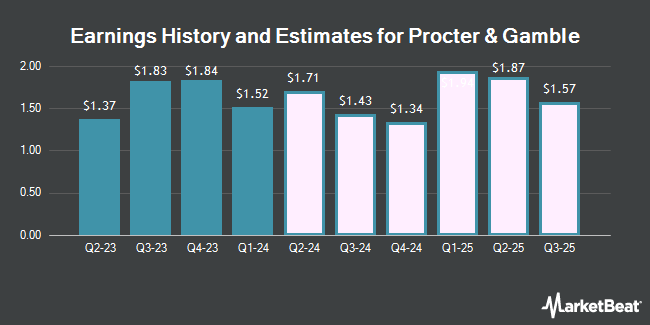

The Procter & Gamble Company (NYSE:PG - Free Report) - Equities research analysts at DA Davidson lowered their Q2 2025 earnings per share (EPS) estimates for shares of Procter & Gamble in a research note issued to investors on Tuesday, November 26th. DA Davidson analyst L. Weiser now anticipates that the company will post earnings of $1.87 per share for the quarter, down from their previous forecast of $1.93. DA Davidson has a "Buy" rating and a $209.00 price objective on the stock. The consensus estimate for Procter & Gamble's current full-year earnings is $6.96 per share. DA Davidson also issued estimates for Procter & Gamble's FY2025 earnings at $7.03 EPS and FY2026 earnings at $7.49 EPS.

Other research analysts have also issued reports about the company. Barclays cut shares of Procter & Gamble from an "overweight" rating to an "equal weight" rating and set a $163.00 target price for the company. in a research note on Monday, September 30th. Wolfe Research upgraded Procter & Gamble to a "strong-buy" rating in a research report on Friday, August 23rd. Royal Bank of Canada reissued a "sector perform" rating and issued a $164.00 price target on shares of Procter & Gamble in a research note on Monday, October 21st. Evercore ISI upped their price objective on Procter & Gamble from $180.00 to $183.00 and gave the company an "outperform" rating in a report on Monday, October 21st. Finally, Morgan Stanley boosted their target price on Procter & Gamble from $174.00 to $191.00 and gave the stock an "overweight" rating in a research report on Monday, October 21st. Eight research analysts have rated the stock with a hold rating, fourteen have given a buy rating and two have assigned a strong buy rating to the stock. According to MarketBeat.com, Procter & Gamble currently has an average rating of "Moderate Buy" and an average price target of $180.45.

Get Our Latest Research Report on PG

Procter & Gamble Stock Performance

Shares of PG stock traded up $0.78 during trading on Wednesday, reaching $180.09. The company had a trading volume of 1,689,676 shares, compared to its average volume of 6,720,529. The company has a market capitalization of $424.12 billion, a PE ratio of 31.08, a PEG ratio of 3.82 and a beta of 0.42. The company has a debt-to-equity ratio of 0.50, a current ratio of 0.75 and a quick ratio of 0.55. The firm's 50 day simple moving average is $170.11 and its two-hundred day simple moving average is $168.83. Procter & Gamble has a one year low of $142.50 and a one year high of $180.43.

Procter & Gamble (NYSE:PG - Get Free Report) last posted its quarterly earnings data on Friday, October 18th. The company reported $1.93 earnings per share for the quarter, topping the consensus estimate of $1.90 by $0.03. The firm had revenue of $21.74 billion for the quarter, compared to analysts' expectations of $21.99 billion. Procter & Gamble had a net margin of 17.07% and a return on equity of 33.25%. The company's quarterly revenue was down .6% compared to the same quarter last year. During the same period in the previous year, the company posted $1.83 EPS.

Hedge Funds Weigh In On Procter & Gamble

Large investors have recently made changes to their positions in the business. Acorn Creek Capital LLC increased its position in shares of Procter & Gamble by 2.8% during the third quarter. Acorn Creek Capital LLC now owns 2,170 shares of the company's stock worth $376,000 after purchasing an additional 59 shares in the last quarter. Patrick M Sweeney & Associates Inc. boosted its position in Procter & Gamble by 1.1% during the third quarter. Patrick M Sweeney & Associates Inc. now owns 5,561 shares of the company's stock worth $963,000 after acquiring an additional 59 shares during the last quarter. Hudson Value Partners LLC raised its holdings in Procter & Gamble by 4.1% in the 2nd quarter. Hudson Value Partners LLC now owns 1,516 shares of the company's stock valued at $250,000 after acquiring an additional 60 shares during the last quarter. Traveka Wealth LLC boosted its holdings in shares of Procter & Gamble by 1.7% during the 3rd quarter. Traveka Wealth LLC now owns 3,554 shares of the company's stock worth $616,000 after purchasing an additional 60 shares during the last quarter. Finally, Fiduciary Alliance LLC increased its holdings in shares of Procter & Gamble by 2.8% in the second quarter. Fiduciary Alliance LLC now owns 2,261 shares of the company's stock valued at $371,000 after purchasing an additional 61 shares during the last quarter. 65.77% of the stock is owned by institutional investors and hedge funds.

Insiders Place Their Bets

In related news, insider Balaji Purushothaman sold 12,800 shares of the stock in a transaction that occurred on Thursday, October 24th. The stock was sold at an average price of $168.99, for a total value of $2,163,072.00. Following the transaction, the insider now owns 11,566 shares of the company's stock, valued at $1,954,538.34. This represents a 52.53 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Susan Street Whaley sold 634 shares of Procter & Gamble stock in a transaction on Wednesday, October 2nd. The shares were sold at an average price of $171.65, for a total value of $108,826.10. Following the sale, the insider now directly owns 19,341 shares of the company's stock, valued at approximately $3,319,882.65. This trade represents a 3.17 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 35,233 shares of company stock valued at $6,024,234 over the last three months. 0.18% of the stock is owned by company insiders.

Procter & Gamble Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, November 15th. Shareholders of record on Friday, October 18th were paid a dividend of $1.0065 per share. The ex-dividend date was Friday, October 18th. This represents a $4.03 annualized dividend and a yield of 2.24%. Procter & Gamble's payout ratio is currently 69.48%.

About Procter & Gamble

(

Get Free Report)

The Procter & Gamble Company engages in the provision of branded consumer packaged goods worldwide. The company operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care. The Beauty segment offers conditioners, shampoos, styling aids, and treatments under the Head & Shoulders, Herbal Essences, Pantene, and Rejoice brands; and antiperspirants and deodorants, personal cleansing, and skin care products under the Olay, Old Spice, Safeguard, Secret, SK-II, and Native brands.

Recommended Stories

Before you consider Procter & Gamble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procter & Gamble wasn't on the list.

While Procter & Gamble currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.