D-Wave Quantum (NYSE:QBTS - Get Free Report) had its price objective increased by equities researchers at Roth Mkm from $3.00 to $7.00 in a report issued on Thursday,Benzinga reports. The firm presently has a "buy" rating on the stock. Roth Mkm's price objective suggests a potential upside of 79.03% from the company's previous close.

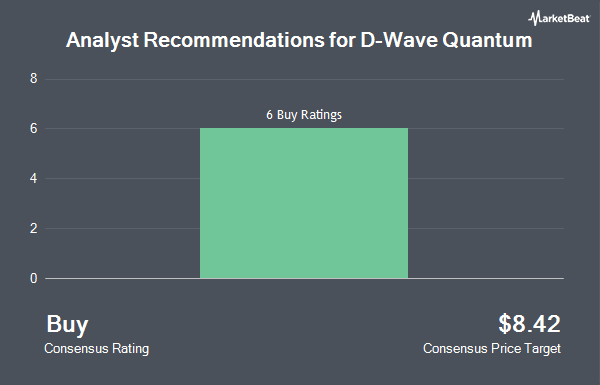

Several other equities research analysts have also recently weighed in on the company. Needham & Company LLC reissued a "buy" rating and set a $2.25 price objective on shares of D-Wave Quantum in a research note on Friday, November 15th. B. Riley upped their target price on shares of D-Wave Quantum from $3.75 to $4.50 and gave the stock a "buy" rating in a research note on Monday, November 25th. Six investment analysts have rated the stock with a buy rating, According to MarketBeat, the stock presently has an average rating of "Buy" and an average price target of $3.71.

View Our Latest Analysis on QBTS

D-Wave Quantum Price Performance

Shares of QBTS stock traded down $0.21 on Thursday, hitting $3.91. 58,408,508 shares of the stock traded hands, compared to its average volume of 7,873,715. D-Wave Quantum has a 52 week low of $0.68 and a 52 week high of $5.38. The firm has a 50 day simple moving average of $1.85 and a two-hundred day simple moving average of $1.33. The firm has a market cap of $875.88 million, a price-to-earnings ratio of -10.74 and a beta of 1.79.

Institutional Investors Weigh In On D-Wave Quantum

Several hedge funds and other institutional investors have recently made changes to their positions in the stock. Penserra Capital Management LLC increased its holdings in shares of D-Wave Quantum by 23.0% during the 3rd quarter. Penserra Capital Management LLC now owns 4,485,777 shares of the company's stock worth $4,409,000 after buying an additional 839,942 shares during the last quarter. Geode Capital Management LLC grew its position in D-Wave Quantum by 33.8% in the third quarter. Geode Capital Management LLC now owns 2,555,927 shares of the company's stock worth $2,513,000 after acquiring an additional 645,039 shares during the period. State Street Corp increased its stake in D-Wave Quantum by 0.9% during the third quarter. State Street Corp now owns 2,020,977 shares of the company's stock worth $1,986,000 after acquiring an additional 17,225 shares during the last quarter. Vanguard Group Inc. raised its position in D-Wave Quantum by 17.9% in the first quarter. Vanguard Group Inc. now owns 1,070,337 shares of the company's stock valued at $2,183,000 after purchasing an additional 162,688 shares during the period. Finally, Marshall Wace LLP acquired a new position in shares of D-Wave Quantum in the 2nd quarter valued at $265,000. Institutional investors and hedge funds own 42.47% of the company's stock.

D-Wave Quantum Company Profile

(

Get Free Report)

D-Wave Quantum Inc develops and delivers quantum computing systems, software, and services worldwide. The company offers Advantage, a fifth-generation quantum computer; Ocean, a suite of open-source python tools; and Leap, a cloud-based service that provides real-time access to a live quantum computer, as well as access to Advantage, hybrid solvers, the Ocean software development kit, live code, demos, learning resources, and a vibrant developer community.

Further Reading

Before you consider D-Wave Quantum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and D-Wave Quantum wasn't on the list.

While D-Wave Quantum currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.