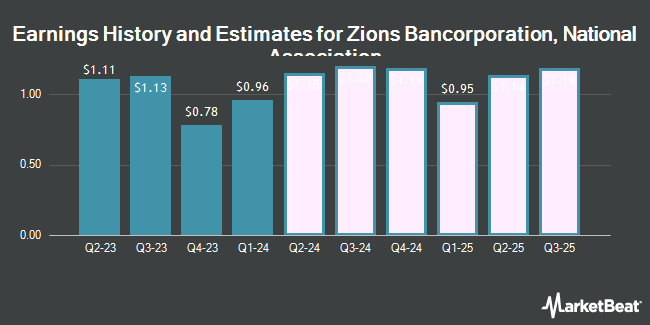

Zions Bancorporation, National Association (NASDAQ:ZION - Free Report) - Stock analysts at DA Davidson boosted their FY2024 earnings per share (EPS) estimates for Zions Bancorporation, National Association in a research note issued to investors on Thursday, December 19th. DA Davidson analyst P. Winter now anticipates that the bank will post earnings per share of $4.87 for the year, up from their prior estimate of $4.83. The consensus estimate for Zions Bancorporation, National Association's current full-year earnings is $4.85 per share. DA Davidson also issued estimates for Zions Bancorporation, National Association's Q4 2024 earnings at $1.29 EPS and FY2025 earnings at $5.10 EPS.

Zions Bancorporation, National Association (NASDAQ:ZION - Get Free Report) last posted its earnings results on Monday, October 21st. The bank reported $1.37 earnings per share for the quarter, topping the consensus estimate of $1.16 by $0.21. Zions Bancorporation, National Association had a net margin of 14.09% and a return on equity of 13.89%. The firm had revenue of $1.28 billion during the quarter, compared to the consensus estimate of $781.63 million. During the same quarter last year, the company earned $1.13 earnings per share.

Other analysts have also issued reports about the company. UBS Group assumed coverage on Zions Bancorporation, National Association in a research note on Tuesday. They set a "neutral" rating and a $64.00 price objective on the stock. Morgan Stanley boosted their price objective on shares of Zions Bancorporation, National Association from $54.00 to $56.00 and gave the company an "equal weight" rating in a research note on Tuesday, October 22nd. Keefe, Bruyette & Woods increased their target price on shares of Zions Bancorporation, National Association from $53.00 to $56.00 and gave the stock a "market perform" rating in a research note on Tuesday, October 22nd. Wells Fargo & Company boosted their price target on shares of Zions Bancorporation, National Association from $54.00 to $62.00 and gave the company an "equal weight" rating in a research report on Friday, November 15th. Finally, Stephens increased their price objective on Zions Bancorporation, National Association from $53.00 to $55.00 and gave the stock an "equal weight" rating in a research report on Tuesday, October 22nd. One investment analyst has rated the stock with a sell rating, seventeen have issued a hold rating and one has assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $57.06.

Check Out Our Latest Analysis on Zions Bancorporation, National Association

Zions Bancorporation, National Association Stock Performance

Zions Bancorporation, National Association stock traded up $1.31 during mid-day trading on Friday, reaching $53.67. The company's stock had a trading volume of 4,734,697 shares, compared to its average volume of 1,988,236. The firm's fifty day moving average price is $56.18 and its two-hundred day moving average price is $49.58. The company has a debt-to-equity ratio of 0.58, a quick ratio of 0.81 and a current ratio of 0.81. Zions Bancorporation, National Association has a 12-month low of $37.76 and a 12-month high of $63.22. The company has a market capitalization of $7.93 billion, a P/E ratio of 12.23, a PEG ratio of 5.10 and a beta of 1.10.

Institutional Investors Weigh In On Zions Bancorporation, National Association

Hedge funds have recently made changes to their positions in the company. Fifth Third Wealth Advisors LLC purchased a new stake in shares of Zions Bancorporation, National Association in the 2nd quarter worth about $198,000. Family Firm Inc. purchased a new position in shares of Zions Bancorporation, National Association during the second quarter valued at approximately $57,000. Clear Creek Financial Management LLC boosted its position in shares of Zions Bancorporation, National Association by 2.7% in the 2nd quarter. Clear Creek Financial Management LLC now owns 14,500 shares of the bank's stock worth $629,000 after purchasing an additional 380 shares in the last quarter. New Millennium Group LLC purchased a new stake in shares of Zions Bancorporation, National Association in the 2nd quarter worth approximately $55,000. Finally, Bank of New York Mellon Corp increased its position in Zions Bancorporation, National Association by 0.3% during the 2nd quarter. Bank of New York Mellon Corp now owns 1,724,325 shares of the bank's stock valued at $74,784,000 after buying an additional 5,609 shares in the last quarter. 76.84% of the stock is currently owned by institutional investors.

Insider Buying and Selling at Zions Bancorporation, National Association

In related news, EVP Jennifer Anne Smith sold 3,605 shares of the business's stock in a transaction dated Friday, November 8th. The stock was sold at an average price of $58.06, for a total transaction of $209,306.30. Following the transaction, the executive vice president now owns 24,714 shares in the company, valued at $1,434,894.84. The trade was a 12.73 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, VP Eric Ellingsen sold 1,238 shares of Zions Bancorporation, National Association stock in a transaction on Monday, November 11th. The shares were sold at an average price of $60.84, for a total transaction of $75,319.92. Following the completion of the sale, the vice president now owns 35,878 shares in the company, valued at approximately $2,182,817.52. This trade represents a 3.34 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 18,881 shares of company stock worth $1,108,184. 2.22% of the stock is currently owned by insiders.

Zions Bancorporation, National Association Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, November 21st. Investors of record on Thursday, November 14th were issued a dividend of $0.43 per share. The ex-dividend date was Thursday, November 14th. This is a boost from Zions Bancorporation, National Association's previous quarterly dividend of $0.41. This represents a $1.72 annualized dividend and a yield of 3.20%. Zions Bancorporation, National Association's dividend payout ratio is currently 39.18%.

About Zions Bancorporation, National Association

(

Get Free Report)

Zions Bancorporation, National Association provides various banking products and related services primarily in the states of Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming. It operates through Zions Bank, California Bank & Trust, Amegy Bank, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and The Commerce Bank of Washington segments.

Read More

Before you consider Zions Bancorporation, National Association, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zions Bancorporation, National Association wasn't on the list.

While Zions Bancorporation, National Association currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report