Darden Restaurants (NYSE:DRI - Free Report) had its price objective hoisted by Stifel Nicolaus from $190.00 to $205.00 in a report issued on Friday morning,Benzinga reports. They currently have a buy rating on the restaurant operator's stock.

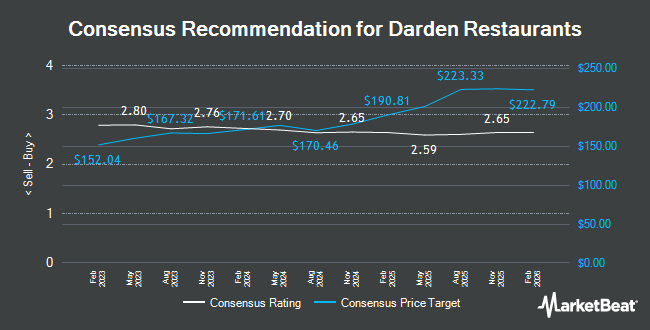

Several other equities analysts have also commented on DRI. JPMorgan Chase & Co. upped their price target on Darden Restaurants from $165.00 to $176.00 and gave the company an "overweight" rating in a research note on Friday, September 20th. Stephens upped their target price on shares of Darden Restaurants from $164.00 to $175.00 and gave the company an "equal weight" rating in a research report on Friday. Robert W. Baird lifted their price target on shares of Darden Restaurants from $180.00 to $194.00 and gave the company a "neutral" rating in a research report on Friday. KeyCorp upped their price objective on shares of Darden Restaurants from $194.00 to $200.00 and gave the stock an "overweight" rating in a report on Friday. Finally, The Goldman Sachs Group began coverage on shares of Darden Restaurants in a report on Thursday, December 5th. They issued a "neutral" rating and a $183.00 target price for the company. One research analyst has rated the stock with a sell rating, nine have given a hold rating and sixteen have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $186.60.

Check Out Our Latest Analysis on Darden Restaurants

Darden Restaurants Trading Up 2.3 %

Darden Restaurants stock traded up $4.15 during midday trading on Friday, hitting $187.59. 4,138,488 shares of the stock were exchanged, compared to its average volume of 1,254,719. The company has a current ratio of 0.35, a quick ratio of 0.22 and a debt-to-equity ratio of 0.65. The stock's 50-day simple moving average is $166.25 and its 200 day simple moving average is $156.99. Darden Restaurants has a fifty-two week low of $135.87 and a fifty-two week high of $188.88. The stock has a market capitalization of $22.04 billion, a price-to-earnings ratio of 21.64, a PEG ratio of 1.90 and a beta of 1.31.

Darden Restaurants (NYSE:DRI - Get Free Report) last announced its quarterly earnings results on Thursday, December 19th. The restaurant operator reported $2.03 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $2.03. Darden Restaurants had a net margin of 9.11% and a return on equity of 49.46%. The business had revenue of $2.89 billion during the quarter, compared to the consensus estimate of $2.87 billion. During the same quarter last year, the firm earned $1.84 EPS. The business's revenue was up 6.0% compared to the same quarter last year. On average, equities analysts anticipate that Darden Restaurants will post 9.47 EPS for the current year.

Darden Restaurants Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Monday, February 3rd. Shareholders of record on Friday, January 10th will be paid a $1.40 dividend. This represents a $5.60 dividend on an annualized basis and a yield of 2.99%. The ex-dividend date is Friday, January 10th. Darden Restaurants's dividend payout ratio is presently 64.59%.

Insider Transactions at Darden Restaurants

In related news, SVP Douglas J. Milanes sold 5,705 shares of the business's stock in a transaction on Monday, September 23rd. The shares were sold at an average price of $172.04, for a total value of $981,488.20. Following the completion of the sale, the senior vice president now directly owns 3,834 shares of the company's stock, valued at $659,601.36. The trade was a 59.81 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider Laura B. Williamson sold 1,666 shares of the firm's stock in a transaction dated Monday, September 23rd. The stock was sold at an average price of $172.00, for a total value of $286,552.00. Following the transaction, the insider now directly owns 5,334 shares in the company, valued at approximately $917,448. The trade was a 23.80 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 59,265 shares of company stock valued at $10,116,030. 0.58% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Darden Restaurants

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the company. Mizuho Securities USA LLC grew its position in shares of Darden Restaurants by 96,162.9% during the third quarter. Mizuho Securities USA LLC now owns 8,861,000 shares of the restaurant operator's stock worth $1,454,356,000 after acquiring an additional 8,851,795 shares during the last quarter. State Street Corp grew its position in Darden Restaurants by 0.6% during the 3rd quarter. State Street Corp now owns 4,707,456 shares of the restaurant operator's stock worth $772,635,000 after purchasing an additional 26,601 shares during the last quarter. Charles Schwab Investment Management Inc. increased its stake in Darden Restaurants by 3.6% in the third quarter. Charles Schwab Investment Management Inc. now owns 3,580,322 shares of the restaurant operator's stock valued at $587,638,000 after purchasing an additional 123,900 shares during the period. Geode Capital Management LLC raised its holdings in shares of Darden Restaurants by 0.6% in the third quarter. Geode Capital Management LLC now owns 2,806,113 shares of the restaurant operator's stock valued at $459,216,000 after buying an additional 17,497 shares during the last quarter. Finally, Raymond James & Associates boosted its stake in shares of Darden Restaurants by 1.9% during the third quarter. Raymond James & Associates now owns 2,352,608 shares of the restaurant operator's stock worth $386,133,000 after buying an additional 44,464 shares during the period. Hedge funds and other institutional investors own 93.64% of the company's stock.

About Darden Restaurants

(

Get Free Report)

Darden Restaurants, Inc, together with its subsidiaries, owns and operates full-service restaurants in the United States and Canada. It operates under Olive Garden, LongHorn Steakhouse, Cheddar's Scratch Kitchen, Yard House, The Capital Grille, Seasons 52, Bahama Breeze, Eddie V's Prime Seafood, and Capital Burger brand names.

See Also

Before you consider Darden Restaurants, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Darden Restaurants wasn't on the list.

While Darden Restaurants currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report