Equities researchers at Guggenheim started coverage on shares of Danaher (NYSE:DHR - Get Free Report) in a research report issued to clients and investors on Thursday, Marketbeat Ratings reports. The brokerage set a "buy" rating and a $275.00 price target on the conglomerate's stock. Guggenheim's price objective indicates a potential upside of 21.60% from the company's previous close.

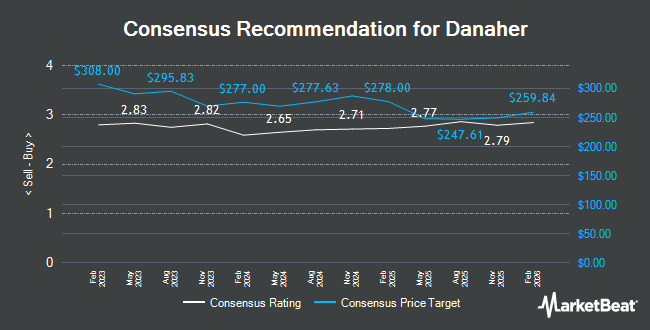

DHR has been the topic of several other research reports. Bank of America upgraded shares of Danaher from a "neutral" rating to a "buy" rating and set a $290.00 target price on the stock in a research report on Friday, December 13th. TD Cowen boosted their price objective on Danaher from $310.00 to $315.00 and gave the stock a "buy" rating in a research note on Wednesday, October 23rd. StockNews.com cut shares of Danaher from a "buy" rating to a "hold" rating in a research report on Saturday, December 14th. Robert W. Baird reduced their target price on shares of Danaher from $278.00 to $277.00 and set an "outperform" rating on the stock in a research note on Wednesday, October 23rd. Finally, KeyCorp lifted their price target on shares of Danaher from $290.00 to $310.00 and gave the company an "overweight" rating in a research report on Wednesday, October 23rd. Five analysts have rated the stock with a hold rating and sixteen have assigned a buy rating to the company's stock. According to MarketBeat, Danaher presently has a consensus rating of "Moderate Buy" and an average target price of $287.30.

Check Out Our Latest Analysis on Danaher

Danaher Price Performance

Shares of NYSE:DHR traded down $2.14 during trading on Thursday, reaching $226.16. 4,549,872 shares of the company's stock traded hands, compared to its average volume of 2,810,747. The company has a quick ratio of 1.01, a current ratio of 1.37 and a debt-to-equity ratio of 0.32. Danaher has a fifty-two week low of $222.53 and a fifty-two week high of $281.70. The company has a 50-day simple moving average of $244.71 and a 200-day simple moving average of $256.93. The firm has a market cap of $163.35 billion, a PE ratio of 43.16, a P/E/G ratio of 4.33 and a beta of 0.83.

Danaher (NYSE:DHR - Get Free Report) last announced its earnings results on Tuesday, October 22nd. The conglomerate reported $1.71 earnings per share for the quarter, topping the consensus estimate of $1.57 by $0.14. Danaher had a return on equity of 10.62% and a net margin of 16.39%. The business had revenue of $5.80 billion during the quarter, compared to the consensus estimate of $5.59 billion. During the same period in the prior year, the company posted $2.02 EPS. The business's quarterly revenue was up 3.1% on a year-over-year basis. As a group, analysts predict that Danaher will post 7.5 earnings per share for the current year.

Institutional Inflows and Outflows

A number of hedge funds have recently made changes to their positions in the business. nVerses Capital LLC acquired a new stake in Danaher during the 2nd quarter worth $25,000. Teachers Insurance & Annuity Association of America acquired a new stake in shares of Danaher during the third quarter worth about $39,000. MidAtlantic Capital Management Inc. purchased a new stake in shares of Danaher in the 3rd quarter valued at about $40,000. FSA Wealth Management LLC acquired a new stake in shares of Danaher in the 3rd quarter valued at about $50,000. Finally, Financial Connections Group Inc. purchased a new position in Danaher during the 2nd quarter worth approximately $51,000. Hedge funds and other institutional investors own 79.05% of the company's stock.

Danaher Company Profile

(

Get Free Report)

Danaher Corporation designs, manufactures, and markets professional, medical, industrial, and commercial products and services worldwide. The Biotechnology segments offers bioprocess technologies, consumables, and services that advance, accelerate, and integrate the development and manufacture of therapeutics; cell line and cell culture media development services; cell culture media, process liquids and buffers for manufacturing, chromatography resins, filtration technologies, aseptic fill finish; single-use hardware and consumables and services, such as the design and installation of full manufacturing suites; lab filtration, separation, and purification; lab-scale protein purification and analytical tools; reagents, membranes, and services; and healthcare filtration solutions.

Read More

Before you consider Danaher, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Danaher wasn't on the list.

While Danaher currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.