Daiwa Securities Group Inc. raised its holdings in DocuSign, Inc. (NASDAQ:DOCU - Free Report) by 24.1% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 19,270 shares of the company's stock after buying an additional 3,737 shares during the quarter. Daiwa Securities Group Inc.'s holdings in DocuSign were worth $1,733,000 at the end of the most recent quarter.

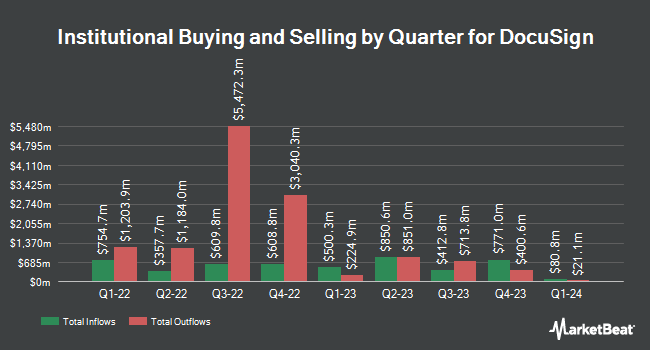

A number of other institutional investors and hedge funds also recently modified their holdings of the stock. Itau Unibanco Holding S.A. purchased a new position in shares of DocuSign in the 3rd quarter worth $28,000. Kestra Investment Management LLC purchased a new position in shares of DocuSign in the 4th quarter worth $30,000. Brooklyn Investment Group purchased a new position in shares of DocuSign in the 3rd quarter worth $33,000. Modus Advisors LLC purchased a new position in shares of DocuSign in the 4th quarter worth $36,000. Finally, First Horizon Advisors Inc. raised its position in shares of DocuSign by 102.6% in the 4th quarter. First Horizon Advisors Inc. now owns 397 shares of the company's stock worth $36,000 after buying an additional 201 shares during the period. Institutional investors and hedge funds own 77.64% of the company's stock.

DocuSign Stock Up 14.8 %

Shares of DocuSign stock traded up $11.06 during trading hours on Friday, hitting $85.76. 11,927,431 shares of the company's stock traded hands, compared to its average volume of 2,402,407. The company has a market cap of $17.33 billion, a PE ratio of 17.68, a PEG ratio of 6.94 and a beta of 1.02. DocuSign, Inc. has a twelve month low of $48.70 and a twelve month high of $107.86. The stock has a 50 day simple moving average of $87.97 and a 200-day simple moving average of $79.37.

DocuSign (NASDAQ:DOCU - Get Free Report) last posted its quarterly earnings results on Thursday, March 13th. The company reported $0.86 EPS for the quarter, topping analysts' consensus estimates of $0.84 by $0.02. The business had revenue of $776.25 million during the quarter, compared to the consensus estimate of $760.94 million. DocuSign had a return on equity of 14.90% and a net margin of 34.73%. The company's revenue for the quarter was up 9.0% compared to the same quarter last year. During the same period last year, the firm earned $0.76 earnings per share. As a group, equities research analysts predict that DocuSign, Inc. will post 1.17 EPS for the current year.

Insider Buying and Selling

In other DocuSign news, insider Robert Chatwani sold 14,800 shares of the firm's stock in a transaction dated Wednesday, December 18th. The shares were sold at an average price of $97.76, for a total value of $1,446,848.00. Following the transaction, the insider now owns 73,414 shares of the company's stock, valued at $7,176,952.64. This trade represents a 16.78 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, CFO Blake Jeffrey Grayson sold 8,000 shares of the firm's stock in a transaction dated Friday, February 14th. The stock was sold at an average price of $86.90, for a total transaction of $695,200.00. Following the completion of the transaction, the chief financial officer now directly owns 77,851 shares in the company, valued at $6,765,251.90. This represents a 9.32 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 104,422 shares of company stock worth $9,665,394. Corporate insiders own 1.66% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages recently weighed in on DOCU. JPMorgan Chase & Co. raised DocuSign from an "underweight" rating to a "neutral" rating and increased their target price for the stock from $70.00 to $75.00 in a research report on Monday, March 10th. Wells Fargo & Company increased their target price on DocuSign from $70.00 to $73.00 and gave the stock an "underweight" rating in a research report on Friday. Jefferies Financial Group increased their price target on DocuSign from $80.00 to $95.00 and gave the company a "buy" rating in a report on Tuesday, December 3rd. Robert W. Baird increased their price target on DocuSign from $59.00 to $100.00 and gave the company a "neutral" rating in a report on Friday, December 6th. Finally, JMP Securities reiterated a "market outperform" rating and issued a $124.00 price target on shares of DocuSign in a report on Tuesday, January 7th. Two equities research analysts have rated the stock with a sell rating, nine have given a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus price target of $95.58.

Read Our Latest Analysis on DOCU

DocuSign Profile

(

Free Report)

DocuSign, Inc provides electronic signature solution in the United States and internationally. The company provides e-signature solution that enables sending and signing of agreements on various devices; Contract Lifecycle Management (CLM), which automates workflows across the entire agreement process; Document Generation streamlines the process of generating new, custom agreements; and Gen for Salesforce, which allows sales representatives to automatically generate agreements with a few clicks from within Salesforce.

Read More

Before you consider DocuSign, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DocuSign wasn't on the list.

While DocuSign currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.