Dai ichi Life Insurance Company Ltd grew its position in shares of Royalty Pharma plc (NASDAQ:RPRX - Free Report) by 79.9% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 169,270 shares of the biopharmaceutical company's stock after purchasing an additional 75,204 shares during the quarter. Dai ichi Life Insurance Company Ltd's holdings in Royalty Pharma were worth $4,789,000 as of its most recent SEC filing.

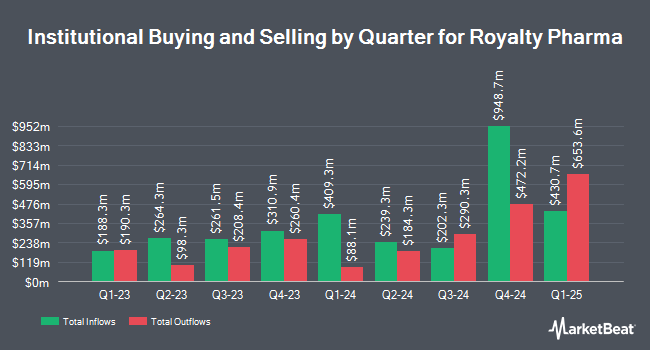

Other hedge funds and other institutional investors also recently made changes to their positions in the company. B. Riley Wealth Advisors Inc. acquired a new position in shares of Royalty Pharma in the 1st quarter valued at about $487,000. California State Teachers Retirement System boosted its position in shares of Royalty Pharma by 2.1% during the 1st quarter. California State Teachers Retirement System now owns 649,055 shares of the biopharmaceutical company's stock worth $19,712,000 after purchasing an additional 13,533 shares in the last quarter. Tidal Investments LLC raised its stake in Royalty Pharma by 28.2% during the 1st quarter. Tidal Investments LLC now owns 90,149 shares of the biopharmaceutical company's stock worth $2,740,000 after buying an additional 19,834 shares during the period. Plato Investment Management Ltd acquired a new position in shares of Royalty Pharma during the first quarter worth approximately $1,163,000. Finally, Advisory Resource Group bought a new stake in Royalty Pharma during the 1st quarter valued at $824,000. 54.35% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of brokerages have commented on RPRX. Citigroup decreased their price objective on Royalty Pharma from $60.00 to $40.00 and set a "buy" rating for the company in a report on Friday, October 25th. The Goldman Sachs Group boosted their price target on shares of Royalty Pharma from $50.00 to $51.00 and gave the stock a "buy" rating in a report on Wednesday, August 14th. Finally, StockNews.com upgraded shares of Royalty Pharma from a "hold" rating to a "buy" rating in a research note on Tuesday, November 5th. One equities research analyst has rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $41.67.

Check Out Our Latest Stock Report on RPRX

Royalty Pharma Price Performance

Shares of NASDAQ:RPRX traded up $0.31 during trading on Wednesday, reaching $26.60. The company had a trading volume of 1,811,546 shares, compared to its average volume of 2,645,659. Royalty Pharma plc has a 12 month low of $25.10 and a 12 month high of $31.66. The company has a current ratio of 1.54, a quick ratio of 1.54 and a debt-to-equity ratio of 0.64. The stock has a market capitalization of $15.67 billion, a P/E ratio of 13.78, a price-to-earnings-growth ratio of 4.65 and a beta of 0.47. The company has a fifty day moving average of $27.19 and a two-hundred day moving average of $27.35.

Royalty Pharma Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 10th. Stockholders of record on Friday, November 15th will be given a dividend of $0.21 per share. The ex-dividend date of this dividend is Friday, November 15th. This represents a $0.84 annualized dividend and a dividend yield of 3.16%. Royalty Pharma's dividend payout ratio (DPR) is presently 43.52%.

About Royalty Pharma

(

Free Report)

Royalty Pharma plc operates as a buyer of biopharmaceutical royalties and a funder of innovations in the biopharmaceutical industry in the United States. It is also involved in the identification, evaluation, and acquisition of royalties on various biopharmaceutical therapies. In addition, the company collaborates with innovators from academic institutions, research hospitals and not-for-profits, small and mid-cap biotechnology companies, and pharmaceutical companies.

See Also

Before you consider Royalty Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royalty Pharma wasn't on the list.

While Royalty Pharma currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.