Daiwa Securities Group Inc. reduced its holdings in shares of Ryan Specialty Holdings, Inc. (NYSE:RYAN - Free Report) by 13.2% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 85,596 shares of the company's stock after selling 13,000 shares during the quarter. Daiwa Securities Group Inc.'s holdings in Ryan Specialty were worth $5,683,000 at the end of the most recent reporting period.

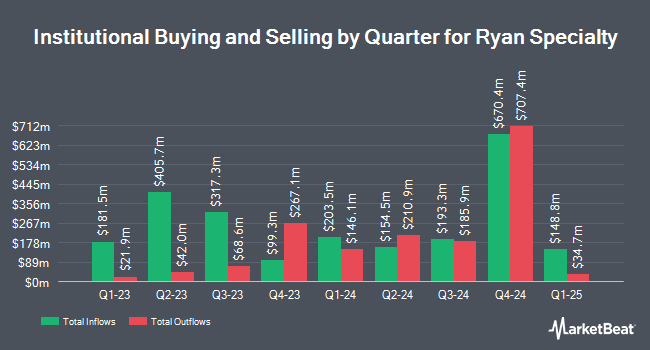

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Quadrature Capital Ltd boosted its stake in Ryan Specialty by 73.5% during the 1st quarter. Quadrature Capital Ltd now owns 8,449 shares of the company's stock valued at $469,000 after purchasing an additional 3,580 shares during the last quarter. Bayesian Capital Management LP purchased a new position in shares of Ryan Specialty during the first quarter valued at approximately $618,000. GAMMA Investing LLC grew its holdings in Ryan Specialty by 96.4% during the second quarter. GAMMA Investing LLC now owns 605 shares of the company's stock worth $35,000 after buying an additional 297 shares in the last quarter. Anderson Hoagland & Co. raised its position in Ryan Specialty by 1.2% in the 2nd quarter. Anderson Hoagland & Co. now owns 51,615 shares of the company's stock valued at $2,909,000 after buying an additional 624 shares during the last quarter. Finally, Renaissance Capital LLC lifted its stake in Ryan Specialty by 45.1% during the 2nd quarter. Renaissance Capital LLC now owns 91,929 shares of the company's stock valued at $5,324,000 after acquiring an additional 28,565 shares in the last quarter. 84.82% of the stock is owned by institutional investors.

Insider Buying and Selling at Ryan Specialty

In other news, Director David P. Bolger sold 7,055 shares of the firm's stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $70.88, for a total transaction of $500,058.40. Following the sale, the director now owns 78,149 shares in the company, valued at approximately $5,539,201.12. This trade represents a 8.28 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, EVP Mark Stephen Katz sold 14,790 shares of Ryan Specialty stock in a transaction on Friday, November 8th. The stock was sold at an average price of $71.39, for a total transaction of $1,055,858.10. Following the sale, the executive vice president now directly owns 12,386 shares of the company's stock, valued at $884,236.54. This represents a 54.42 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 11.10% of the company's stock.

Ryan Specialty Stock Performance

NYSE:RYAN traded up $0.16 on Wednesday, reaching $75.23. 296,416 shares of the company's stock were exchanged, compared to its average volume of 868,978. The company has a debt-to-equity ratio of 2.40, a current ratio of 1.01 and a quick ratio of 1.01. The firm has a market cap of $19.70 billion, a price-to-earnings ratio of 97.69, a P/E/G ratio of 1.69 and a beta of 0.62. Ryan Specialty Holdings, Inc. has a 52 week low of $41.49 and a 52 week high of $75.86. The stock has a fifty day simple moving average of $69.27 and a 200-day simple moving average of $62.80.

Ryan Specialty (NYSE:RYAN - Get Free Report) last posted its earnings results on Wednesday, October 30th. The company reported $0.41 earnings per share for the quarter, meeting analysts' consensus estimates of $0.41. Ryan Specialty had a return on equity of 47.90% and a net margin of 10.31%. The business had revenue of $604.69 million during the quarter, compared to analyst estimates of $602.04 million. During the same quarter in the previous year, the firm earned $0.32 EPS. The company's quarterly revenue was up 20.5% compared to the same quarter last year. As a group, sell-side analysts predict that Ryan Specialty Holdings, Inc. will post 1.8 earnings per share for the current year.

Ryan Specialty Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Tuesday, November 26th. Shareholders of record on Tuesday, November 12th were paid a $0.11 dividend. This represents a $0.44 annualized dividend and a yield of 0.58%. The ex-dividend date was Tuesday, November 12th. Ryan Specialty's dividend payout ratio is presently 57.14%.

Analysts Set New Price Targets

Several analysts have recently commented on the stock. Barclays increased their target price on shares of Ryan Specialty from $76.00 to $88.00 and gave the company an "overweight" rating in a report on Thursday, November 21st. UBS Group increased their target price on shares of Ryan Specialty from $67.00 to $76.00 and gave the company a "buy" rating in a report on Tuesday, August 13th. Bank of America increased their target price on shares of Ryan Specialty from $75.00 to $84.00 and gave the company a "buy" rating in a report on Thursday, October 10th. Wells Fargo & Company increased their target price on shares of Ryan Specialty from $63.00 to $70.00 and gave the company an "equal weight" rating in a report on Thursday, October 10th. Finally, JPMorgan Chase & Co. increased their target price on shares of Ryan Specialty from $54.00 to $56.00 and gave the company an "underweight" rating in a report on Friday, August 2nd. One analyst has rated the stock with a sell rating, five have issued a hold rating and five have given a buy rating to the company. Based on data from MarketBeat, Ryan Specialty presently has an average rating of "Hold" and a consensus target price of $71.67.

Check Out Our Latest Report on Ryan Specialty

Ryan Specialty Profile

(

Free Report)

Ryan Specialty Holdings, Inc operates as a service provider of specialty products and solutions for insurance brokers, agents, and carriers in the United States, Canada, the United Kingdom, Europe, and Singapore. It offers distribution, underwriting, product development, administration, and risk management services by acting as a wholesale broker and a managing underwriter.

Further Reading

Before you consider Ryan Specialty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ryan Specialty wasn't on the list.

While Ryan Specialty currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.