Duolingo (NASDAQ:DUOL - Get Free Report) had its price target hoisted by DA Davidson from $250.00 to $350.00 in a report released on Thursday,Benzinga reports. The firm currently has a "buy" rating on the stock. DA Davidson's target price suggests a potential upside of 10.63% from the company's previous close.

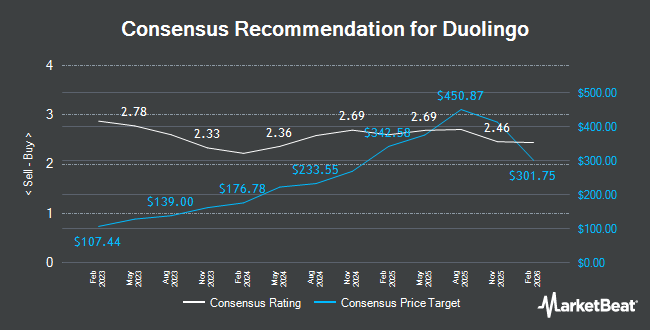

Several other equities analysts also recently weighed in on DUOL. Evercore ISI upgraded shares of Duolingo to a "strong-buy" rating in a report on Monday, August 5th. Wolfe Research started coverage on Duolingo in a research note on Tuesday, July 16th. They issued a "peer perform" rating on the stock. Piper Sandler raised their price target on Duolingo from $271.00 to $351.00 and gave the stock an "overweight" rating in a research report on Thursday. Bank of America upped their price objective on shares of Duolingo from $292.00 to $298.00 and gave the company a "buy" rating in a research note on Wednesday, September 25th. Finally, Needham & Company LLC boosted their price objective on shares of Duolingo from $310.00 to $370.00 and gave the company a "buy" rating in a research note on Thursday. Four equities research analysts have rated the stock with a hold rating, seven have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $325.44.

Check Out Our Latest Stock Report on DUOL

Duolingo Stock Down 0.8 %

DUOL stock traded down $2.48 during midday trading on Thursday, hitting $316.37. The company's stock had a trading volume of 864,688 shares, compared to its average volume of 700,676. The firm has a 50-day simple moving average of $266.39 and a 200-day simple moving average of $220.10. The firm has a market capitalization of $13.77 billion, a P/E ratio of 224.80 and a beta of 0.79. The company has a quick ratio of 3.28, a current ratio of 3.28 and a debt-to-equity ratio of 0.07. Duolingo has a 52-week low of $145.05 and a 52-week high of $324.00.

Duolingo (NASDAQ:DUOL - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The company reported $0.49 EPS for the quarter, beating analysts' consensus estimates of $0.36 by $0.13. The business had revenue of $192.59 million for the quarter, compared to the consensus estimate of $189.19 million. Duolingo had a return on equity of 9.64% and a net margin of 10.44%. The business's revenue for the quarter was up 39.9% on a year-over-year basis. During the same quarter in the prior year, the business posted $0.06 EPS. As a group, equities analysts forecast that Duolingo will post 1.87 EPS for the current year.

Insider Activity

In other news, insider Robert Meese sold 5,000 shares of the stock in a transaction dated Wednesday, September 25th. The shares were sold at an average price of $285.04, for a total transaction of $1,425,200.00. Following the transaction, the insider now owns 142,053 shares of the company's stock, valued at approximately $40,490,787.12. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In other Duolingo news, CFO Matthew Skaruppa sold 17,591 shares of the stock in a transaction on Wednesday, August 21st. The stock was sold at an average price of $207.27, for a total transaction of $3,646,086.57. Following the completion of the transaction, the chief financial officer now directly owns 88,856 shares of the company's stock, valued at approximately $18,417,183.12. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider Robert Meese sold 5,000 shares of the firm's stock in a transaction dated Wednesday, September 25th. The shares were sold at an average price of $285.04, for a total transaction of $1,425,200.00. Following the transaction, the insider now owns 142,053 shares of the company's stock, valued at approximately $40,490,787.12. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 68,874 shares of company stock worth $15,332,342. 18.30% of the stock is currently owned by insiders.

Institutional Investors Weigh In On Duolingo

Several large investors have recently made changes to their positions in DUOL. Mount Lucas Management LP grew its position in Duolingo by 2.4% during the third quarter. Mount Lucas Management LP now owns 1,340 shares of the company's stock worth $378,000 after buying an additional 32 shares in the last quarter. CIBC Asset Management Inc raised its position in shares of Duolingo by 3.1% during the 3rd quarter. CIBC Asset Management Inc now owns 1,061 shares of the company's stock valued at $299,000 after acquiring an additional 32 shares during the last quarter. Pinnacle Wealth Planning Services Inc. boosted its stake in Duolingo by 5.5% during the 1st quarter. Pinnacle Wealth Planning Services Inc. now owns 1,046 shares of the company's stock worth $231,000 after acquiring an additional 55 shares during the last quarter. Mercer Global Advisors Inc. ADV grew its position in shares of Duolingo by 3.9% in the 2nd quarter. Mercer Global Advisors Inc. ADV now owns 1,962 shares of the company's stock valued at $409,000 after purchasing an additional 73 shares during the period. Finally, Farther Finance Advisors LLC raised its stake in shares of Duolingo by 164.6% in the 3rd quarter. Farther Finance Advisors LLC now owns 127 shares of the company's stock valued at $36,000 after purchasing an additional 79 shares during the period. Institutional investors own 91.59% of the company's stock.

About Duolingo

(

Get Free Report)

Duolingo, Inc operates as a mobile learning platform in the United States, the United Kingdom, and internationally. The company offers courses in 40 different languages, including Spanish, English, French, German, Italian, Portuguese, Japanese, and Chinese through its Duolingo app. It also provides a digital English language proficiency assessment exam.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Duolingo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Duolingo wasn't on the list.

While Duolingo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.