Atria Wealth Solutions Inc. raised its stake in shares of Datadog, Inc. (NASDAQ:DDOG - Free Report) by 450.8% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 42,626 shares of the company's stock after buying an additional 34,887 shares during the period. Atria Wealth Solutions Inc.'s holdings in Datadog were worth $6,091,000 at the end of the most recent quarter.

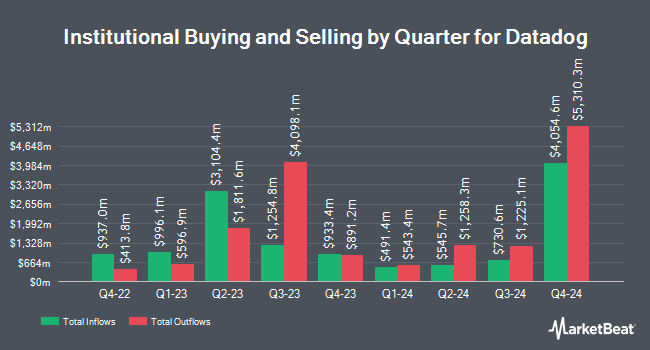

Several other institutional investors also recently bought and sold shares of DDOG. Allworth Financial LP grew its position in Datadog by 7.7% during the fourth quarter. Allworth Financial LP now owns 1,043 shares of the company's stock worth $146,000 after buying an additional 75 shares in the last quarter. Spire Wealth Management boosted its position in shares of Datadog by 21.4% during the fourth quarter. Spire Wealth Management now owns 453 shares of the company's stock worth $65,000 after purchasing an additional 80 shares in the last quarter. Avior Wealth Management LLC grew its holdings in shares of Datadog by 55.9% in the 4th quarter. Avior Wealth Management LLC now owns 226 shares of the company's stock valued at $32,000 after buying an additional 81 shares during the period. Pathstone Holdings LLC increased its position in shares of Datadog by 0.4% in the 3rd quarter. Pathstone Holdings LLC now owns 23,152 shares of the company's stock valued at $2,664,000 after buying an additional 91 shares in the last quarter. Finally, Parsons Capital Management Inc. RI raised its stake in Datadog by 2.0% during the 4th quarter. Parsons Capital Management Inc. RI now owns 4,943 shares of the company's stock worth $706,000 after buying an additional 96 shares during the period. 78.29% of the stock is currently owned by institutional investors.

Datadog Price Performance

Shares of DDOG traded down $6.13 during trading hours on Friday, hitting $120.11. 4,234,152 shares of the stock were exchanged, compared to its average volume of 5,089,662. Datadog, Inc. has a fifty-two week low of $98.80 and a fifty-two week high of $170.08. The business has a 50-day moving average of $142.85 and a 200-day moving average of $131.47. The firm has a market capitalization of $40.81 billion, a P/E ratio of 235.52, a price-to-earnings-growth ratio of 44.94 and a beta of 1.15.

Datadog (NASDAQ:DDOG - Get Free Report) last issued its quarterly earnings results on Thursday, February 13th. The company reported $0.13 EPS for the quarter, missing analysts' consensus estimates of $0.44 by ($0.31). Datadog had a net margin of 6.85% and a return on equity of 8.28%. As a group, analysts forecast that Datadog, Inc. will post 0.34 earnings per share for the current fiscal year.

Insider Buying and Selling

In other Datadog news, Director Amit Agarwal sold 25,000 shares of the stock in a transaction on Wednesday, January 22nd. The stock was sold at an average price of $139.47, for a total transaction of $3,486,750.00. Following the sale, the director now owns 195,667 shares in the company, valued at $27,289,676.49. This represents a 11.33 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Shardul Shah sold 7,916 shares of the business's stock in a transaction on Monday, December 16th. The shares were sold at an average price of $155.25, for a total value of $1,228,959.00. Following the sale, the director now owns 435,701 shares in the company, valued at approximately $67,642,580.25. The trade was a 1.78 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 556,674 shares of company stock worth $82,904,025 in the last ninety days. Corporate insiders own 11.78% of the company's stock.

Analyst Ratings Changes

A number of research firms have recently commented on DDOG. Jefferies Financial Group raised their price target on Datadog from $155.00 to $170.00 and gave the stock a "buy" rating in a research report on Monday, January 6th. Citigroup cut their price target on shares of Datadog from $170.00 to $165.00 and set a "buy" rating on the stock in a research note on Friday, February 14th. Cantor Fitzgerald initiated coverage on shares of Datadog in a research report on Friday, January 17th. They set an "overweight" rating and a $180.00 price objective for the company. Stifel Nicolaus lowered shares of Datadog from a "buy" rating to a "hold" rating and reduced their target price for the stock from $165.00 to $140.00 in a research note on Wednesday, January 29th. Finally, JMP Securities reissued a "market perform" rating on shares of Datadog in a research note on Friday, February 14th. One analyst has rated the stock with a sell rating, seven have assigned a hold rating, twenty-two have given a buy rating and two have assigned a strong buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $158.39.

View Our Latest Analysis on DDOG

Datadog Profile

(

Free Report)

Datadog, Inc operates an observability and security platform for cloud applications in North America and internationally. The company's products comprise infrastructure and application performance monitoring, log management, digital experience monitoring, continuous profiler, database monitoring, data streams and universal service monitoring, network monitoring, incident management, workflow automation, observability pipelines, cloud cost and cloud security management, application security management, cloud SIEM, sensitive data scanner, and CI visibility.

Featured Stories

Before you consider Datadog, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Datadog wasn't on the list.

While Datadog currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.