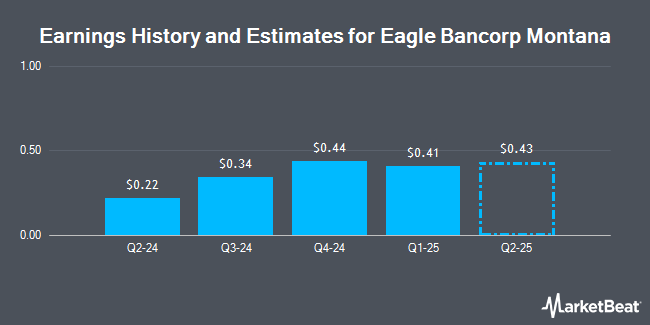

Eagle Bancorp Montana, Inc. (NASDAQ:EBMT - Free Report) - Equities research analysts at DA Davidson lowered their FY2025 EPS estimates for Eagle Bancorp Montana in a report issued on Thursday, December 19th. DA Davidson analyst J. Rulis now forecasts that the bank will post earnings of $1.55 per share for the year, down from their previous forecast of $1.60. The consensus estimate for Eagle Bancorp Montana's current full-year earnings is $1.10 per share.

Eagle Bancorp Montana (NASDAQ:EBMT - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The bank reported $0.34 EPS for the quarter, topping analysts' consensus estimates of $0.30 by $0.04. The business had revenue of $31.74 million for the quarter, compared to analysts' expectations of $20.60 million. Eagle Bancorp Montana had a return on equity of 4.96% and a net margin of 7.03%.

Separately, StockNews.com lowered shares of Eagle Bancorp Montana from a "buy" rating to a "hold" rating in a report on Wednesday, November 20th.

Read Our Latest Report on Eagle Bancorp Montana

Eagle Bancorp Montana Trading Down 0.1 %

NASDAQ:EBMT traded down $0.02 during midday trading on Friday, reaching $15.64. 13,063 shares of the stock traded hands, compared to its average volume of 11,680. The stock has a market capitalization of $125.39 million, a P/E ratio of 14.48 and a beta of 0.51. Eagle Bancorp Montana has a 12 month low of $12.32 and a 12 month high of $17.65. The company has a debt-to-equity ratio of 1.57, a quick ratio of 0.93 and a current ratio of 0.94. The company has a fifty day moving average of $16.80 and a 200 day moving average of $15.11.

Hedge Funds Weigh In On Eagle Bancorp Montana

Several large investors have recently made changes to their positions in the business. Barclays PLC increased its position in Eagle Bancorp Montana by 25.8% during the 3rd quarter. Barclays PLC now owns 10,567 shares of the bank's stock valued at $167,000 after buying an additional 2,165 shares in the last quarter. Geode Capital Management LLC grew its stake in shares of Eagle Bancorp Montana by 17.5% in the third quarter. Geode Capital Management LLC now owns 77,133 shares of the bank's stock worth $1,218,000 after acquiring an additional 11,490 shares during the last quarter. State Street Corp boosted its stake in Eagle Bancorp Montana by 5.9% in the 3rd quarter. State Street Corp now owns 17,838 shares of the bank's stock worth $282,000 after purchasing an additional 1,000 shares in the last quarter. Fourthstone LLC boosted its stake in Eagle Bancorp Montana by 1.1% in the 3rd quarter. Fourthstone LLC now owns 520,663 shares of the bank's stock worth $8,221,000 after purchasing an additional 5,898 shares in the last quarter. Finally, John G Ullman & Associates Inc. grew its position in Eagle Bancorp Montana by 13.4% during the 3rd quarter. John G Ullman & Associates Inc. now owns 62,574 shares of the bank's stock valued at $988,000 after purchasing an additional 7,382 shares during the last quarter. 35.66% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Eagle Bancorp Montana news, Director Peter Joseph Johnson sold 5,000 shares of the stock in a transaction on Friday, November 22nd. The stock was sold at an average price of $16.97, for a total value of $84,850.00. Following the completion of the transaction, the director now owns 57,838 shares in the company, valued at approximately $981,510.86. This represents a 7.96 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Kenneth M. Walsh sold 6,705 shares of the company's stock in a transaction dated Friday, November 1st. The stock was sold at an average price of $16.44, for a total transaction of $110,230.20. Following the completion of the sale, the director now directly owns 141,033 shares in the company, valued at $2,318,582.52. This represents a 4.54 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 12,795 shares of company stock worth $213,610. 6.70% of the stock is currently owned by corporate insiders.

Eagle Bancorp Montana Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, December 6th. Shareholders of record on Friday, November 15th were given a dividend of $0.142 per share. This represents a $0.57 dividend on an annualized basis and a yield of 3.63%. The ex-dividend date was Friday, November 15th. Eagle Bancorp Montana's payout ratio is currently 52.78%.

Eagle Bancorp Montana Company Profile

(

Get Free Report)

Eagle Bancorp Montana, Inc operates as the bank holding company for Opportunity Bank of Montana that provides various retail banking products and services to small businesses and individuals in Montana. It accepts various deposit products, such as checking, savings, money market, and individual retirement accounts, as well as certificates of deposit accounts.

Featured Articles

Before you consider Eagle Bancorp Montana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eagle Bancorp Montana wasn't on the list.

While Eagle Bancorp Montana currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.