Daiwa Securities Group Inc. boosted its position in shares of Keysight Technologies, Inc. (NYSE:KEYS - Free Report) by 21.1% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 25,478 shares of the scientific and technical instruments company's stock after buying an additional 4,432 shares during the quarter. Daiwa Securities Group Inc.'s holdings in Keysight Technologies were worth $4,049,000 at the end of the most recent quarter.

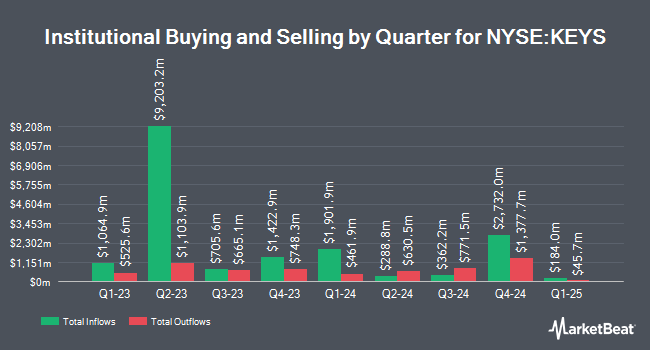

A number of other hedge funds have also recently bought and sold shares of the company. Swedbank AB boosted its holdings in Keysight Technologies by 3.8% during the second quarter. Swedbank AB now owns 4,128,892 shares of the scientific and technical instruments company's stock worth $564,626,000 after buying an additional 151,446 shares in the last quarter. Natixis Advisors LLC grew its holdings in shares of Keysight Technologies by 8.7% in the 3rd quarter. Natixis Advisors LLC now owns 176,966 shares of the scientific and technical instruments company's stock worth $28,125,000 after acquiring an additional 14,185 shares during the last quarter. Janney Montgomery Scott LLC raised its position in shares of Keysight Technologies by 72.6% during the third quarter. Janney Montgomery Scott LLC now owns 16,895 shares of the scientific and technical instruments company's stock worth $2,685,000 after purchasing an additional 7,106 shares during the period. Speece Thorson Capital Group Inc. boosted its position in shares of Keysight Technologies by 28.7% in the 3rd quarter. Speece Thorson Capital Group Inc. now owns 80,629 shares of the scientific and technical instruments company's stock valued at $12,814,000 after purchasing an additional 17,962 shares during the period. Finally, Teachers Retirement System of The State of Kentucky lifted its stake in Keysight Technologies by 172.6% during the first quarter. Teachers Retirement System of The State of Kentucky now owns 41,977 shares of the scientific and technical instruments company's stock valued at $6,565,000 after buying an additional 26,577 shares in the last quarter. 84.58% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities research analysts recently commented on KEYS shares. Morgan Stanley upped their price target on shares of Keysight Technologies from $165.00 to $180.00 and gave the company an "overweight" rating in a research report on Wednesday, November 20th. Bank of America increased their price objective on Keysight Technologies from $150.00 to $160.00 and gave the stock an "underperform" rating in a research note on Wednesday, November 20th. Deutsche Bank Aktiengesellschaft upped their target price on Keysight Technologies from $175.00 to $180.00 and gave the company a "buy" rating in a report on Wednesday, November 20th. JPMorgan Chase & Co. raised their price target on shares of Keysight Technologies from $155.00 to $165.00 and gave the stock a "neutral" rating in a report on Wednesday, August 21st. Finally, Barclays upped their price objective on shares of Keysight Technologies from $180.00 to $200.00 and gave the company an "overweight" rating in a research note on Wednesday, November 20th. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and eight have assigned a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $177.30.

Check Out Our Latest Stock Report on KEYS

Keysight Technologies Trading Up 0.1 %

NYSE:KEYS opened at $171.90 on Wednesday. The firm has a market cap of $29.83 billion, a price-to-earnings ratio of 49.11, a P/E/G ratio of 2.22 and a beta of 0.98. Keysight Technologies, Inc. has a 12 month low of $119.72 and a 12 month high of $175.39. The company has a quick ratio of 2.27, a current ratio of 2.98 and a debt-to-equity ratio of 0.35. The company's 50 day moving average is $157.00 and its 200-day moving average is $146.49.

Insider Activity

In other news, VP Lisa M. Poole sold 350 shares of Keysight Technologies stock in a transaction dated Monday, November 25th. The shares were sold at an average price of $171.79, for a total transaction of $60,126.50. Following the sale, the vice president now directly owns 4,820 shares in the company, valued at approximately $828,027.80. The trade was a 6.77 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 0.60% of the stock is currently owned by company insiders.

Keysight Technologies Profile

(

Free Report)

Keysight Technologies, Inc provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries in the Americas, Europe, and the Asia Pacific. The company operates in two segments, Communications Solutions Group and Electronic Industrial Solutions Group.

Featured Articles

Before you consider Keysight Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keysight Technologies wasn't on the list.

While Keysight Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.