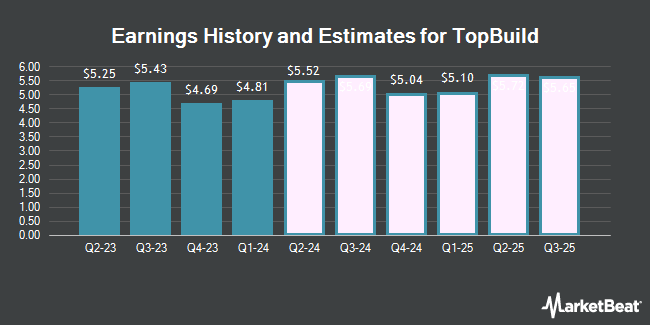

TopBuild Corp. (NYSE:BLD - Free Report) - Equities research analysts at DA Davidson increased their FY2024 EPS estimates for shares of TopBuild in a research report issued to clients and investors on Thursday, November 7th. DA Davidson analyst K. Yinger now expects that the construction company will post earnings of $21.03 per share for the year, up from their previous estimate of $20.94. DA Davidson has a "Buy" rating and a $450.00 price target on the stock. The consensus estimate for TopBuild's current full-year earnings is $21.02 per share. DA Davidson also issued estimates for TopBuild's FY2025 earnings at $22.85 EPS.

TopBuild (NYSE:BLD - Get Free Report) last announced its quarterly earnings results on Tuesday, November 5th. The construction company reported $5.68 EPS for the quarter, topping the consensus estimate of $5.62 by $0.06. The company had revenue of $1.37 billion during the quarter, compared to analyst estimates of $1.39 billion. TopBuild had a return on equity of 26.40% and a net margin of 11.66%. The firm's revenue was up 3.6% on a year-over-year basis. During the same period in the prior year, the firm posted $5.43 earnings per share.

A number of other analysts have also issued reports on BLD. Evercore ISI dropped their target price on TopBuild from $491.00 to $443.00 and set an "outperform" rating on the stock in a research report on Wednesday, November 6th. Truist Financial reduced their target price on TopBuild from $410.00 to $395.00 and set a "hold" rating for the company in a research note on Wednesday, August 7th. StockNews.com raised shares of TopBuild from a "hold" rating to a "buy" rating in a report on Tuesday, October 29th. Jefferies Financial Group decreased their price target on TopBuild from $525.00 to $515.00 and set a "buy" rating for the company in a research note on Wednesday, October 9th. Finally, Stephens lowered their target price on shares of TopBuild from $435.00 to $400.00 and set an "equal weight" rating for the company in a research note on Thursday, August 8th. Two analysts have rated the stock with a hold rating and nine have issued a buy rating to the company's stock. Based on data from MarketBeat, TopBuild presently has a consensus rating of "Moderate Buy" and a consensus target price of $440.44.

Get Our Latest Stock Analysis on BLD

TopBuild Stock Up 0.9 %

Shares of BLD traded up $3.45 during midday trading on Monday, reaching $372.34. 118,865 shares of the company were exchanged, compared to its average volume of 287,404. The company has a current ratio of 2.01, a quick ratio of 1.82 and a debt-to-equity ratio of 0.64. TopBuild has a 1-year low of $266.42 and a 1-year high of $495.68. The company has a market cap of $10.98 billion, a price-to-earnings ratio of 18.61, a P/E/G ratio of 2.32 and a beta of 1.79. The stock has a 50-day moving average price of $384.66 and a 200-day moving average price of $399.30.

Institutional Inflows and Outflows

A number of institutional investors have recently made changes to their positions in the stock. Vaughan Nelson Investment Management L.P. bought a new stake in TopBuild during the 3rd quarter valued at approximately $114,220,000. Jennison Associates LLC boosted its position in shares of TopBuild by 2,833.6% in the third quarter. Jennison Associates LLC now owns 114,030 shares of the construction company's stock valued at $46,389,000 after acquiring an additional 110,143 shares during the period. Natixis Advisors LLC acquired a new stake in shares of TopBuild in the third quarter worth $41,981,000. Liontrust Investment Partners LLP increased its position in TopBuild by 21.1% during the second quarter. Liontrust Investment Partners LLP now owns 332,050 shares of the construction company's stock worth $127,929,000 after acquiring an additional 57,880 shares during the period. Finally, BNP PARIBAS ASSET MANAGEMENT Holding S.A. increased its position in TopBuild by 54.2% during the third quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 120,625 shares of the construction company's stock worth $49,072,000 after acquiring an additional 42,395 shares during the period. 95.67% of the stock is owned by institutional investors.

About TopBuild

(

Get Free Report)

TopBuild Corp., together with its subsidiaries, engages in the installation and distribution of insulation and other building material products to the construction industry. The company operates in two segments, Installation and Specialty Distribution. It provides insulation products and accessories, glass and windows, rain gutters, garage doors, fireplaces, roofing materials, closet shelving, and other products.

Read More

Before you consider TopBuild, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TopBuild wasn't on the list.

While TopBuild currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.