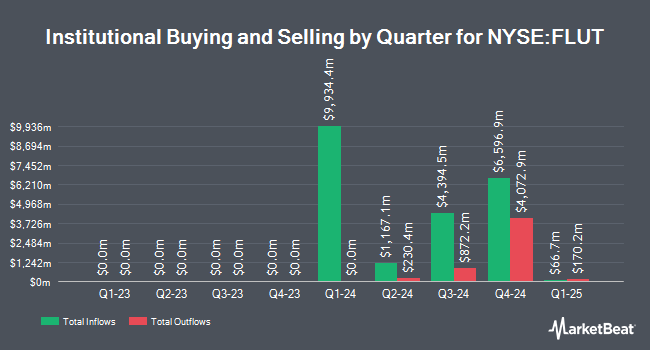

Dai ichi Life Insurance Company Ltd reduced its position in shares of Flutter Entertainment plc (NYSE:FLUT - Free Report) by 65.2% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 3,972 shares of the company's stock after selling 7,428 shares during the period. Dai ichi Life Insurance Company Ltd's holdings in Flutter Entertainment were worth $942,000 at the end of the most recent quarter.

Several other institutional investors have also recently made changes to their positions in FLUT. DekaBank Deutsche Girozentrale bought a new position in shares of Flutter Entertainment in the 1st quarter worth $22,498,000. Raymond James & Associates lifted its stake in Flutter Entertainment by 10.0% during the third quarter. Raymond James & Associates now owns 18,348 shares of the company's stock worth $4,354,000 after purchasing an additional 1,663 shares during the last quarter. Russell Investments Group Ltd. purchased a new position in shares of Flutter Entertainment in the 1st quarter worth about $318,000. Sumitomo Mitsui DS Asset Management Company Ltd purchased a new position in shares of Flutter Entertainment in the 3rd quarter worth about $3,888,000. Finally, GSA Capital Partners LLP increased its position in shares of Flutter Entertainment by 48.3% during the 3rd quarter. GSA Capital Partners LLP now owns 12,034 shares of the company's stock valued at $2,855,000 after purchasing an additional 3,922 shares during the last quarter.

Wall Street Analysts Forecast Growth

A number of research firms recently weighed in on FLUT. Needham & Company LLC boosted their target price on Flutter Entertainment from $270.00 to $300.00 and gave the stock a "buy" rating in a research report on Wednesday, November 13th. JMP Securities boosted their price objective on shares of Flutter Entertainment from $287.00 to $299.00 and gave the stock a "market outperform" rating in a report on Wednesday, November 13th. Wells Fargo & Company increased their target price on shares of Flutter Entertainment from $295.00 to $300.00 and gave the company an "overweight" rating in a report on Wednesday, November 13th. Moffett Nathanson boosted their price target on shares of Flutter Entertainment from $245.00 to $275.00 and gave the stock a "buy" rating in a research note on Thursday, September 26th. Finally, Oppenheimer upped their price target on shares of Flutter Entertainment from $300.00 to $305.00 and gave the company an "outperform" rating in a research report on Wednesday, November 13th. Fifteen equities research analysts have rated the stock with a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, Flutter Entertainment currently has a consensus rating of "Buy" and an average price target of $298.79.

Get Our Latest Research Report on Flutter Entertainment

Flutter Entertainment Trading Up 1.1 %

FLUT traded up $2.99 during midday trading on Friday, reaching $276.32. 554,026 shares of the company's stock traded hands, compared to its average volume of 1,156,190. Flutter Entertainment plc has a 52 week low of $150.65 and a 52 week high of $279.04. The firm has a fifty day moving average of $242.43 and a two-hundred day moving average of $214.57.

Flutter Entertainment declared that its Board of Directors has approved a share repurchase plan on Wednesday, September 25th that allows the company to buyback $5.00 billion in shares. This buyback authorization allows the company to buy up to 11.7% of its stock through open market purchases. Stock buyback plans are typically an indication that the company's leadership believes its shares are undervalued.

Flutter Entertainment Company Profile

(

Free Report)

Flutter Entertainment plc operates as a sports betting and gaming company in the United Kingdom, Ireland, Australia, the United States, Italy, and internationally. The company operates through four segments: UK & Ireland, Australia, International, and US. It offers sports betting, iGaming, daily fantasy sports, online racing wagering, and TV broadcasting products; sportsbooks and exchange sports betting products, and gaming products; and online sports betting.

Recommended Stories

Before you consider Flutter Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flutter Entertainment wasn't on the list.

While Flutter Entertainment currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.