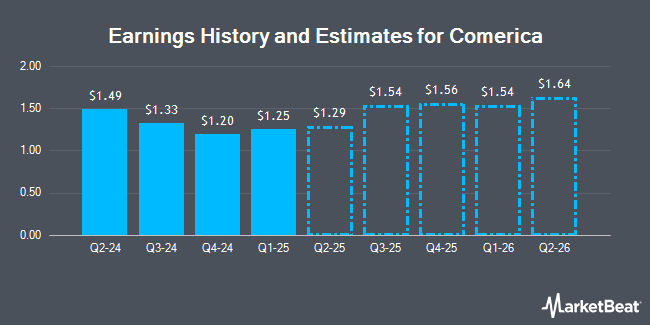

Comerica Incorporated (NYSE:CMA - Free Report) - Research analysts at DA Davidson increased their Q1 2025 earnings per share estimates for shares of Comerica in a research note issued on Wednesday, April 2nd. DA Davidson analyst P. Winter now expects that the financial services provider will post earnings per share of $1.02 for the quarter, up from their prior estimate of $1.01. DA Davidson currently has a "Neutral" rating and a $67.00 price target on the stock. The consensus estimate for Comerica's current full-year earnings is $5.28 per share. DA Davidson also issued estimates for Comerica's FY2026 earnings at $5.82 EPS.

CMA has been the topic of a number of other reports. Royal Bank of Canada dropped their price objective on Comerica from $78.00 to $76.00 and set an "outperform" rating on the stock in a research note on Thursday, January 23rd. Argus raised Comerica to a "hold" rating in a research report on Friday, January 31st. Barclays upped their price target on Comerica from $66.00 to $68.00 and gave the stock an "underweight" rating in a report on Monday, January 6th. Wells Fargo & Company lowered their price objective on shares of Comerica from $70.00 to $67.00 and set an "equal weight" rating on the stock in a research note on Friday, March 28th. Finally, Truist Financial upgraded shares of Comerica to a "hold" rating in a research note on Monday, January 6th. Four equities research analysts have rated the stock with a sell rating, twelve have issued a hold rating and seven have issued a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $67.57.

Get Our Latest Stock Analysis on Comerica

Comerica Stock Performance

CMA traded up $0.45 during trading on Thursday, hitting $51.73. The stock had a trading volume of 853,584 shares, compared to its average volume of 2,111,180. The firm has a market cap of $6.79 billion, a PE ratio of 10.29 and a beta of 0.96. The company has a current ratio of 0.97, a quick ratio of 0.97 and a debt-to-equity ratio of 1.09. Comerica has a 12 month low of $45.32 and a 12 month high of $73.45. The company has a 50 day simple moving average of $62.05 and a 200-day simple moving average of $63.50.

Comerica (NYSE:CMA - Get Free Report) last released its quarterly earnings results on Wednesday, January 22nd. The financial services provider reported $1.20 EPS for the quarter, missing analysts' consensus estimates of $1.25 by ($0.05). Comerica had a net margin of 13.98% and a return on equity of 12.04%. During the same quarter in the prior year, the business posted $1.46 earnings per share.

Institutional Investors Weigh In On Comerica

Hedge funds have recently made changes to their positions in the company. Trust Co. of Vermont grew its stake in Comerica by 300.0% during the fourth quarter. Trust Co. of Vermont now owns 428 shares of the financial services provider's stock worth $26,000 after buying an additional 321 shares during the last quarter. Luken Investment Analytics LLC acquired a new position in shares of Comerica in the 4th quarter worth approximately $31,000. MCF Advisors LLC grew its position in Comerica by 56.3% during the 4th quarter. MCF Advisors LLC now owns 633 shares of the financial services provider's stock worth $39,000 after acquiring an additional 228 shares during the last quarter. Wilmington Savings Fund Society FSB acquired a new stake in Comerica during the 3rd quarter valued at $42,000. Finally, V Square Quantitative Management LLC raised its position in Comerica by 36.7% in the 4th quarter. V Square Quantitative Management LLC now owns 824 shares of the financial services provider's stock valued at $51,000 after purchasing an additional 221 shares during the last quarter. Institutional investors and hedge funds own 80.74% of the company's stock.

Comerica Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Tuesday, April 1st. Stockholders of record on Friday, March 14th were paid a $0.71 dividend. The ex-dividend date was Friday, March 14th. This represents a $2.84 annualized dividend and a dividend yield of 5.49%. Comerica's dividend payout ratio is presently 56.57%.

Comerica Company Profile

(

Get Free Report)

Comerica Incorporated, through its subsidiaries, provides various financial products and services. The company operates through Commercial Bank, Retail Bank, Wealth Management, and Finance segments. The Commercial Bank segment offers various products and services, including commercial loans and lines of credit, deposits, cash management, payment solutions, card services, capital market products, international trade finance, letters of credit, foreign exchange management services, and loan syndication services for small and middle market businesses, multinational corporations, and governmental entities.

Read More

Before you consider Comerica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comerica wasn't on the list.

While Comerica currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.