (NASDAQ:CYTK - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The biopharmaceutical company reported ($1.36) EPS for the quarter, missing analysts' consensus estimates of ($1.27) by ($0.09). The firm had revenue of $0.46 million during the quarter, compared to the consensus estimate of $1.21 million. The business's quarterly revenue was up 22.5% compared to the same quarter last year. During the same period in the prior year, the business earned ($1.35) earnings per share. Equities analysts expect that Cytokinetics will post -5.25 EPS for the current fiscal year.

Insider Activity

In other Cytokinetics news, EVP Fady Ibraham Malik sold 6,342 shares of the stock in a transaction dated Tuesday, November 12th. The shares were sold at an average price of $58.48, for a total value of $370,880.16. Following the completion of the sale, the executive vice president now owns 113,878 shares in the company, valued at approximately $6,659,585.44. This trade represents a 5.28 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, CEO Robert I. Blum sold 5,000 shares of the business's stock in a transaction on Wednesday, October 9th. The stock was sold at an average price of $55.61, for a total value of $278,050.00. Following the completion of the transaction, the chief executive officer now directly owns 397,456 shares in the company, valued at approximately $22,102,528.16. This represents a 1.24 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 74,816 shares of company stock worth $3,923,463 over the last 90 days. 3.40% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently modified their holdings of the stock. Darwin Global Management Ltd. purchased a new stake in Cytokinetics during the second quarter valued at about $246,074,000. Geode Capital Management LLC grew its position in Cytokinetics by 4.0% during the third quarter. Geode Capital Management LLC now owns 2,848,584 shares of the biopharmaceutical company's stock valued at $150,433,000 after acquiring an additional 109,938 shares during the last quarter. Charles Schwab Investment Management Inc. raised its stake in shares of Cytokinetics by 42.7% during the third quarter. Charles Schwab Investment Management Inc. now owns 1,321,391 shares of the biopharmaceutical company's stock worth $69,769,000 after acquiring an additional 395,709 shares in the last quarter. Westfield Capital Management Co. LP boosted its stake in shares of Cytokinetics by 38.9% in the 3rd quarter. Westfield Capital Management Co. LP now owns 1,212,886 shares of the biopharmaceutical company's stock valued at $64,040,000 after purchasing an additional 339,373 shares in the last quarter. Finally, Janus Henderson Group PLC raised its position in Cytokinetics by 17.2% in the 3rd quarter. Janus Henderson Group PLC now owns 1,143,830 shares of the biopharmaceutical company's stock worth $60,399,000 after purchasing an additional 167,501 shares during the period.

Cytokinetics Company Profile

(

Get Free Report)

Cytokinetics, Incorporated, a late-stage biopharmaceutical company, focuses on discovering, developing, and commercializing muscle activators and inhibitors as potential treatments for debilitating diseases. The company develops small molecule drug candidates primarily engineered to impact muscle function and contractility.

See Also

Before you consider Cytokinetics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cytokinetics wasn't on the list.

While Cytokinetics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.