Dana Investment Advisors Inc. lessened its stake in shares of Workday, Inc. (NASDAQ:WDAY - Free Report) by 8.2% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 89,211 shares of the software maker's stock after selling 7,931 shares during the quarter. Workday makes up approximately 0.8% of Dana Investment Advisors Inc.'s holdings, making the stock its 23rd largest holding. Dana Investment Advisors Inc.'s holdings in Workday were worth $23,019,000 at the end of the most recent reporting period.

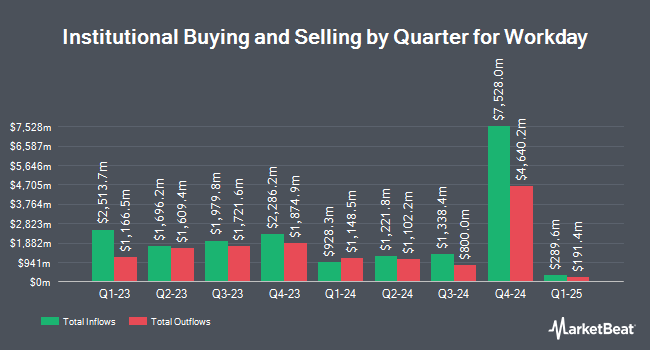

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. Marcum Wealth LLC grew its holdings in Workday by 4.4% in the 4th quarter. Marcum Wealth LLC now owns 966 shares of the software maker's stock valued at $249,000 after buying an additional 41 shares during the period. Custom Index Systems LLC grew its holdings in Workday by 3.0% in the 4th quarter. Custom Index Systems LLC now owns 1,412 shares of the software maker's stock valued at $364,000 after buying an additional 41 shares during the period. Meeder Asset Management Inc. grew its holdings in Workday by 42.2% in the 3rd quarter. Meeder Asset Management Inc. now owns 145 shares of the software maker's stock valued at $35,000 after buying an additional 43 shares during the period. Kingsview Wealth Management LLC grew its holdings in Workday by 0.9% in the 3rd quarter. Kingsview Wealth Management LLC now owns 5,085 shares of the software maker's stock valued at $1,243,000 after buying an additional 43 shares during the period. Finally, Fulton Bank N.A. grew its holdings in Workday by 1.3% in the 4th quarter. Fulton Bank N.A. now owns 3,696 shares of the software maker's stock valued at $954,000 after buying an additional 48 shares during the period. Hedge funds and other institutional investors own 89.81% of the company's stock.

Insiders Place Their Bets

In other news, major shareholder David A. Duffield sold 70,090 shares of the business's stock in a transaction that occurred on Wednesday, January 8th. The stock was sold at an average price of $254.53, for a total value of $17,840,007.70. Following the completion of the sale, the insider now directly owns 102,997 shares in the company, valued at approximately $26,215,826.41. The trade was a 40.49 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Wayne A.I. Frederick sold 1,829 shares of the business's stock in a transaction that occurred on Thursday, January 2nd. The shares were sold at an average price of $253.09, for a total value of $462,901.61. Following the completion of the sale, the director now owns 6,845 shares of the company's stock, valued at $1,732,401.05. This trade represents a 21.09 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 435,829 shares of company stock worth $113,033,319 in the last three months. 20.00% of the stock is owned by insiders.

Workday Price Performance

WDAY stock opened at $259.61 on Thursday. The company has a quick ratio of 2.05, a current ratio of 2.05 and a debt-to-equity ratio of 0.35. Workday, Inc. has a 52-week low of $199.81 and a 52-week high of $294.00. The stock's 50 day moving average is $258.98 and its two-hundred day moving average is $255.49. The company has a market capitalization of $69.06 billion, a PE ratio of 43.05, a P/E/G ratio of 3.55 and a beta of 1.35.

Workday (NASDAQ:WDAY - Get Free Report) last posted its quarterly earnings data on Tuesday, February 25th. The software maker reported $0.48 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.75 by ($1.27). Workday had a return on equity of 6.13% and a net margin of 19.86%. The business had revenue of $2.21 billion for the quarter, compared to analysts' expectations of $2.18 billion. Analysts predict that Workday, Inc. will post 2.63 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several analysts have commented on WDAY shares. JPMorgan Chase & Co. lifted their price target on Workday from $285.00 to $310.00 and gave the company an "overweight" rating in a report on Wednesday, February 26th. Scotiabank lifted their price target on Workday from $340.00 to $355.00 and gave the company a "sector outperform" rating in a report on Thursday, February 27th. UBS Group lifted their price target on Workday from $255.00 to $285.00 and gave the company a "neutral" rating in a report on Wednesday, February 26th. StockNews.com lowered Workday from a "buy" rating to a "hold" rating in a research note on Monday, January 13th. Finally, BNP Paribas raised Workday to a "strong-buy" rating in a research note on Friday, February 14th. Ten research analysts have rated the stock with a hold rating, twenty have given a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $302.14.

View Our Latest Research Report on Workday

Workday Profile

(

Free Report)

Workday, Inc provides enterprise cloud applications in the United States and internationally. Its applications help its customers to plan, execute, analyze, and extend to other applications and environments to manage their business and operations. The company offers a suite of financial management applications to maintain accounting information in the general ledger; manage financial processes, such as payables and receivables; identify real-time financial, operational, and management insights; enhance financial consolidation; reduce time-to-close; promote internal control and auditability; and achieve consistency across finance operations.

Further Reading

Want to see what other hedge funds are holding WDAY? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Workday, Inc. (NASDAQ:WDAY - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Workday, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Workday wasn't on the list.

While Workday currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.