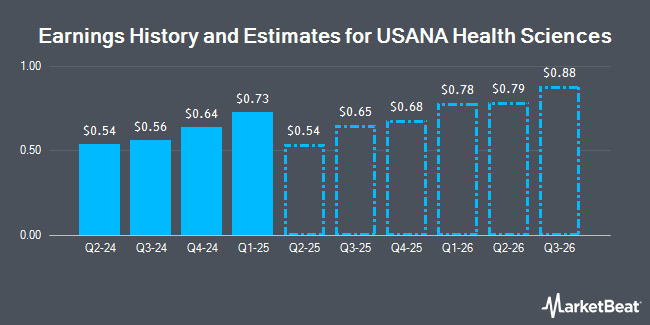

USANA Health Sciences, Inc. (NYSE:USNA - Free Report) - Research analysts at DA Davidson decreased their Q1 2025 earnings per share (EPS) estimates for shares of USANA Health Sciences in a research report issued on Thursday, February 27th. DA Davidson analyst C. Xue now forecasts that the company will earn $0.76 per share for the quarter, down from their prior forecast of $0.83. DA Davidson currently has a "Neutral" rating and a $36.00 price objective on the stock. The consensus estimate for USANA Health Sciences' current full-year earnings is $2.45 per share. DA Davidson also issued estimates for USANA Health Sciences' Q1 2025 earnings at $0.76 EPS, FY2025 earnings at $2.38 EPS, FY2025 earnings at $2.38 EPS and FY2026 earnings at $2.59 EPS.

A number of other equities analysts have also issued reports on USNA. StockNews.com lowered USANA Health Sciences from a "strong-buy" rating to a "buy" rating in a research report on Friday, February 14th. Sidoti lowered USANA Health Sciences from a "strong-buy" rating to a "hold" rating in a report on Tuesday, February 18th.

View Our Latest Stock Report on USANA Health Sciences

USANA Health Sciences Stock Performance

Shares of USNA stock traded down $0.26 during trading hours on Friday, reaching $29.72. The company had a trading volume of 208,391 shares, compared to its average volume of 169,774. The company has a market capitalization of $566.44 million, a P/E ratio of 10.54, a price-to-earnings-growth ratio of 0.93 and a beta of 0.87. The stock's fifty day simple moving average is $33.34 and its 200 day simple moving average is $36.41. USANA Health Sciences has a twelve month low of $27.71 and a twelve month high of $50.32.

USANA Health Sciences (NYSE:USNA - Get Free Report) last issued its earnings results on Tuesday, February 25th. The company reported $0.64 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.49 by $0.15. The business had revenue of $213.61 million during the quarter, compared to analysts' expectations of $208.82 million. USANA Health Sciences had a return on equity of 10.64% and a net margin of 6.30%.

Hedge Funds Weigh In On USANA Health Sciences

Several large investors have recently bought and sold shares of USNA. R Squared Ltd bought a new stake in shares of USANA Health Sciences during the fourth quarter valued at approximately $28,000. Safe Harbor Fiduciary LLC acquired a new position in USANA Health Sciences during the third quarter worth $30,000. KBC Group NV lifted its holdings in shares of USANA Health Sciences by 96.6% during the third quarter. KBC Group NV now owns 1,056 shares of the company's stock valued at $40,000 after acquiring an additional 519 shares during the period. KLP Kapitalforvaltning AS acquired a new stake in shares of USANA Health Sciences in the 4th quarter valued at $83,000. Finally, Quantbot Technologies LP acquired a new stake in shares of USANA Health Sciences in the 4th quarter valued at $132,000. 54.25% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling at USANA Health Sciences

In other USANA Health Sciences news, CEO Jim Brown sold 5,000 shares of the company's stock in a transaction that occurred on Monday, March 3rd. The stock was sold at an average price of $29.47, for a total transaction of $147,350.00. Following the completion of the sale, the chief executive officer now owns 15,716 shares of the company's stock, valued at $463,150.52. This represents a 24.14 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Company insiders own 0.33% of the company's stock.

About USANA Health Sciences

(

Get Free Report)

USANA Health Sciences, Inc develops, manufactures, and sells science-based nutritional, personal care, and skincare products in the Asia Pacific, the Americas, and Europe. The company offers USANA nutritional products that comprise essentials/CellSentials, such as vitamin and mineral supplements that provide a foundation of total body nutrition for various age groups; optimizers consisting of targeted supplements that are designed to meet cardiovascular, skeletal/structural, and digestive health needs; and food that include meal replacement shakes, snack bars, and other related products.

Read More

Before you consider USANA Health Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and USANA Health Sciences wasn't on the list.

While USANA Health Sciences currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.