Dai ichi Life Insurance Company Ltd purchased a new stake in shares of Masco Co. (NYSE:MAS - Free Report) in the third quarter, according to its most recent disclosure with the SEC. The firm purchased 7,185 shares of the construction company's stock, valued at approximately $603,000.

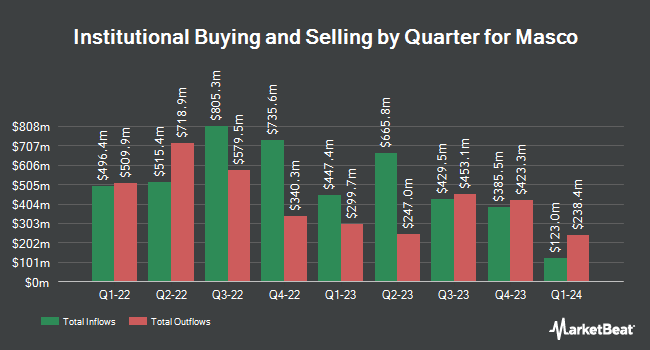

Several other hedge funds also recently modified their holdings of the company. Manning & Napier Advisors LLC bought a new stake in Masco during the second quarter worth approximately $82,363,000. Assenagon Asset Management S.A. lifted its position in shares of Masco by 956.3% during the 3rd quarter. Assenagon Asset Management S.A. now owns 989,640 shares of the construction company's stock valued at $83,070,000 after acquiring an additional 895,950 shares during the last quarter. Acadian Asset Management LLC grew its holdings in shares of Masco by 66.5% in the 2nd quarter. Acadian Asset Management LLC now owns 1,823,934 shares of the construction company's stock worth $121,581,000 after acquiring an additional 728,690 shares during the last quarter. Bank of Montreal Can raised its position in shares of Masco by 86.5% during the second quarter. Bank of Montreal Can now owns 634,740 shares of the construction company's stock worth $42,318,000 after purchasing an additional 294,409 shares during the period. Finally, Teachers Retirement System of The State of Kentucky lifted its holdings in shares of Masco by 89.5% during the second quarter. Teachers Retirement System of The State of Kentucky now owns 579,597 shares of the construction company's stock valued at $38,642,000 after purchasing an additional 273,718 shares during the last quarter. 93.91% of the stock is currently owned by institutional investors and hedge funds.

Masco Stock Up 0.2 %

Shares of NYSE:MAS traded up $0.14 on Friday, reaching $80.56. The company had a trading volume of 684,524 shares, compared to its average volume of 1,789,307. The stock has a market capitalization of $17.38 billion, a P/E ratio of 21.49, a P/E/G ratio of 2.61 and a beta of 1.24. The stock has a 50-day moving average price of $81.69 and a 200 day moving average price of $75.69. Masco Co. has a twelve month low of $59.72 and a twelve month high of $86.70. The company has a quick ratio of 1.21, a current ratio of 1.83 and a debt-to-equity ratio of 20.74.

Masco (NYSE:MAS - Get Free Report) last posted its earnings results on Tuesday, October 29th. The construction company reported $1.08 earnings per share for the quarter, hitting the consensus estimate of $1.08. Masco had a return on equity of 615.54% and a net margin of 10.54%. The firm had revenue of $1.98 billion during the quarter, compared to analyst estimates of $2 billion. During the same period in the previous year, the company earned $1.00 EPS. The company's revenue for the quarter was up .2% on a year-over-year basis. On average, equities analysts expect that Masco Co. will post 4.09 EPS for the current year.

Masco Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, November 25th. Investors of record on Friday, November 8th were issued a $0.29 dividend. The ex-dividend date of this dividend was Friday, November 8th. This represents a $1.16 annualized dividend and a yield of 1.44%. Masco's dividend payout ratio (DPR) is presently 30.85%.

Insiders Place Their Bets

In other Masco news, VP Kenneth G. Cole sold 37,814 shares of Masco stock in a transaction that occurred on Tuesday, September 10th. The stock was sold at an average price of $78.32, for a total value of $2,961,592.48. Following the transaction, the vice president now directly owns 36,980 shares of the company's stock, valued at $2,896,273.60. The trade was a 50.56 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Company insiders own 1.10% of the company's stock.

Analysts Set New Price Targets

Several analysts have issued reports on the company. Loop Capital boosted their price objective on Masco from $76.00 to $87.00 and gave the stock a "hold" rating in a report on Wednesday, October 30th. Barclays boosted their price target on shares of Masco from $92.00 to $93.00 and gave the company an "overweight" rating in a report on Wednesday, October 30th. Wells Fargo & Company raised their price objective on shares of Masco from $90.00 to $92.00 and gave the stock an "overweight" rating in a research note on Monday, October 7th. Evercore ISI boosted their target price on shares of Masco from $78.00 to $82.00 and gave the company an "in-line" rating in a research note on Wednesday, October 30th. Finally, JPMorgan Chase & Co. raised their target price on Masco from $80.00 to $83.50 and gave the stock a "neutral" rating in a research report on Tuesday, November 5th. Eight investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average target price of $85.96.

Check Out Our Latest Stock Report on Masco

Masco Profile

(

Free Report)

Masco Corporation designs, manufactures, and distributes home improvement and building products in North America, Europe, and internationally. The company's Plumbing Products segment offers faucets, showerheads, handheld showers, valves, bath hardware and accessories, bathing units, shower bases and enclosures, sinks, toilets, acrylic tubs, shower trays, spas, exercise pools, and fitness systems; brass, copper, and composite plumbing system components; connected water products; thermoplastic solutions, extruded plastic profiles, specialized fabrications, and PEX tubing products; and other non-decorative plumbing products.

See Also

Before you consider Masco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Masco wasn't on the list.

While Masco currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.